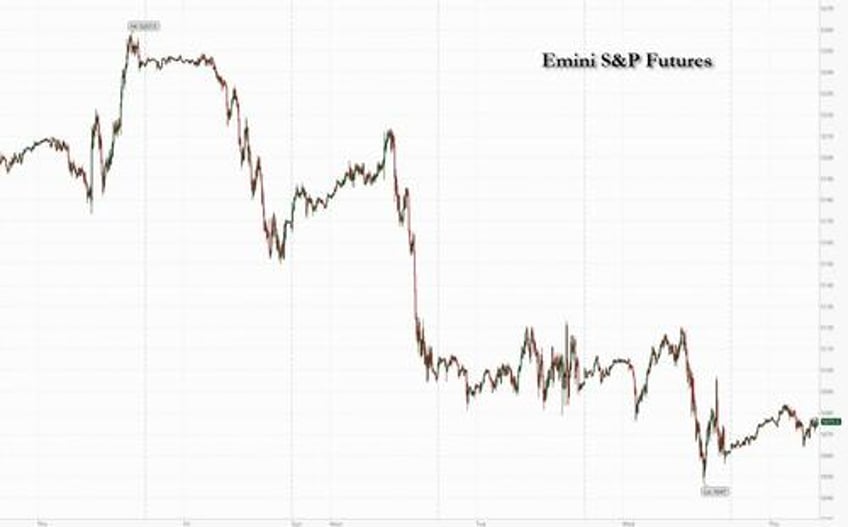

US equity futures are higher after four consecutive days of selling, although that is the same pattern we have seen all week as futures initially rise only to dump later in the day. As of 7:40am, S&P futures are up 0.3% while tech stocks were set to outperform, pushing the Nasdaq 0.4% higher after TSMC delivered a better-than-projected revenue outlook. An index of global chip stocks and AI poster child Nvidia fell into a technical correction amid the recent selloff, with Evercore ISI analyst Julian Emanuel thinking this is only the start, with the downdraft in stocks only starting and set to continue through the rest of 2024. The dollar steadied, while US Treasuries pared an earlier gain to trade flat. In Europe, major markets are higher with Spain/France leading and Germany lagging. Commodities are mixed: oil is falling further; precious and base metals are higher. Reports from Netflix and L’Oreal are due after the close of their respective markets. Investors will also be parsing initial US jobless data, the latest Leading Index and Existing Home Sales data, as well as speakers from a raft of central banks.

In premarket trading, semis are rebounding from yesterday’s post ASML selloff (MD +1.0%, NVDA +1.4% and MU +2.5%) after Taiwan’s TSMC, the main chipmaker for Nvidia and Apple, reported sales guidance that was better than expected and it stuck by plans to spend up to $32 billion over the course of this year, shoring up expectations for a sustained increase in AI demand. Also on the chip sector front, Micron Technology shares are up 1.5% in premarket trading after Bloomberg reported that the largest maker of US computer memory-chips is poised to get more than $6 billion in grants from the Commerce Department to help pay for domestic factory projects. MegaCap Tech are also mostly higher: AAPL +32bp and AMZN +23bp. Here are the other notable premarket movers:

- Blackstone Inc. collected more fees from big retail funds and credit strategies this year, compensating for the slower pace of deal exits, the asset manager said in its first-quarter report.

- EBay shares rise 3.5% after Morgan Stanley double-upgrades the e-commerce firm to overweight from underweight. Analysts recommend a pair trade with Etsy on the prospect of a narrowing valuation gap as eBay approaches positive growth thanks to a boost from AI.

- Etsy shares fall 3.7% as Morgan Stanley cuts Etsy to underweight.

- JetBlue shares advance 1.6% after the airline was upgraded to neutral from underweight at JPMorgan, which sees the company as “increasingly well-positioned for a modest potential move to the upside based on improving market sentiment.”

- Las Vegas Sands decline 2.5% after reporting first quarter results late Wednesday. The casino operator exceeded adjusted profit expectations in the quarter, but results at its Macau locations broadly missed Wall Street’s estimates.

- Match Group shares slip 2.3% after the dating-app company was downgraded to equal-weight from overweight at Morgan Stanley, which flags concerns over Tinder saturation and execution.

- Synovus Financial shares trade 7.7% lower after first-quarter net interest income missed the average analyst estimate.

- Williams Cos. shares edge 0.7% lower on low volumes as the natural gas pipeline and processing firm receives its only sell-equivalent rating. Wolfe downgrades to underperform from peerperform saying it is a “great company, not a great value.”

