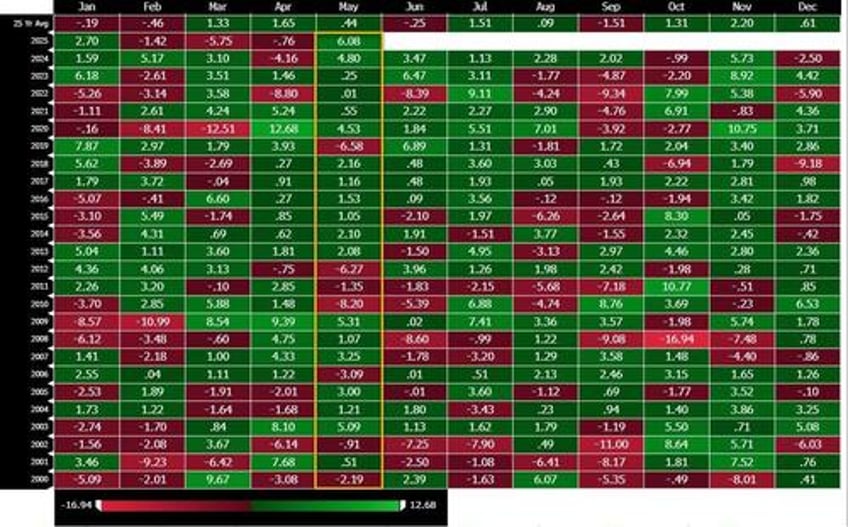

After the rollercoaster turmoil of April, what a triumphant return for the S&P last week - and month - were: the S&P closed the shortened week up +188bps, rising +6.15% for the month, the best May monthly performance since 1997.

According to Goldman's shares sales trading desk, on the week, Asset Managers - who were roughly flat the prior week - finished $4BN net sellers, and appeared to be using the MSCI rebal as an opportunistic liquidity event, with supply heavily concentrated in tech and consumer. On the other hand, Hedge Funds finished slight buyers (+$800m) with constructive demand in Tech following better than feared NVDA guidance, consumer (follow through in BIRK and AS FOs), and macro products.