Great news for DIYers and contractors alike: Home Depot CFO Richard McPhail told CNBC this morning that the retailer has no plans to raise prices despite tariffs. This puts Home Depot at odds with Walmart, which is set to hike prices later this month. While Home Depot reaffirmed its full-year sales outlook, it delivered mixed results for the first quarter.

"Because of our scale, the great partnerships we have with our suppliers and productivity that we continue to drive in our business, we intend to generally maintain our current pricing levels across our portfolio," CFO McPhail told CNBC in an interview.

McPhail said that more than half of what is on store shelves nationwide comes from suppliers in the U.S. He said the retailer has been pushing to diversify sourcing in recent years. He said by this time next year, not a single country will have 10% of its purchases.

The CFO's comments offer weekend warriors—installing gardens, building chicken coops, and catching up on yard work—a big sigh of relief this spring as the summer season approaches in the Northern Hemisphere.

Home Depot's pricing strategy is at odds with Walmart's, which announced last week that the tariff war threatens its low-price model.

Walmart CFO John David Rainey warned that price hikes were imminent: "If you've not already seen it, it will happen in May and then it will become more pronounced."

On the earnings front, Home Depot forecasts 2.8% total sales growth and 1% comparable sales growth for the year, assuming current tariff levels remain in place (30% on Chinese goods, 10% on others). The outlook, which came in better than feared (according to several Wall Street analysts), suggests consumer spending remains resilient, even as University of Michigan survey respondents, particularly among Democrats, continue to express incoming apocalyptic inflation.

First-quarter earnings missed Wall Street expectations for the first time since May 2020, though sales beat estimates.

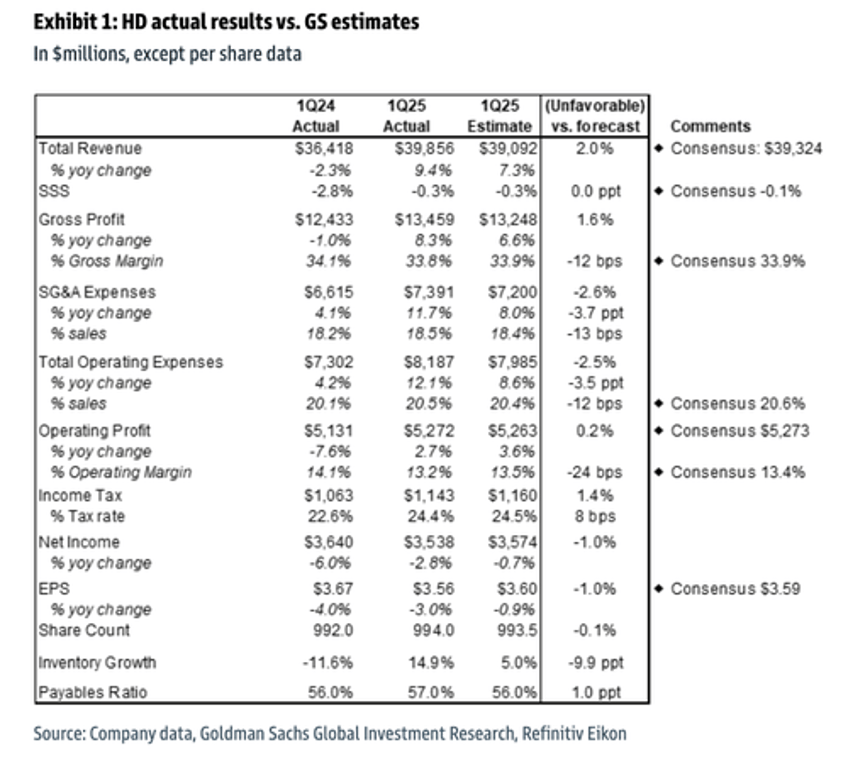

Here's what Home Depot reported via Goldman analyst Kate McShane's first take:

HD reported adj. 1Q25 EPS of $3.56, below the GS estimate of $3.60 and consensus (Refinitiv) of $3.59. Net sales increased 9.4% y/y to $39.9bn (vs. GS/consensus of $39.1bn/$39.3bn) as comparable sales decreased -0.3% y/y, consistent with the GS estimate of -0.3% and below consensus of -0.1%. Foreign exchange rates negatively impacted total company comparable sales by ~70 bps. During the quarter, HD experienced increases in both average ticket (+0.03% y/y) decelerating from +0.3% in 4Q, and transactions (+2.1% y/y) decelerating from +7.6% in Q4. Comparable sales in the U.S. increased +0.2% y/y. HD's operating margin decreased -86 bps y/y to 13.2% (vs. GS/consensus of 13.5%/13.4%) as gross margin decreased -37 bps y/y to 33.8% while total operating expenses as a % of sales increased +49 bps y/y to 20.5%.

