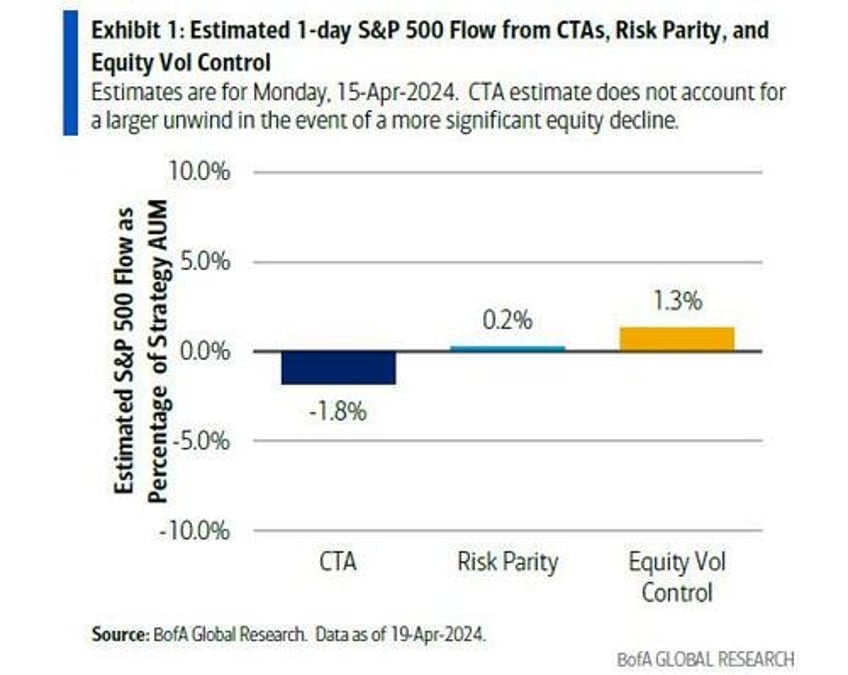

On one hand, the technical storm appears to have subsided: as we predicted last night, just days after the biggest CTA shake-out in over a year (thanks to the fake Iran-Israel war, which on Thursday shook out all the sell stops thanks to the latest brutal bear trap, and thus paradoxically removed any residual selling pressure), other systematic funds finally stepped in to buy the dip, with vol control and Risk-Parity strategies both starting to add leverage back after a sharper unwind last week.

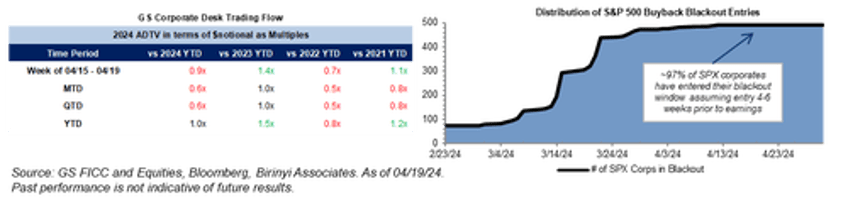

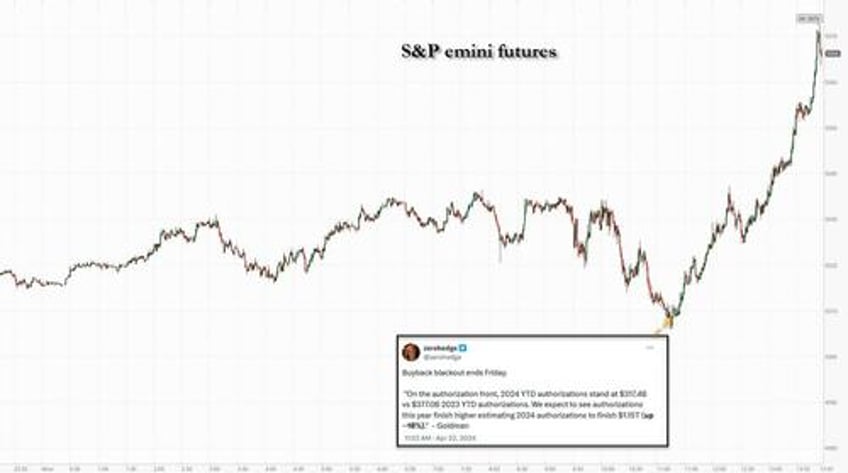

Add to that our reminder that the stock buyback blackout ends on Friday, which the algos immediately rushed to frontrun...

