The week after payrolls is usually quiet for data (key US event on the calendar is the FOMC minutes on Wednesday) so all eyes will focus on Wednesday's 90-day extension to the reciprocal tariffs announced on Liberation Day back on April 2nd. However, there are increasingly suggestions that August 1st might be the new July 9th (see below).

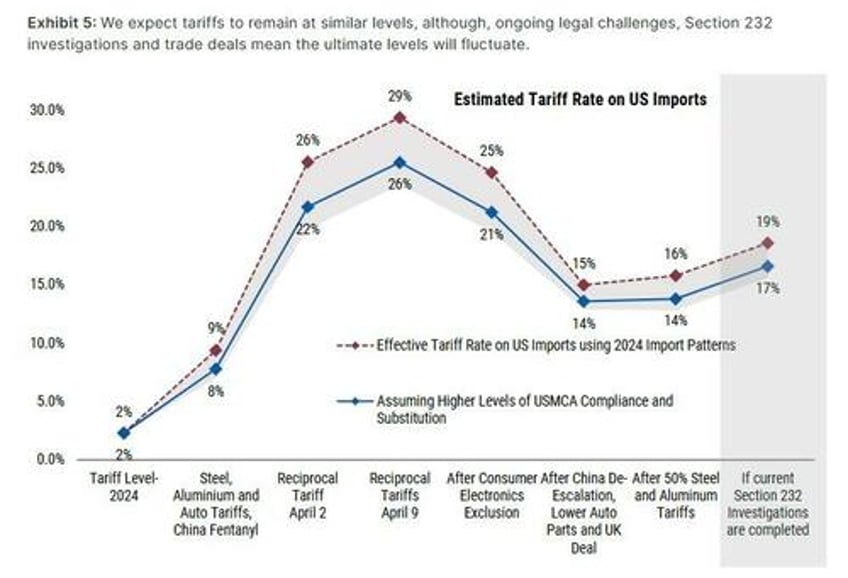

As a benchmark, DB's economists believe the current effective rate is around 15% (same as Morgan Stanley, see chart below), which is obviously a good deal below the implied rate from Liberation Day, but well above the low single figures before Trump returned to office. It is good news for markets that Section 899 (the revenge tax) has been consigned to the history books after not making it into the tax bill. It's also good news that Bessent has recently sounded more positive on the direction of travel in recent talks.

However, with financial conditions easy again and with the S&P 500 back at all-time highs, it wouldn't be a surprise to see the Trump Administration take a tough stance with those who they don't think negotiations are going in the right direction.

President Trump said at the end of last week that by the July 9 deadline, tariffs would be "fully covered and they’ll range in value from maybe 60 or 70% tariffs to 10 and 20%." Then over the weekend he said that he'd “signed some letters and they’ll go out on Monday – probably 12”. Overnight this was firmed up to noon Washington time today.

On Thursday he'd mentioned that the letters could go out on the Friday holiday and apply from August 1st if no deal can be made. This gave some comfort that there could be yet another extension and time to do deals. Bessent has also reiterated over the weekend that some countries would be able to negotiate a three-week extension to August 1st. So maybe we'll just be here again in three weeks when everyone is on the beach apart from the trade negotiators.

For Europe, Bloomberg reported that the union is willing to accept a 10% universal tariff if exemptions for areas such as autos (25%) and steel and aluminum (50%) are provided. For Japan, the mood turned negative last week as President Trump said that they should "pay 30%, 35%, or whatever the number is that we determine, because we also have a very big trade deficit with Japan." On the bright side, Treasury Secretary Bessent said they were "very close" to a deal with India, and on Thursday the US reached a trade deal with Vietnam.

Then overnight Trump posted on social media that "Any Country aligning themselves with the Anti-American policies of BRICS, will be charged an ADDITIONAL 10% Tariff,” This follows a BRICs summit in Rio over the weekend where the group condemned US and Israeli strikes on Iran.

In terms of key events this week, a highlight will be June's FOMC meeting minutes released on Wednesday. Economists expect more details to emerge around the extent of divisions among Committee members. Staying with monetary policy, central bank decisions are due in Australia tomorrow and New Zealand on Wednesday. DB's economists forecast 25bps cuts for both.

So lots of headlines in recent days, stand by for lots more over the next two days, and then likely beyond.

