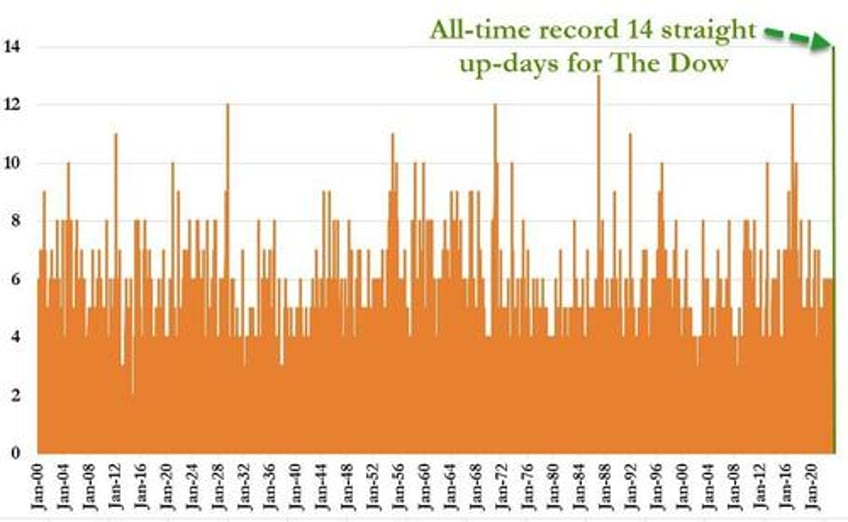

With just three hours to go until the oldest US equity index was set to close green for the 14th day in a row, its longest stretch of gains since the Dow Jones' inception in 1896....

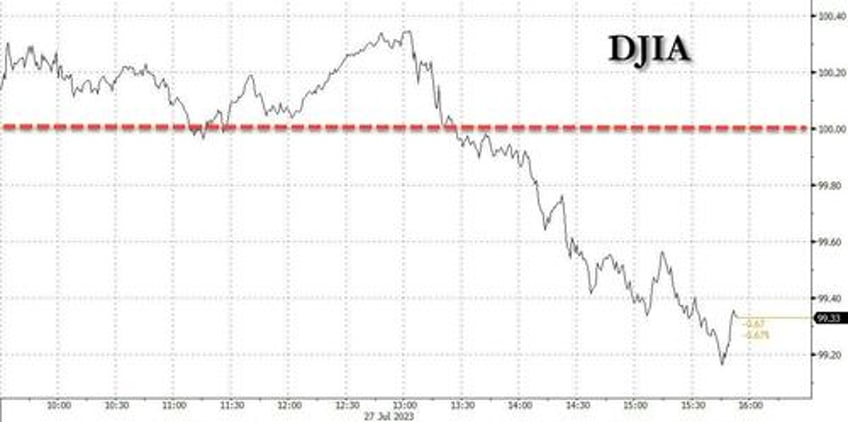

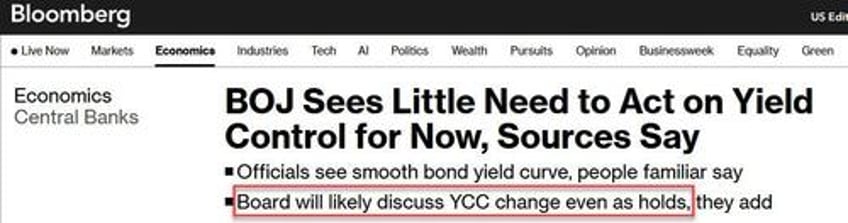

... and with stocks levitating merrily one day after Powell effectively gave the green light to keep buying by assuring markets that the "July Goodbye" was, for all intents and purposes, the last rate hike, the market suddenly deflated like a Hindenburg balloon encountering a spark just after 1pm Eastern when the BOJ's favorite mouthpiece, the Nikkei, decided at the perfectly obvious local time of 2am, to blast a report claiming that the BOJ would "discuss" tweaking its infamous yield curve control (something it did back in December to catastrophic consequences).

That was all it took to reverse all the Dow gains and send it deep in the red, putting a screeching halt to all imminent celebrations of euphoric market stupidity.

Mind you, the report said nothing new: just last week, Bloomberg reported exactly the same when it also noted that a YCC discussion was imminent, however with the substantial caveat that the BOJ would end up doing nothing despite said discussion.

What the report did, was spark a marketwide momemtum reversal (as amateur retail traders once again got spooked out by whoever planted the trial baloon, who just happened to be long the yen) and stop hunt, as first the USDJPY plunged below the key level of 141 and then 140...

.... while fears that the BOJ would spark another round of JGB liquidations, sent both JGBs and US Treasuries (recall Japan is the largest foreign holder of TSYs, so dumping JGBs would suggest less demand for US paper too) crashing, with the 10Y yield surging above 4.00%

And since everyone is watching the 4.00% level as a catalyst to sell long duration assets - you know, those stocks which are up 50%, 100%, or much more YTD - spoos promptly panicked, and tumbled 70 points after the planted BOJ story.