... and in retrospect it's almost surprising stocks soared more than 1% at their highs.

But after the biggest slide in stocks since the bank crisis last March, has the threat to markets faded away and is it safe to BTFD? At least according to one reformer permabear, the answer is a resounding no.

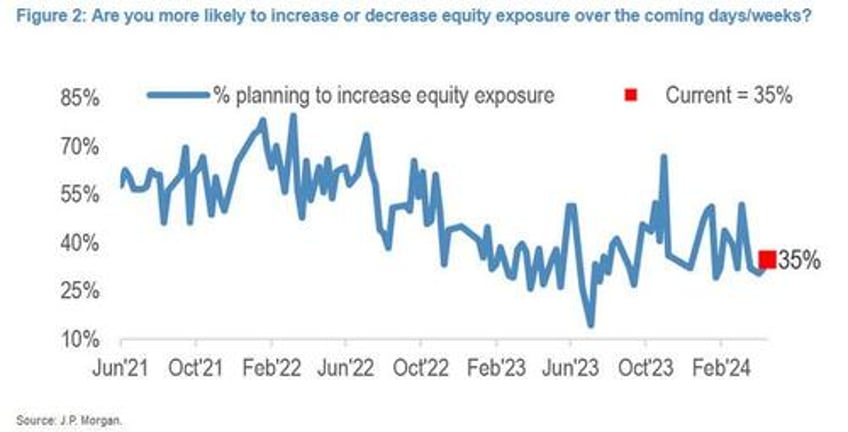

Having incorrectly called the market in both 2022 and 2023, when he was first bullish during an epic rout, only to turn bearish at the lows and stay bearish during the biggest market rally in recent history, JPMorgan's Marko Kolanovic - who has remained bearish in 2024 in hopes that a crash magically emerges out of nowhere even as the government is injecting $1 trillion in fiscal stimmies every 100 days in an election year, and finally validates his stubborn pessimism even though most of his clients have long ago seen their short positions stopped out - wrote a piece this afternoon titled "The correction likely has further to go" (available to pro subscribers in the usual place), in which he writes that, as one may expect, "we think the sell-off has further to go" and warns that he remains "concerned about continued complacency in equity valuations, inflation staying too hot, further Fed repricing, and a profit outlook where the implied acceleration this year might end up too optimistic."

According to the Croat, who since October 2022 hasn't seen a dip that wasn't a guaranteed harbinger to a great depressionary collapse (and then when it proved to be just another dip-buying opportunity, would promptly provide a polysyllabic, extensive, if petulant analysis of why the market surged even as he never explained why he failed to predict it in the first place... again... and again... and again), "the current market narrative and patterns are increasingly resembling those of last summer, when upside inflation surprises and hawkish Fed revisions drove a correction in risk assets, but investor positioning now appears more elevated."

