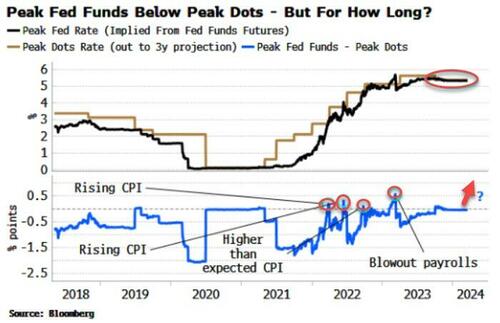

The rates market in the US is once again on the threshold of expecting rates to peak at a higher level than the Federal Reserve. If the central bank does not raise its projections next week, the market may take the initiative and price higher rates.

Traders have been consistently clear for most of this cycle that Fed rate rises will eventually have to be met with swift cuts to restabilize the economy. Only on a few, fairly brief occasions did pricing get ahead of the Fed and rates were expected to peak at a higher level than the central bank’s projections.

We could be knocking on the door of another of these episodes. The peak expected rate as inferred from fed funds futures has been moored almost identically at the peak rate expected by the Fed itself, based on the FOMC’s dots. The chart below shows the previous times pricing exceeded the Fed’s projections.

There are four distinct episodes, all of them driven by a sell-off in rates markets rather than a move lower in the dots. As shown in the chart, the first two were when CPI was rising and had not yet peaked. The third was a higher-than-expected CPI print, while the fourth was January 2023’s monster payrolls number.

None lasted long, with the previous episode being curtailed by the SVB crisis, but the move higher in rates on each occasion was rapid and brutal if you were on the wrong side of it.

Speculation is mounting that the Fed at its meeting might reduce the number of cuts expected.

All else equal, that would take the market back below the dots.

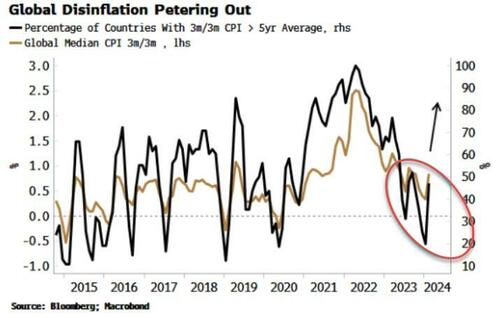

But traders are beginning to get uneasy about “sticky” inflation. Sticky might not be the problem - there are multiple signs that inflation will start rising again, as discussed here and here. Moreover, it’s not just a US phenomenon: globally there are signs that the disinflation trend is ending.

The market may well get impatient and move rate expectations higher if the Fed does not move the dots higher next week, sensing a policy mistake is in the offing. And if inflation keeps rising, then this latest episode where the market out-hawks the Fed may not be so brief.