General Motors shares are higher in premarket trading after raising its 2024 guidance and beating Wall Street analysts' top- and bottom-line expectations for the first quarter. The automaker cited stable pricing and increasing demand for its petrol-powered vehicles.

GM boosted its adjusted pretax profit forecast to $12.5 billion to $14.5 billion, or $9 to $10 a share, up from its previous range of $12 billion to $14 billion, or $8.50 and $9.50 a share, for the year on a more robust car market in North America offsetting losses in other regions.

The automaker increased its 2024 forecast for adjusted automotive free cash flow to $8.5 billion and $10.5 billion, up from the previous estimate of $8 billion to $10 billion.

"Over the last 24 months, we have been growing at an annualized rate of 15%," GM Chief Financial Officer Paul Jacobson told investors on an earnings call, noting, "That gave us the confidence to raise full-year guidance."

Investors overlooked the company's waning electric vehicles unit in China primarily because of its strong performance in the US.

"There ... is the reality that the pricing is staying stronger for longer than anybody anticipated," Tim Piechowski, portfolio manager at ACR Alpine Capital Research in St. Louis, which owns GM shares, told Reuters.

"The engine of the company is truck and SUV at this point," Piechowski said, adding, "They're just generating substantial profit and free cash flow that will continue to fund the initiatives in EV. Full steam ahead."

Here's a snapshot of the 2024 forecast (courtesy of Bloomberg):

Sees adjusted EPS $9.00 to $10.00, saw $8.50 to $9.50, estimate $9.04 (Bloomberg Consensus)

Sees adjusted auto free cash flow $8.5 billion to $10.5 billion, saw $8 billion to $10 billion

Sees adjusted Ebit $12.5 billion to $14.5 billion, saw $12 billion to $14 billion, estimate $12.69 billion

Sees net income $10.1 billion to $11.5 billion, saw $9.8 billion to $11.2 billion, estimate $10.22 billion

Sees Automotive net cash provided by operating activities $18.3 billion to $21.3 billion

For the first quarter, GM increased revenue to $43 billion, or about 8% year over year, with most of the gain coming from North America. That boosted profits, rising to $2.62 a share, up from $2.21 one year ago, beating the $2.12 average Wall Street analyst estimate tracked by Bloomberg.

Here's a snapshot of first-quarter results (courtesy of Bloomberg):

Adjusted EPS $2.62 vs. $2.21 y/y, estimate $2.12

Net sales and rev. $43.01 billion, +7.6% y/y, estimate $42.19 billion

Cruise net sales and revenue $25 million, estimate $29.3 million

Automotive net sales and revenue $39.21 billion, +7% y/y, estimate $37.69 billion

GM Financial net sales and revenue $3.81 billion, +14% y/y, estimate $3.6 billion

North America adjusted Ebit $3.84 billion, +7.4% y/y, estimate $3.02 billion

International operations adjusted Ebit loss $10 million vs. profit $347 million y/y, estimate profit $223.3 million

GM financial adjusted EBT $737 million, -4.4% y/y

Adjusted automotive free cash flow $1.09 billion vs. negative $132 million y/y

GMNA vehicle sales 792,000 units, +9.5% y/y, estimate 739,557

GMI vehicle sales 104,000 units, -26% y/y, estimate 164,343

Adjusted Ebit $3.87 billion, estimate $3.13 billion

Following supply chain snarls during Covid, GM's vehicle inventories rose to 534,000, well above the 2023 averages. Last quarter's inventory means the automaker has roughly 63 days of supply, which GM considers 'healthy.'

GM's strength in the US allowed investors to overlook an operating loss of about $100 million in GM's China operation.

"We expect things to normalize a little bit and turn back to profit," Jacobson told investors on the call while referring to China.

Shares of GM are up 5% in premarket trading. As of Monday's close, shares entered a technical bull market on the year, rising 20.3%.

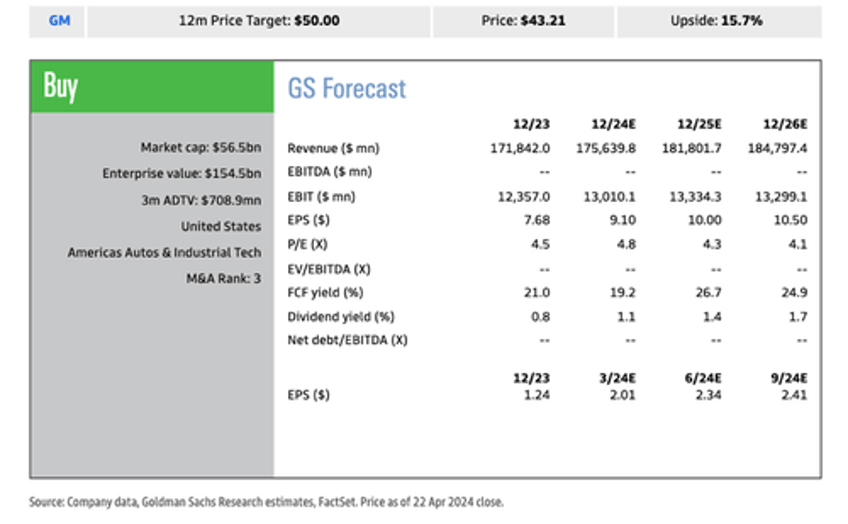

In a note to clients, Goldman told them GM is a "Buy rated" company with a 12-month price target of $50 based on 5X applied to our normalized EPS estimate of $10.00.

They noted several risks to their bull outlook, including the auto cycle, market share, margins, FCF, and GM's ability to achieve profitably to electric vehicles.