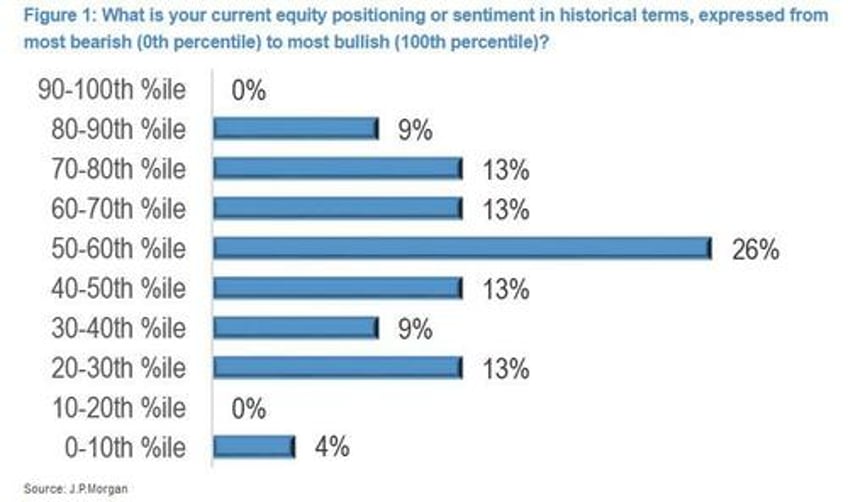

Fully elevated, eh? Funny he should say that, because just a few pages later in his own analysis, Kolanovic publishes this recurring chart showing how JPM clients see their positioning, and according to which just 35% plan to increase their equity exposure, which is tied for the lowest since last summer.

And if that wasn't enough, a chart showing how clients view their own equity positioning/sentiment in historical terms, reveals a perfectly balanced, if somewhat bearish distribution.

Needless to say, both charts clearly refute Marko's baseless contention that "investor positioning now appears more elevated" than it was a year ago, but then again, we would be the last to accuse the Croat of objectively analyzing data and interpreting facts without bias or a tendency to goalseek a predetermined bearish outcome (at least until the JPM trading desk has had its fill of purchasing all the stocks that JPM's clients have to sell, after listening to Marko of course).

Anyway, for those who are curious, here is what else Kolanovic had to say about the market's "problematic backdrop."

USD, bond yields, oil and concentration all showing elevated risks remains a problematic backdrop. The multiple expansion seen in past months, extremely low volatility metrics up to recently, tightest credit spreads since 2007, and the general inability by market participants earlier in the year to identify any potential negative catalysts for stocks are starting to shift. We remain concerned about continued complacency in equity valuations, inflation staying too hot, further Fed repricing, rates moving higher for the “wrong reasons”, and a profit outlook where the implied acceleration this year might end up too optimistic.

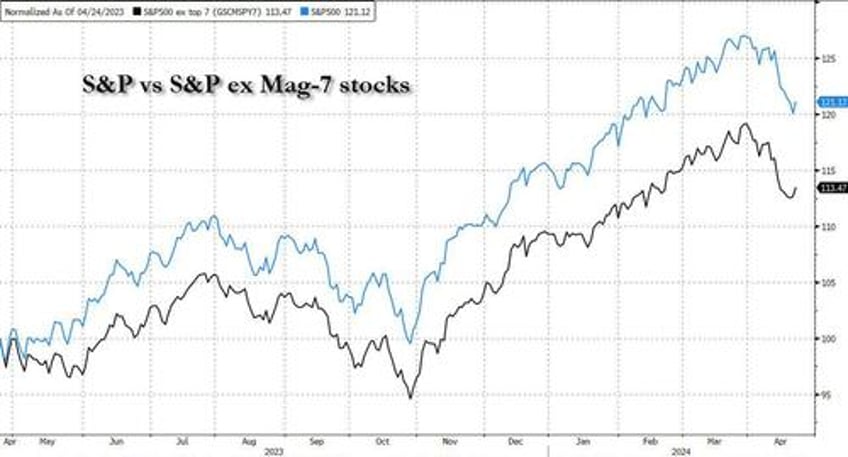

Market concentration has been very high, and positioning extended, which are typically red flags, at risk of a reversal. The combination of these macro factors increases the downside risks, and suggests that more Defensive trading should be appropriate

Alas, none of that is accurate, relevant or actionable: in fact, concentration in the largest stocks has been far higher late in 2023 and earlier this year, and the result has already been felt following the recent Nasdaq drubbing, which hammered not only the Mag 7s but everything else too.