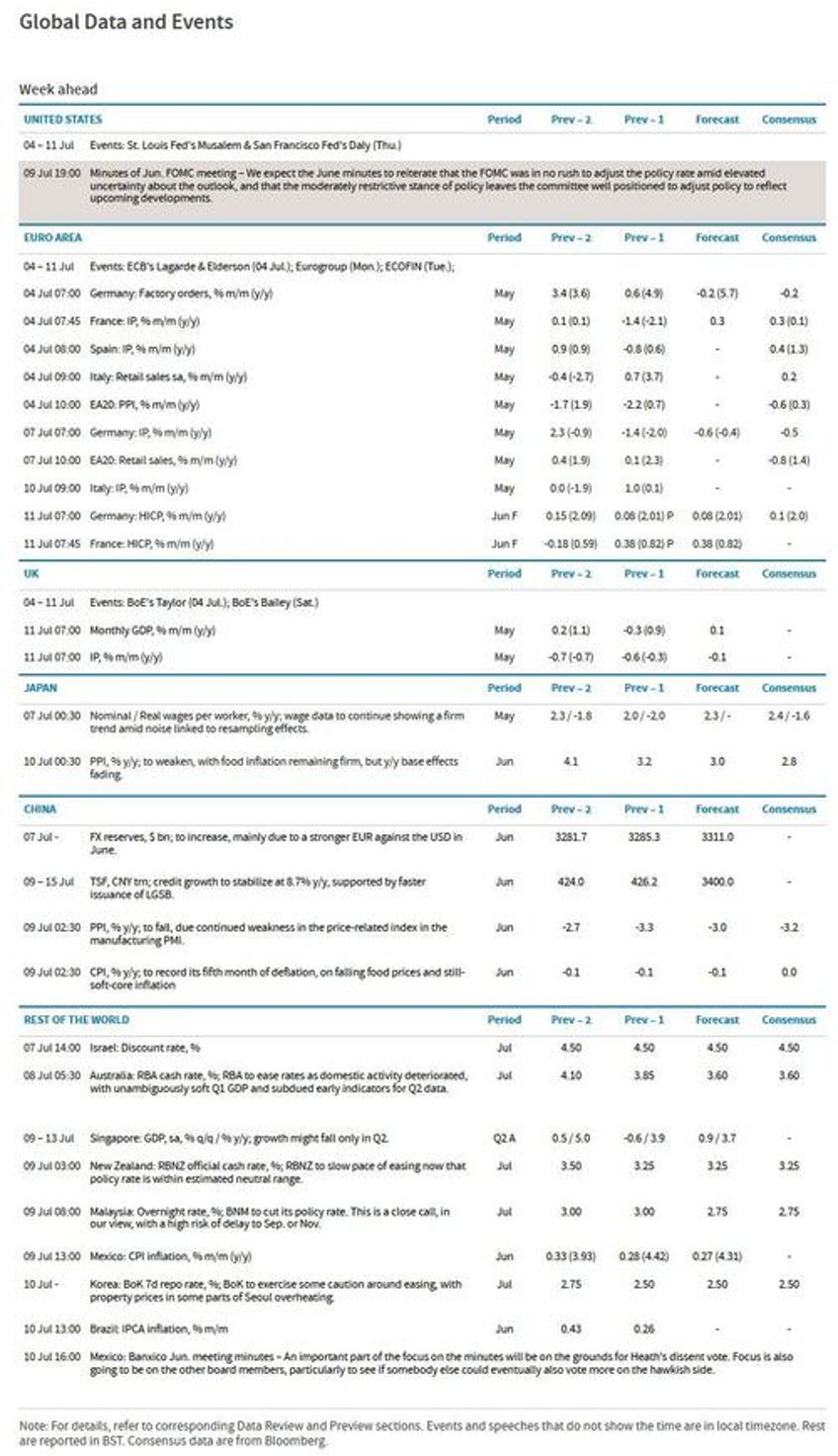

Courtesy of DB, here is a Day-by-day calendar of events

Monday July 7

- Data: China June foreign reserves, Japan May labor cash earnings, leading and coincident index, Germany May industrial production, Eurozone May retail sales, Sweden June CPI

- Central banks: ECB's Nagel and Holzmann speak

Tuesday July 8

- Data: US June NFIB small business optimism, NY Fed 1-yr inflation expectations, May consumer credit, Japan June Economy Watchers survey, bank lending, May BoP current account balance, BoP trade balance, Germany May trade balance, France May trade balance, current account balance

