There continues to be scant evidence of inflation hedging in markets despite clear signs price-growth risks are rising.

Inflation remains in focus this week as we get the first quarter’s update for US PCE on Friday. Regardless of one data point, the trend is clearly that inflation has stopped falling, with multiple leading indicators suggesting a recurrence.

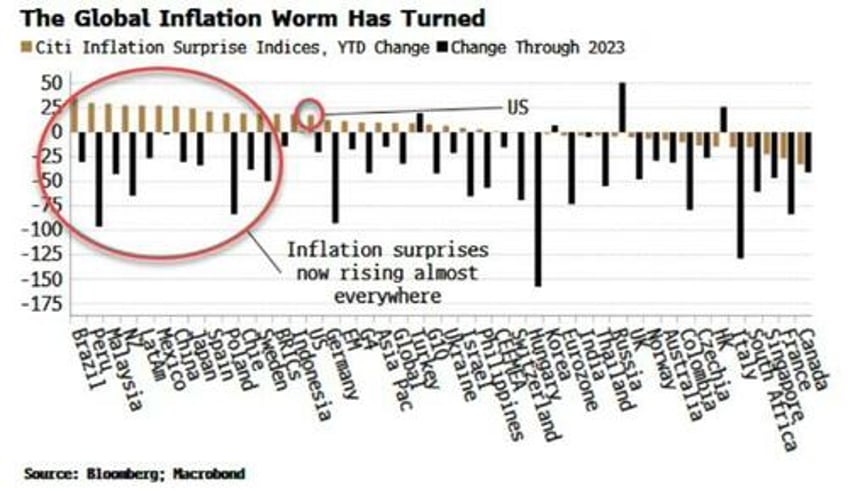

It’s not just in the US though. Globally, inflation is resurfacing. Through last year, the Citi Inflation Surprise indices were falling almost everywhere. Year-to-date in 2024, they are now rising in two-thirds of the countries the indices cover.

But that is not being priced in markets. Ven Ram points out that two-year Treasuries would struggle to sell-off on even a sticky core PCE print later this week, and that’s probably true in the nearer term. But even two-year yields are not yet pricing in the likelihood of a proper inflation shock that would require several more hikes from the Federal Reserve. That’s not a base case at the moment, but its probability is still underpriced.

Yields have been rising, and so have gold and silver, but there is a distinct lack of the inflation urgency seen in 2021 and early 2022, when CPI was hitting decade highs and the Federal Reserve had not yet responded with interest rate hikes.

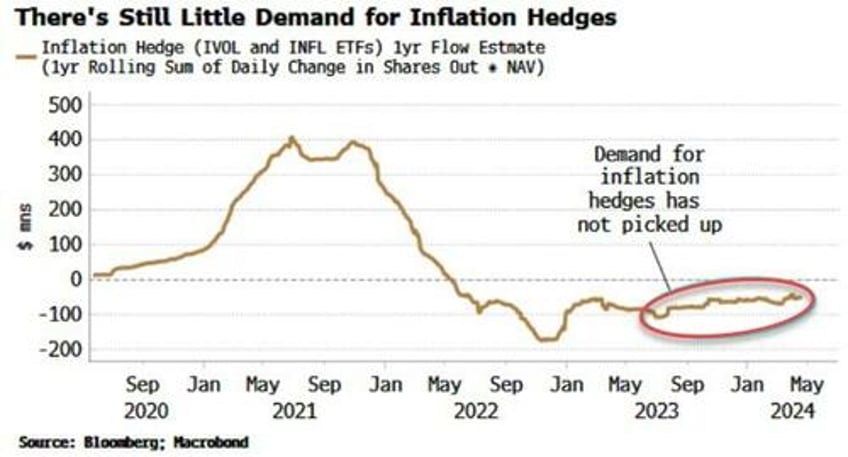

As one sign of the relative complacency, take two ETFs that are designed to hedge inflation, INFL and IVOL.

These saw marked inflows in 2021, but the flows have been muted since the Fed started raising rates in 2022 and have remained so.

There have also been no marked pick-up in flows to ETFs of inflation-linked bonds, such as the TIP ETF.

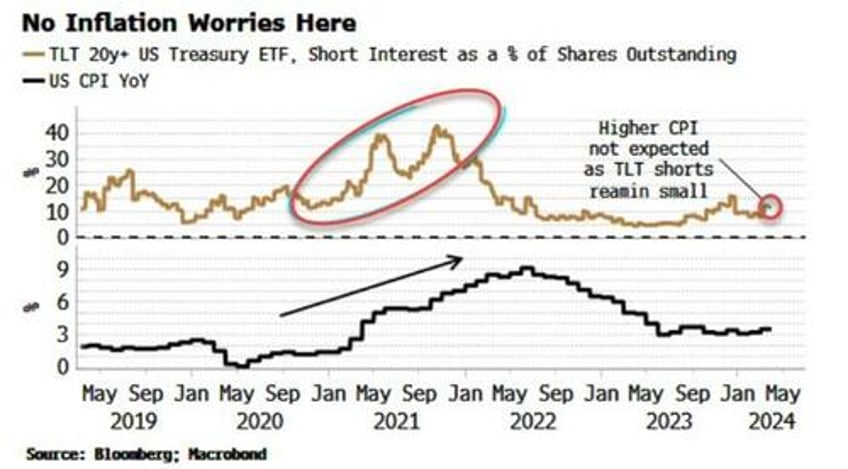

Similarly shorting interest in Treasuries continues to be minimal. JPMorgan’s Client Treasury Survey is registering a near series-low of outright shorts, while short interest in the TLT long-term UST ETF is low and has barely risen.

There are no inflation alarms ringing. But that could prove to be misguided as inflation shows clear signs of resurfacing.

This is even more so as the structural backdrop, with increasingly coordinated fiscal and monetary policy, is conducive to a secular rise in price growth.