By Marcel Kasumovich of One River Asset Management

“We will promptly formulate and introduce policies to restore and expand consumption,” declared Jin Xiandong at the monthly presser for China’s National Development and Reform Commission (NDRC). Xiandong may not be the household name of Powell, but he packs a mighty punch.

China’s Commerce Ministry provided the details - an 11-point plan to meet the NDRC objectives. It is a stark contrast to Western macro policy where central banks do the heavy lifting.

China’s economy barely grew in the second quarter amid a global manufacturing slump. It’s a welcomed slump for overheated economies like the US, having cooled inflation. But China deviated from the inflation pack, averaging 1.4% in the previous two years compared to 6% in the US and 5% in Europe.

Proactive easing is a policy option in China. But is it effective? Economic systems are mostly stable, with brief periods of chaos.

The West and the East have a meeting of the minds on what this means – draft policy to restore order, a return to the natural state of stability. But what if it’s a misdiagnosis? Brief periods of instability can be seen as naturally occurring, even desirable - a cleansing, a healthy resetting of expectations.

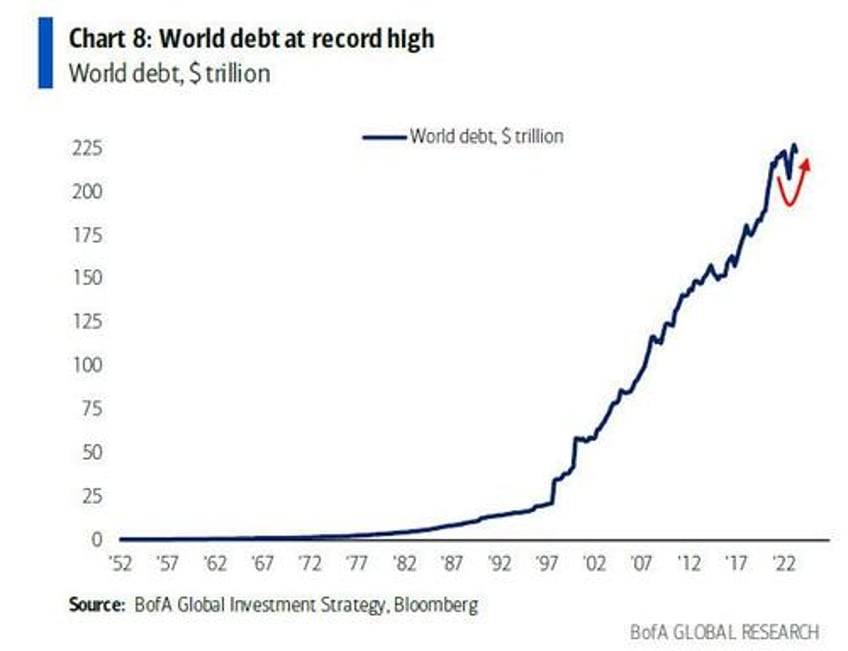

What if the problem is our incessant need to control, to cajole, to combat nature. Hyman Minsky thought so and was mostly ignored. Balance sheets tell the story, carrying infinitively lived truths. Balance sheet weakness is the cost of artificial stability.

Policy intervention smooths and soothes shocks - with debt. And if the assets on the other side of the balance sheet aren’t productive, future instability will be even greater.

Such is the irony of intervention - near term stability is celebrated, even among economic rivals. The resultant instability is a problem for the next generation.

And the US and China take their corners in the ring of the cold war, where innovation under vastly different philosophies will determine the victor. But their capacities to do so are constrained by a common problem - debt.