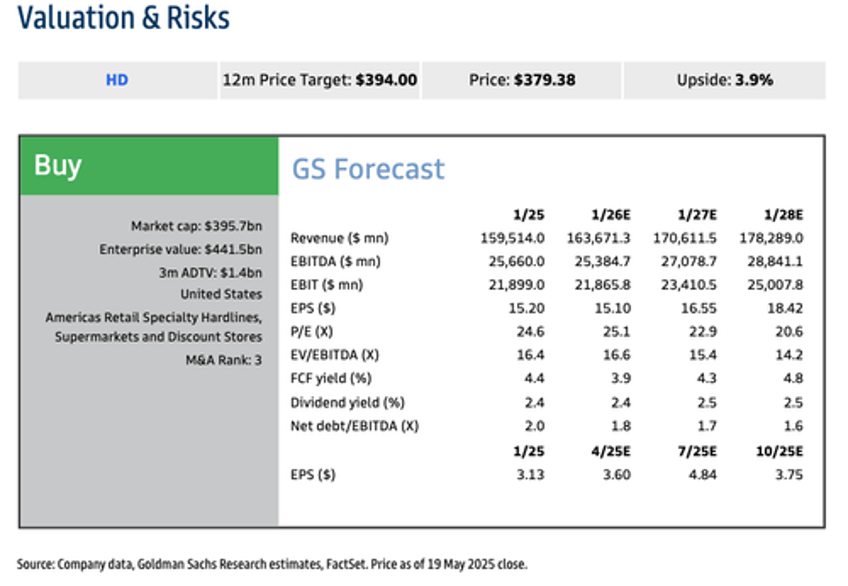

Management reaffirmed their FY25 guidance including sales growth of approximately 2.8% (vs. consensus of +2.9%), a 1.0% increase in comparable sales (vs. consensus of +1.1%), gross margin of 33.4% (vs. consensus of 33.4%), adj. operating margin of 13.4% (vs. consensus of 13.3%), and adj. EPS growth of approximately -2.0% (vs. consensus of +0.0%). HD also plans to open ~13 new stores and expect for capital expenditures to be approximately 2.5% of total sales.

Analysis

Average ticket increased slightly +0.03% y/y to $90.71 from $90.68 in the prior year, while total customer transactions increased +2.1% y/y (decelerating from +7.6% in 4Q). Management noted that they saw better engagement in smaller projects and their Spring events.

Gross margin decreased -37 bps y/y to 33.8%, slightly below GS/consensus estimates of 33.9%.

Total operating expenses increased +12.1% y/y to $8.2bn, while total operating expenses as a % of sales increased +49 bps y/y to 20.5%.

Adjusted operating margin decreased -86 bps y/y to 13.2%, below the GS/consensus estimates of 13.5%/13.4%, and adjusted operating profit of $5.3bn compares to $5.1bn in the prior year (+2.7%).

Inventory increased +14.9% y/y (vs. +11.8% in 4Q) which we note compares to the sales increase of 9.4%. The company's payable ratio of 57.0% increased from 56.0% in the prior year.

Here are Home Depot's actual 1Q25 results versus estimates via Goldman.

McShane maintained a "Buy" rating on the home improvement retailer and a 12-month price target of $394.

Additional commentary from Wall Street (list courtesy of Bloomberg):

TD Cowen (buy), Max Rakhlenko

"Key positives included better-than-feared 1Q comps at (0.3%) which were only slightly below Street, and management reiterated the FY guide," Rakhlenko writes in a note

That said, adjusted EPS missed both consensus estimate, and his projection, due to lower EBIT margin, with misses in both gross margin and SG&A

Key topics on call will include tariffs/HD's ability to navigate supply chains and pass through price increases, housing dynamics, Pro/Big Ticket engagement, near-term trends

Vital Knowledge, Adam Crisafulli

- This HD report falls into the 'better than feared' bucket based on the decent U.S. comp number and reaffirmed guidance," writes Crisafulli in a note

Stifel (hold), W. Andrew Carter

Carter views the 1Q report as "neutral," noting that guidance requires an "acceleration in comparable sales growth" for the rest of the year, though he's seeing "signs of resilience and potential strength for home improvement"

Says commentary on the conference call will be "key for adding context around the Liberation Day shock"

Expects "muted overall response" for the stock and looks for commentary on call to gain "comfort" in the reiterated guidance

Truist (buy), Scot Ciccarelli

"1Q appears to be a middle of the fairway shot for Home Depot, despite a weather-impacted February, constantly changing rhetoric out of DC and stubbornly-high mortgage rates," Ciccarelli writes in a note

U.S. comparable sales were "just below" his estimate, but "just above" most recent competitor revisions

HD's lack of comments on tariffs seems to suggest that management views the "ultimate impact as neutral-ish" and that they are focused on how the core business is trending now; expects "plenty of questions" on tariffs during the call

Still need to see how steep the future growth curve will be, but positives include HD's 2nd straight positive U.S. comp., Truist credit card data suggests that sales accelerated as weather improved, SRS acquisition will "incrementally benefit" comp. sales by mid-2Q, and Cicarelli expects further sales/earnings gains as the year progresses

Citi (buy), Steven Zaccone

Expects results to be viewed "favorably" and says HD's results/guidance put "greater focus" on Lowe's earnings report Wednesday, where expectations are lower for comp. sales results/guidance change and tariffs may be more challenging to manage given smaller scale

Key topics for call will be: details on comparable sales cadence; ticket vs. transaction contribution to comps for the rest of the year; expected gross margin puts/takes from tariff impact and subsequent price increases; SRS performance; demand elasticity for Pro vs. DIY consumers

Bloomberg Intelligence, Drew Reading

"Reaffirmed full-year guidance and indication that it's well- positioned to navigate tariffs reflect an increasingly diversified supply chain," Reading writes

Within 12 months, HD expects that no country will account for more than 10% of its sourcing

Challenges include a weak housing market and an "increasingly cautious" consumer who is putting off big-ticket discretionary projects

The takeaway: As Walmart's low-price model comes under pressure, consumers will likely catch on to the shift—and increasingly turn to Home Depot for their DIY needs, especially with stable pricing and strong product availability with its supply chain mainly sourced from the U.S. and diversified worldwide.