In fact, one could argue that the recent selloff provided just the breather these extremely popular stocks needed to resume their vapid meltup, which will continue until one of two things happen: i) Trump wins the election and the government stops injecting trillions in fiscal stimmies or ii) the thing that we have said since February 2023 as the only necessary and sufficient condition for stocks to crash, happens and Marko turns bullish.

Rally won't end until Wilson and Marko turn bullish

— zerohedge (@zerohedge) February 7, 2023

Considering the S&P was at 4000 when we said that, one can argue that the simplest condition to trigger a market rally has also been the most accurate one, and since Kolanovic has refused to turn bullish in over a year, the S&P has soared more than 30% since the JPM strategist turned bearish.

Bottom line: fade this latest in a long series of bearish calls - if for no other reason than this one: those who really matter at JPM - the bank's trading desk - remains thoroughly bullish.

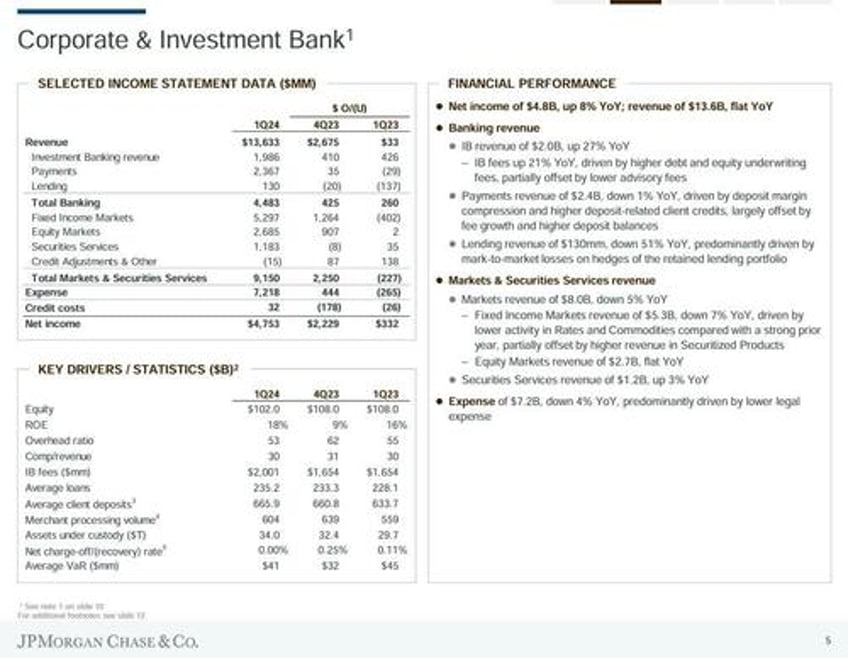

In fact, one can argue that JPM's giant trading platform continues to perform admirably... if not for the bank's clients, then for JPM itself, whose equity sales and trading desk had another phenomenal quarter.

Why? Because all those stocks that JPM clients sold to the bank's flow desk - in hopes that Marko Kolanovic would be right at least once in the past two years - have served to propel the bank's own P&L gains into the stratosphere.