- Zscaler shares rise 2.4% as KeyBanc Capital Markets raised the recommendation on the security software firm’s stock to overweight from sector weight.

In the last week, investors have been unwinding gains from a record rally in the first quarter as they come to grips with an overlever, overheating US economy and stubborn inflation that’s forced them to recalibrate rate bets. Money markets signal just two rate cuts by the Fed this year, starting in September, down from 7 at the start of the year, after a fresh round of hot inflation sent Treasury yields soaring to 2024 highs. Offsetting disappointment about the speed of rate cuts, though, investors are more optimistic about growth and the potential feedthrough to corporate profits, according to Peter Oppenheimer, global equity strategy chief at Goldman Sachs.

“Growth is fine, but we’re not likely to get the boost in terms of lower rates that the markets had expected,” Oppenheimer said in an interview with Bloomberg TV. “That’s causing some indigestion, so earnings will really be crucial here.”

Overnight, Loretta Mester became the latest Fed official to warn it shouldn’t rush to cut rates. Meanwhile, Michelle Bowman said progress on inflation may have stalled and questioned the degree to which monetary policy is restraining the economy.

Elsewhere, Joe Biden ramped up his campaign rhetoric, calling China “xenophobic” and highlighting its economic woes, as he sought to make the case for US economic strength.

In Europe, the Stoxx 600 rises 0.4% as investors weighed a slate of upbeat corporate earnings reports against concerns around higher-for-longer interest rates. The utilities sub-index leads gains while energy stocks fall the most. In company news, engineering company ABB hit another record high after it posted strong first-quarter earnings. Here are some of the biggest European movers Thursday:

- ABB (ABBN SE +5.2%) jumps after posting an overall 1Q beat, according to analysts, driven primarily by its electrification unit performance

- Aixtron (AIXA GY +6.1%) climbs after the German chip equipment maker said that Wolfspeed placed multiple tool orders in 3Q and 4Q last year

- Edenred (EDEN FP +3.8%) rises following its first-quarter results, which Citi says are a “step in the right direction” for the payment-service provider

- Tele2 (TEL2B SS +5.1%) advances after it beat estimates to 1Q Ebitda, driven by strong performance in its key Swedish market, as well as “decent” growth in the Baltics

- Nordea Bank (NDA FH +0.4%) rises after reporting record profits and net interest income in the first quarter on the back of an enduring tailwind from interest rates

- National Grid (NG/ LN +1.6%) gains after it said a change in the way it reports earnings will boost EPS over the current financial year. Analyst reactions were mixed

- Sartorius (DIM FP -14%) plunges after the company reported revenue for the first quarter that missed the average analyst estimates

- EQT (EQT SS -5.1%) falls with analysts saying that the Swedish private equity firm’s quarterly print is showing continued slowness in fundraising

- Schindler (SCHP SE -0.4%) drops after the elevator maker reported revenue shy of expectations, according to Vontobel

- International Distributions Services (IDS LN -3.9%) falls, trimming some gains from Wednesday’s rally that followed news of a rejected takeover bid from Czech entrepreneur Daniel Kretinsky’s firm

- Rentokil (RTO LN -2.8%) drops after the pest control company delivered 1Q in-line results. Investors remain cautious about the integration of the Terminix acquisition, Citi says

Earlier in the session, Asia’s stock benchmark rebounded after a six-day selloff, as sentiment stabilized with the region’s currencies regaining some footing. The MSCI Asia Pacific Index rose as much as 1.1% but pared the gain to 0.6%, set for its best day since April 9. Tencent, Samsung Electronics and BHP Group were among the biggest contributors to the advance. Chip stocks were in focus as TSMC delivered a better-than-projected revenue outlook and stuck with plans to spend as much as $32 billion in 2024. Shares in Hong Kong were among the region’s best performers. Benchmarks in mainland China extended their advance to the second day following a clarification from the country’s securities regulator over delisting rules.

- Hang Seng and Shanghai Comp conformed to the positive mood but with upside capped in the mainland by US-China trade frictions after President Biden called for an increase in tariffs on Chinese metals.

- Nikkei 225 recovered all of its opening losses and returned to above the 38,000 level.

- ASX 200 was led by the mining industry after BHP's encouraging quarterly production update.