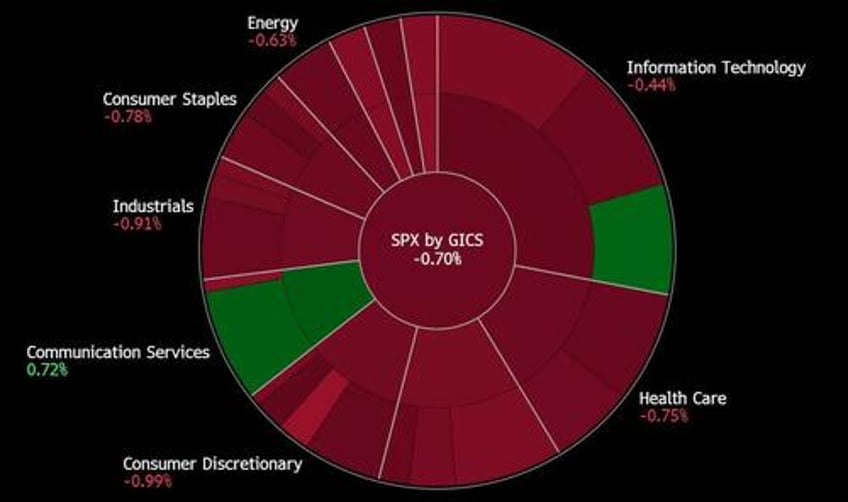

Pretty much every sector (with the exception of Communications services, where last night's META earnings blowout kept the lights on), was red.

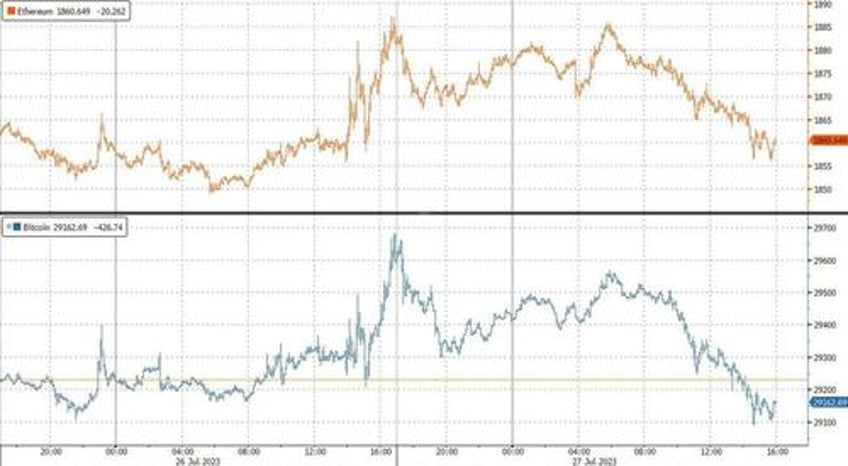

The carnage spilled over into crypto...

.... and even precious metals were hammered although the pain here started well before the BOJ news, and instead it was today's stellar US economic data that sparked the rout.

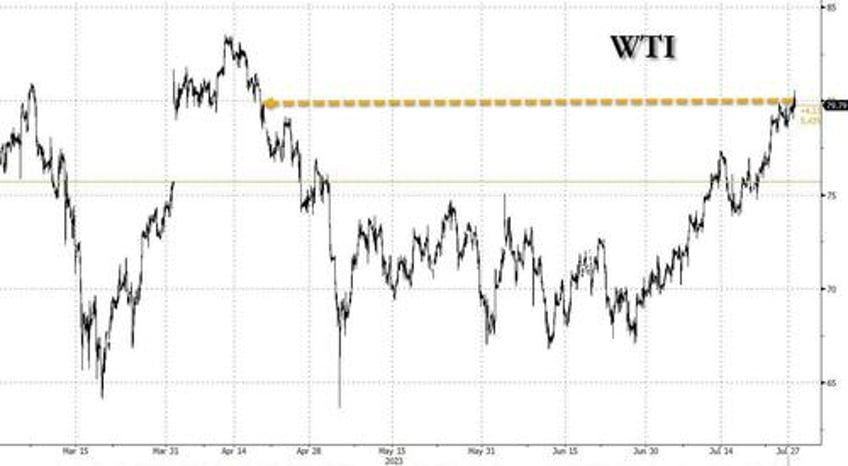

The only asset class that did well, was the most beaten down one: oil briefly tipped above $80 and having crossed back above its 200DMA for the first time this year, is a fraction away from a new bull market and much more gains.

Turning to the world of derivatives, flows followed price: according to SpotGamma, put buyers came in this afternoon, unlocking after the SPX touched fresh highs at the 4600 Call Wall. Yet absent into the afternoon was 0DTE flow (red) - one would have assumed that they try would bring some mean reversion before the close, but it was not meant to be.