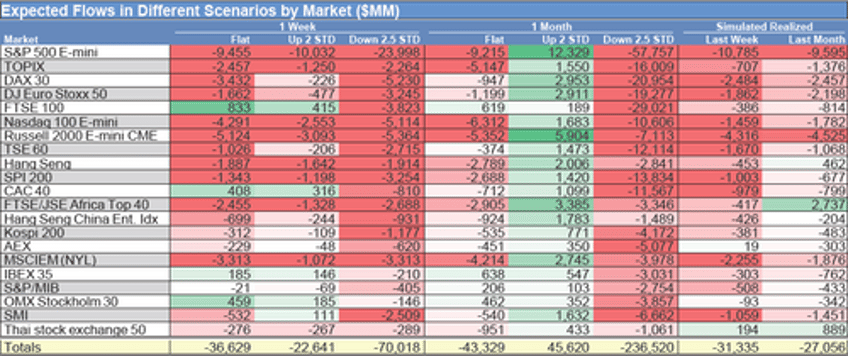

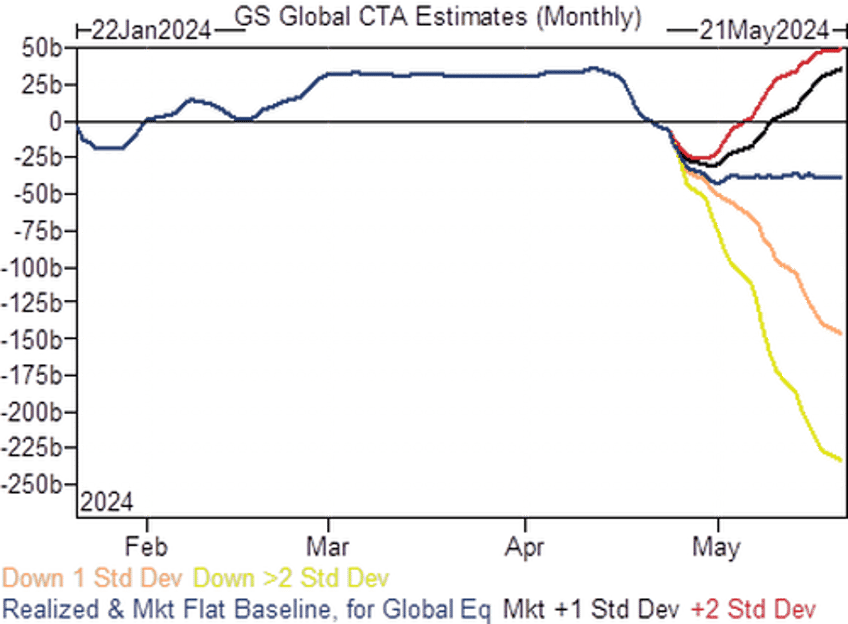

Then again, while Marko's relentless bearishness remains a source of comfort for all bulls, there is one looming risk: while we previously noted that both vol-control and risk parity funds are again buying, the same can not be said for CTAs, and as Goldman trader Cullen Morgan writes in his weekly Equity Positioning and Key Levels note (available to pro subs in the usual place), CTAs are sellers under almost all market conditions, and should the selling resume, CTAs have as much as $237BN in total global selling (and $58BN in S&P futs) over the next month. The only loophole: should the tape push higher over the next month, only then would CTAs buy some $46BN in global stocks, and $12BN in the US.

CTA Flows:

Over the next 1 week…

- Flat tape: -$36bn to sell (-$9.5bn SPX to sell)

- Up tape: -$23bn to sell (-$10bn SPX to sell)

- Down tape: -$70bn to sell (-$24bn SPX to sell)

Over the next 1 month…

- Flat tape: -$43bn to sell (-$9bn SPX to sell)

- Up tape: +$46bn to buy (+$12m SPX to buy)

- Down tape: -$237bn to sell (-$58bn SPX to sell)

On the other hand, after today's powerful bounce, we are now closer to tripping the short-term pivot level to the upside, rather than the all-important medium-term pivot level to the downside, to wit:

Key pivot levels for SPX:

- Short term: 5116

- Med term: 4888

- Long term: 4625

Anyway, while stock may swoon over the next few days and weeks, practically and pragmatically speaking the odds of a full-blown selloff (let alone crash), in an election year when the Fed is injecting $1 trillion in new debt every 100 days, are nil... unless of course Marko gets the tap on the shoulder that it is time for JPM's desk to liquidate all its holdings. At which point he will of course turn bullish, and all bets are off.

More in the full JPM and Goldman notes, both available to pro subscribers.