- Central banks: RBA decision, ECB's Nagel speaks

Wednesday July 9

- Data: US May wholesale trade sales, China June CPI, PPI, Japan June M2, M3, machine tool orders

- Central banks: FOMC minutes, RBNZ decision, ECB's Nagel and Guindos speak

Thursday July 10

- Data: US initial jobless claims, UK June RICS house price balance, Japan June PPI, Italy May industrial production, Denmark and Norway June CPI, Sweden May GDP indicator

- Central banks: Fed's Musalem and Daly speak, ECB's Cipollone and Villeroy speak

Friday July 11

- Data: US June federal budget balance, UK May monthly GDP, Germany June wholesale price index, May current account balance, Canada June jobs report, May building permits

* * *

Turning to just the US, the minutes of the June FOMC meeting will be released on Wednesday. St. Louis Fed President Musalem and San Francisco Fed President Daly will take part in public speaking engagements on Thursday.

Monday, July 7

- There are no major economic data releases scheduled.

Tuesday, July 8

- 06:00 AM NFIB small business optimism, June (consensus 98.6, last 98.8)

- 11:00 AM New York Fed 1-year inflation expectations, June (last 3.2%)

Wednesday, July 9

- 10:00 AM Wholesale inventories, May final (consensus -0.3%, last -0.3%)

- 02:00 PM FOMC meeting minutes, June 17-18:At its June meeting, the FOMC left the funds rate unchanged at 4.25%-4.5%. In the Summary of Economic Projections (SEP), FOMC participants raised their inflation forecasts and lowered their GDP growth forecasts to reflect larger tariff increases than they had previously assumed, but they made only moderate changes and were likely cautious in their tariff assumptions. The median 2025 dot—the key market focus at the June meeting—was unchanged by a narrow 10-9 majority at two cuts to 3.875%, while the median 2026 and 2027 dots both increased by 25bp. In the press conference Chair Powell reiterated that the FOMC was well positioned to respond to future developments and noted that he still expected to see meaningful tariff effects on consumer prices over the summer.

In the June minutes, we will also look for further clues on how FOMC participants are thinking about the Fed’s upcoming monetary policy framework review. We expect the FOMC’s “Statement of Longer-Run Goals and Monetary Policy Strategy” to return to saying that the FOMC will respond to “deviations” in both directions from maximum employment in normal times or at least water down the shortfalls language, under which the FOMC had previously committed to responding only to shortfalls from maximum employment. The Committee will also likely return to flexible inflation targeting (rather than flexible average inflation targeting) as its main strategy, though it is likely to retain the option to use a make-up strategy in some cases when the economy is at the zero lower bound (ZLB). As part of its review of communication strategies, the FOMC could introduce alternative economic scenarios to highlight risks and could also show corresponding monetary policy paths to explain how it might act under different circumstances.

Thursday, July 10

- 08:30 AM Initial jobless claims, week ended July 5 (GS 235k, last 233k); Continuing jobless claims, week ended June 28 (last 1,964k)

- 09:00 AM St. Louis Fed President Musalem (FOMC voter) speaks: St. Louis Fed President Alberto Musalem will speak at an event hosted by the Official Monetary and Financial Institutions Forum. Moderated and audience Q&A is expected. On June 6th, Musalem noted that while tariffs could have only a temporary effect on inflation lasting “a quarter or two,” their impact on inflation could also “last longer,” and noted there was a “50-50” chance that either scenario takes place. Musalem stressed that “if market-implied and/or survey measures of medium- to long-term inflation expectations begin to rise, at that point it becomes very important to prioritise price stability.”

- 02:30 PM San Francisco Fed President Daly (FOMC non-voter) speaks: San Francisco Fed President Mary Daly will deliver a speech on the economic outlook at an event hosted by MNI. On June 26th, Daly said that her “modal outlook has been for some time that we would begin to be able to adjust the rates in the fall, and I haven’t really changed that view.” Daly also said she “saw three scenarios [on how tariffs affect inflation]: one scenario … is that it’s just delayed … the second is that it’s just delayed but it will be a one-off … and then the third, which … is not my modal but is increasingly possible, is that this just doesn’t amount to what the models in history would tell us because businesses find ways to absorb the cost, and they split it down the production chain, and ultimately consumers pay less of that.”

Friday, July 11

- There are no major economic data releases scheduled.

Source: DB, Goldman, Barclays