Luxury group Richemont, the owner of Cartier and Van Cleef & Arpels jewelry, reported a surprise drop in revenue from the Americas in the three months through June. Faltering demand in one of its biggest markets is an ominous sign of a weakening consumer.

Richemont reported an overall 19% increase in sales. Jewelry revenue rose 24%, coming in line with analyst expectations. Its watchmaker division recorded sales growth of 10% at constant currencies, missing analyst consensus forecasts. Most of the growth came from Asia-Pacific and European markets. However, the slowdown in luxury demand in the US, which saw a 4% decline, overshadowed optimism.

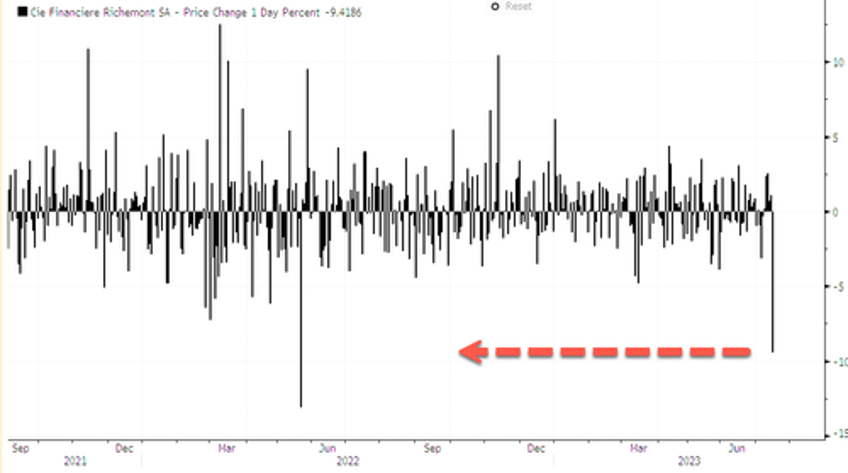

Pessisms about US markets sent shares of Richemont in Europe tumbling as much as 9.5%, the most significant decline in more than a year.

Luxury goods stocks slid on the news, LVMH Moet Hennessy Louis Vuitton SE fell 3%, Hermes dropped 3%, and Kering declined 2.0%. The Stoxx 600 Consumer Products index fell 2.6%.

In May, Richemont Chairman Johann Rupert warned about an emerging US downturn, forecasting that the world's largest economy would experience a credit contraction.

During that time, we warned about the bust of the luxury bubble in a note titled Did Europe's Luxury Bubble Just Burst?

Even though Richemont's overall sales were solid, mainly because of Asia and Europe, there were new concerns about a China slowdown following overnight news of weaker-than-expected GDP numbers.

Here's what Wall Street analysts are saying about the US slowdown (list courtesy of Bloomberg):

Citi (buy, PT CHF180.5)

- A mixed bag of results but full-year consensus for sales and operating profits should remain broadly unchanged

- "The miss was entirely due to the US turning negative," analysts Thomas Chauvet and Lorenzo Bracco write

- Expect pressure on the share price

Bloomberg Intelligence

- "Richemont's slight beat on consensus confirms support from high-margin jewelry, own retail and Asia, where we expect China to have rebounded," wrote Bloomberg analyst Deborah Aitken

- "That supports a more muted performance in Americas, where we expect more investment to build up," she adds

- The 2% drop in sales in the Americas falls slightly short of consensus, though there was a wide range of estimates due to its 25% fiscal 1Q23 comparable year-ago growth base there. Similarly for Europe, where growth is against a 42% year-ago mark

Vontobel analyst Jean-Philippe Bertschy

- "Negative growth in the Americas is likely to temper some of the market expectations."

This adds to the mounting concerns about a slowdown in the US economy, and it comes during a period where the Biden administration is promoting 'Bidenomics' ahead of the 2024 presidential election cycle.