By Michael Msika, Bloomberg Markets Live reporter and strategist

UK inflation has cooled more than expected for the first time since January, which may provide a temporary relief to underperforming British stocks, as traders trim wagers on the extent of further Bank of England policy tightening.

While moves by the Fed and the ECB have helped bring down price pressures significantly in the US and Europe over the past year, the Bank of England has had less success. Inflation is still running at 7.9% year-on-year, and further policy tightening will still be necessary, which threatens to send the UK economy into a recession.

A surge in the pound has failed to lift domestic stocks as investors fret about the economy, with many attributing the strength of the currency to hawkish policy rather than confidence in the market. With speculative positioning on sterling rising to the highest since 2007, a reversal could boost large-cap exporters instead.

“I’m not so optimistic about UK domestic stocks,” says Anthi Tsouvali, multi-asset strategist at State Street Global Markets. “I think that inflation will be high for a while.” It might take time for sentiment to turn, she predicts, favoring large caps that have little exposure to the local market.

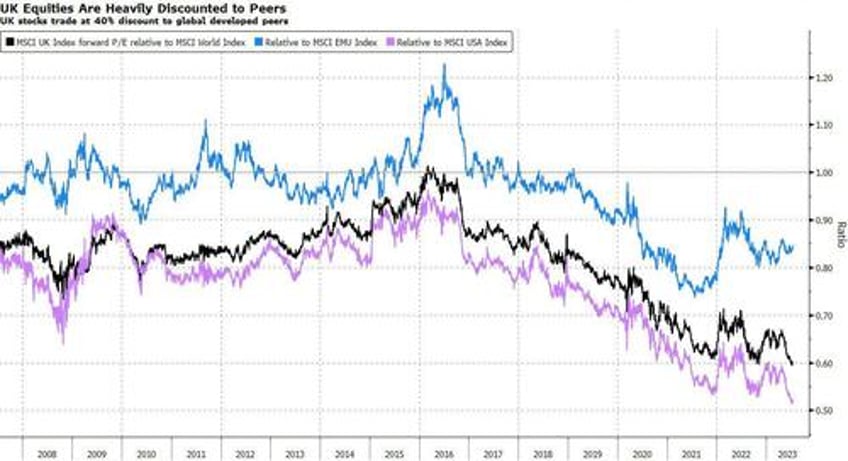

Overall, British stocks remain out of favor. According to the Bank of America fund manager survey in July, allocation to UK equities fell four percentage points in the past month to a net 21% of respondents now underweight.

Investors have sold UK stocks indiscriminately in the past 18 months, says Canaccord Genuity’s Quest analyst Graham Simpson, predicting that a peak in bearishness isn’t far off. That’s made the UK market “cheap as chips,” he notes. Indeed, the MSCI UK Index now trades at a 40% discount to global peers.

While neither interest rates or inflation are at satisfactory levels, “we could finally be at a stage where we have enough ‘known knowns’. And that is something UK investors can work with and potentially reap the rewards,” he said before the latest inflation data. Screening for factors of value, quality and momentum, he names stocks including 3i, AJ Bell, Bytes, Centamin, Gamma Communications, Hikma, IMI, JD Sports, MITIE, Morgan Sindall, Paragon, and Wise.

“UK mid and small cap stocks look cheap and would garner interest if a rollover in UK inflation can lift UK macro sentiment,” Morgan Stanley strategists led by Graham Secker said earlier this month, flagging the extreme pessimism from investors over the UK market. While the strategists see recession and monetary tightening risks rising, with a “likely challenging autumn ahead,” they still see decent disinflation in the second half of the year.

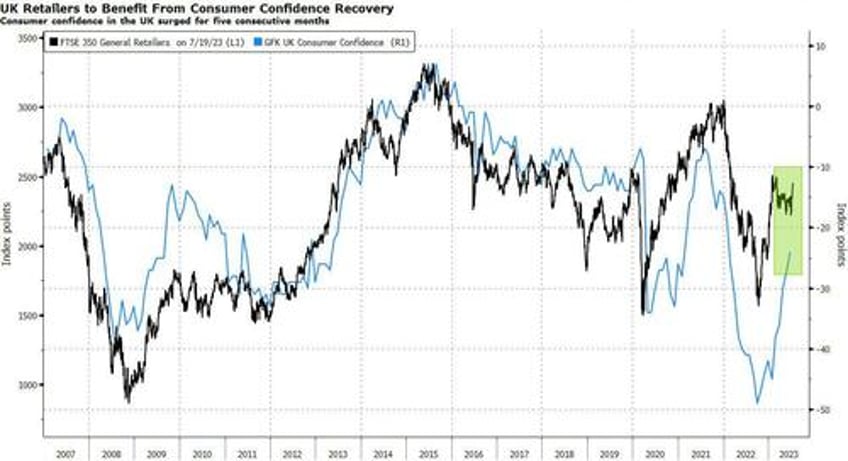

One bright spot has been the resilient UK consumer, with confidence levels rising for five consecutive months. The next reading is due Friday and figures are expected to stabilize.

“UK equities offer very attractive expected returns for the long-term investors, but it requires the mentality of going against consensus and having a long-term investment horizon,” says Saxo Bank strategist Peter Garnry.