In FX, the Bloomberg Dollar Spot Index is down 0.1%, falling for a second day. The dollar has jumped about 4% this year, outperforming all major currencies, as reduced prospects for Fed rate cuts feed greenback strength and higher US yields. Separately, the Bloomberg Asia Dollar Index edged higher, supporting investor appetite toward the region. The yen was steady following a joint statement from US Treasury Secretary Janet Yellen alongside the finance ministers of Japan and South Korea that noted “serious concerns” about the depreciation of the two Asian currencies. A global gauge of emerging-market currencies gained for a second day, suggesting some stability after hitting a 2024 low earlier this week.

In rates, treasuries erased an earlier gain US 10-year yields unchanged at 4.58%, near Wednesday’s low, trailing gilts by 1.5bp in the sector; curve spreads remain within 1bp of Wednesday’s close, inverted 2s10s around -35bp. Gilts outperform their German counterparts. $23b 5-year TIPS sale at 1pm New York time is week’s final coupon auction.

In commodities, oil prices added to Wednesday’s drop, with WTI down another 0.6% to trade near $82 a barrel, weighed by weaker Chinese industrial data and a swelling in US crude inventories, while gold rose. Spot gold rises 0.8% to around $2,379/oz.

Bitcoin was back above $62k after briefly dipping below $60k yesterday, while Ethereum finds support around $3k. Binance converted the entire pool of assets held in an emergency fund for users into USDC stablecoin. The fund serves as a backstop for customers in “extreme situations”, according to Bloomberg.

Looking at today's calendar, US session includes weekly jobless claims data, a packed Fed speaker slate and 5-year TIPS new-issue auction. US economic data slate includes April Philadelphia Fed business outlook and weekly jobless claims (8:30am), March Leading index and existing home sales (10am). Fed speakers include Bowman (9:05am, 9:15am), Williams (9:15am), Bostic (11am, 5:45pm) and Collins (12pm)

Market Snapshot

- S&P 500 futures up 0.3% to 5,076.50

- STOXX Europe 600 up 0.3% to 500.26

- MXAP up 0.8% to 170.64

- MXAPJ up 0.9% to 524.05

- Nikkei up 0.3% to 38,079.70

- Topix up 0.5% to 2,677.45

- Hang Seng Index up 0.8% to 16,385.87

- Shanghai Composite little changed at 3,074.23

- Sensex little changed at 72,888.80

- Australia S&P/ASX 200 up 0.5% to 7,642.11

- Kospi up 2.0% to 2,634.70

- German 10Y yield little changed at 2.44%

- Euro little changed at $1.0676

- Brent Futures down 0.3% to $86.99/bbl

- Gold spot up 0.8% to $2,379.19

- US Dollar Index little changed at 105.86

Top Overnight News

- BOJ board member Asahi Noguchi said on Thursday the pace of future rate hikes would likely be much slower than that of its global peers in recent policy tightenings, as the impact of rising domestic wages has yet be fully passed onto prices. RTRS

- A US congressional effort to force TikTok’s Chinese owner to divest the app has gained steam after House Speaker Mike Johnson unveiled a new package of legislation that could compel the Senate to support the measure. FT

- Berkshire Hathaway priced ¥263.3 billion ($1.71 billion) of bonds in the firm’s largest yen debt deal since its 2019 debut sale. The surprisingly big offering raises speculation that Warren Buffett may be planning another foray into Japanese stocks. BBG

- TSMC’s rebound accelerated, with “extremely high” AI demand bolstering its outlook. The chipmaker expects revenue to grow as much as 30% this quarter following its first profit rise in a year. Chip stocks may see some relief on the results. Nvidia ticked up premarket, as did ASML’s stock. BBG

- European diplomats traveled to Israel on Wednesday to make one more plea for restraint in response to the aerial attack that Iran launched this weekend, but Britain’s foreign secretary acknowledged that an Israeli reprisal seemed inevitable. NYT

- Fed’s Mester says the central bank will require additional time before deciding when to commence rate cuts, but she expressed confidence in the disinflationary process eventually resuming. Barron's

- Corporate pension funds are shifting money into bonds. State and local government funds are swapping stocks for alternative investments. The nation’s largest public pension, the California Public Employees’ Retirement System, is planning to move close to $25 billion out of equities and into private equity and private debt. WSJ

- The Biden administration said Wednesday it would allow some American and European oil companies to carry on in Venezuela after U.S. efforts to coax President Nicolás Maduro into democratic overhauls by lifting economic sanctions ended in a hardening of his authoritarian regime. WSJ

