After several years of earnings disappointment culminating with last quarter's catastrophic earnings release which was clearly meant to be the company's kitchen sink, it was only a matter before the company released results that would impress a market that had largely given up hope in the OG chipmaker (at least until it was trounced by Nvidia).

Well, that what finally happened today, when Intel not only beat conservative Q2 earnings estimates - in the process returning to profitability earlier than expected after two quarters of losses - but gave what it had not given in a very long time: upbeat guidance.

Here is what the company reported for Q2:

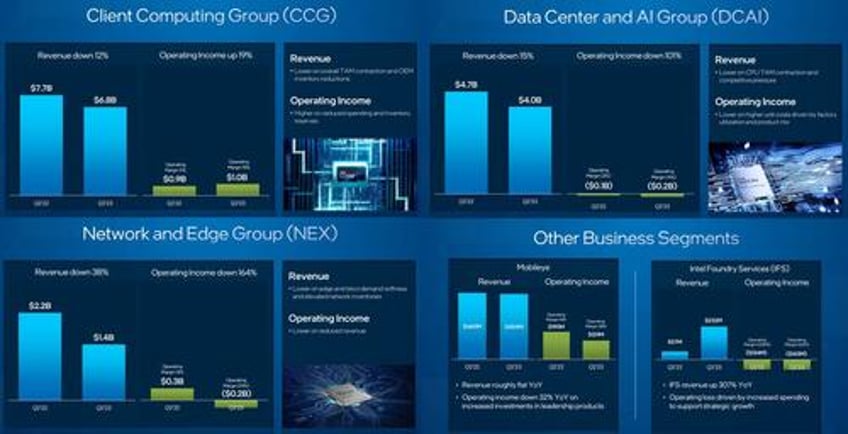

- Revenue $12.9 billion, beating est. $12.02 billion, and $900MM above the company's prior guidance

- Client Computing revenue $6.78 billion, beating est. $6.1 billion

- Datacenter & AI revenue $4.0 billion, beating est. $3.82 billion

- Network & Edge revenue $1.36 billion, missing est. $1.57 billion

- Intel Foundry Services revenue $232 million, beating est $152 million

- Mobileye revenue $454 million

- EPS $0.13, beating than the est. -$0.03 and well above the company's previous guidance of -$0.04.

- Adjusted operating margin 3.5%, beating est. -1.61%

- Adjusted gross margin 39.8%, beating est. 37.2%

Despite the across the board beat, Intel still remains far from its heyday when it generated quarterly sales of more than $20 billion as recently as 2021.

Client computing, Intel’s PC chip business, generated $6.78 billion in revenue last quarter. That compares with an estimate of $6.1 billion. Data-center sales were $4 billion, versus an average projection of $3.82 billion.

The company’s factory network, once the envy of the chip business, is crucial to whether Intel can regain its dominance. CEO Pat Gelsinger has promised that he will have the best production in the industry again by 2025 — and will even open those facilities up for rivals to use on a contract basis. In the meantime, the costly push to catch up with industry leader Taiwan Semi is weighing on profit.

Commenting on the quarter, Intel said that it:

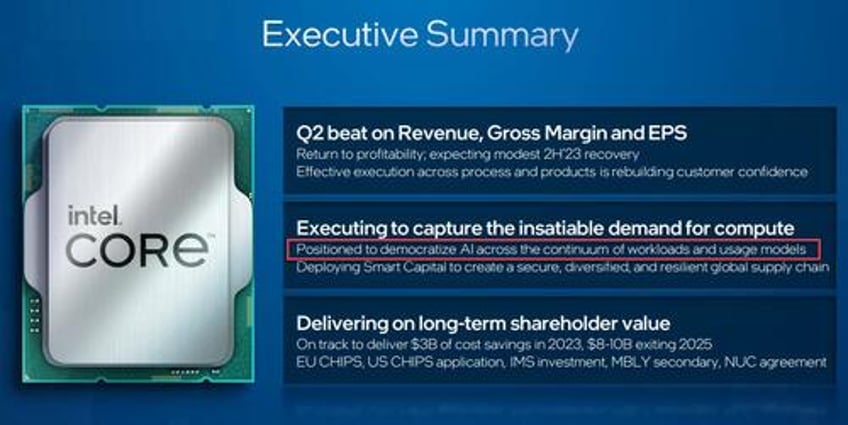

- Expects a modest 2H recovery as it returns to profitability

- Is on Track to deliver $3BN of cost savings in 2023, and $8-10BN exiting 2025

- Remains focused on operational efficiencies

And in a long overdue revelation, the company realized that it has to mention AI at every possible opportunity. Looking at the exec sum it has finally started doing so.

But the most notable part of the Q2 earnings report was the company's outlook, where Intel now sees revenue up to $13.9BN, well above the consensus est of $13.23BN (although granted the range given is very broad at $12.9BN to $13.9BN), and also expects gross margin of 43.0%, above the median estimate of 41.0%, and resulting in EPS of $0.20, also above the consensus est. of $0.16, as the company returns to some semblance of normalcy.

Despite the rebound in margins, they remain nowhere near the 60% level that it maintained for years, when it had dominant market share and productive factories. The company, one of the few in the industry that doesn’t outsource production, has been running its plants at less than full capacity. That’s helped reduce the amount of supply in a market where customers already have too much inventory.

The outlook suggests Intel has turned a corner after sluggish demand for personal computer chips battered its business. Management had promised that the second half of the year would show improvement, and now investors are seeing evidence of that.

Still, the copmany remains in the early stages of a turnaround, which hinges on reestablishing Intel’s once-bulletproof lead in chip technology.

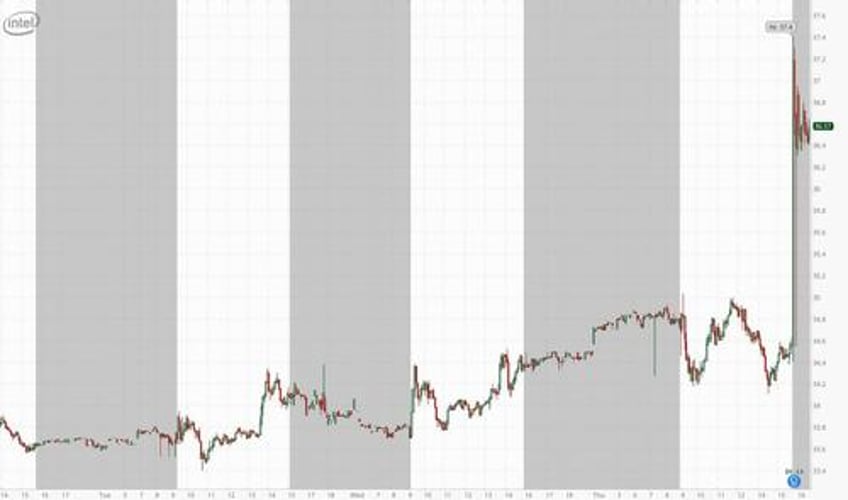

Though Intel stock has gained 31% this year through Thursday’s close, that underperformed a rally by chip-related shares. The Philadelphia Stock Exchange Semiconductor Index is up 49% in 2023. Content with what the company earnings, INTC shares rose about 7% in late trading after the report was released.

As Bloomberg notes, investors have yet to fully buy into Gelsinger’s turnaround plan. Rivals such as Nvidia and AMD have seen their stocks surge more dramatically, helped by the rush to use their chips in new artificial intelligence systems. Intel is seen as a relative laggard in that segment.