- Cash paid out from PE funds has tumbled to a decade low, leaving investors less able, or willing, to allocate new money. As a result, the biggest backers want buyout executives to put in more of their own assets, prompting them to load up on debt and pledge personal possessions — including their homes. BBG

- Iran is exporting more oil than at any time for the past six years, giving its economy a $35bn-a-year boost even as western countries discuss stepping up sanctions in response to its attack on Israel. Tehran sold an average of 1.56mn barrels a day during the first three months of the year, almost all of it to China and its highest level since the third quarter of 2018. FT

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mostly higher after gradually shrugging off headwinds from the tech-led selling in the US. ASX 200 was led by the mining industry after BHP's encouraging quarterly production update. Nikkei 225 recovered all of its opening losses and returned to above the 38,000 level. Hang Seng and Shanghai Comp. conformed to the positive mood but with upside capped in the mainland by US-China trade frictions after President Biden called for an increase in tariffs on Chinese metals.

Top Asian News

- PBoC Governor Pan met with Fed Chair Powell and they exchanged views on the economic situation, monetary policy and financial stability, while Pan also met with IMF's Georgieva in Washington and exchanged views on cooperation between China and the IMF.

- PBoC Deputy Governor says there is still room for monetary policy going forward.

- US President Biden commented there is no trade war when asked about the proposed China metals tariffs, while he also commented that he wants fair competition, not conflict, with China.

- US Secretary of State Blinken is travelling to China on April 23rd, according to Politico.

- BoJ Board Member Noguchi said it is essential for the BoJ to maintain ultra-loose monetary policy and it is essential to continue to maintain an appropriate balance between labour supply and demand through the continuation of its accommodative monetary policy to achieve the 2% price target. Noguchi said it will take a significant amount of time until trend inflation continues to rise to around 2%, while the focus now is on the pace at which the policy rate will be adjusted and at what level it will eventually stabilise.

- Japanese Finance Minister Suzuki held a bilateral meeting with US Treasury Secretary Yellen and agreed to communicate closely on FX, while Suzuki said he wants to closely consult with the US and South Korea on FX.

- Japanese Vice Finance Minister for International Affairs Kanda said Japan is always communicating with the US and each country's authorities on Japan's stance on FX and financial markets.

- PBoC official says high real interest rates in some sectors may help control capacity and reduce inventories.

European bourses, Stoxx600 (+0.3%) are mostly, but modestly firmer. Initially futures were lifted following strong TSMC results/guidance, though equities have tilted slightly lower in recent trade. European sectors are mixed, having initially held a positive tilt; Energy underperforms, given the slump in oil prices following bearish crude inventory data and geopolitical updates. Utilities is found at the top of the pile. US Equity Futures (ES +0.1%, NQ +0.2%, RTY +0.1%) are incrementally firmer, though ultimately resides around the unchanged mark; TSMC (-2.2%) beat on Q1 expectations and notes of strong AI demand, name was initially firmer in the pre-market but has since trimmed markedly and fallen into the red.

Top European news

- ECB's Schnabel said financial markets repricing of rates over the last few months shows investors expect policymakers, at least for now, to continue to pay more attention to actual inflation outcomes.

- ECB's Vasle said he sees the deposit rate 'much closer' to 3% by year-end if disinflation goes to plan, according to Reuters.

- ECB's de Guindos says inflation has fallen further this year, expected to continue declining in the medium term but the pace will be slower. If inflation conditions are met, it would be appropriate to reduce the current level of restrictions.

FX

- USD is softer vs. all major peers with the DXY back on a 105 handle after printing a 106.51 high earlier in the week.

- EUR/USD has continued its recovery after printing a base around the 1.06 mark earlier in the week. That being said, policy divergences remain wide between the Fed and ECB, therefore, focus amongst strategists is on whether the pair can hold above 1.05.

- GBP is attempting to claw back some losses vs. the USD but Cable hasn't been able to reclaim a 1.25 handle throughout the week.

- Antipodeans are both firmer vs. the USD following a pick-up in sentiment in APAC hours and firm trade in base metals. AUD/USD saw little sustained follow-through from Aus. jobs as the unexpected contraction in employment was driven by part-time jobs.

- PBoC set USD/CNY mid-point at 7.1020 vs exp. 7.2281 (prev. 7.1025).

Fixed Income

- USTs are bid, but only modestly so with newsflow somewhat limited thus far ahead of IJC & Fed speak. Positive undertones continue from the strong 20yr sale on Wednesday; USTs around their 108-10+ peak, surpassing Tuesday's 108-08 best.

- Bunds are also firmer and closer to USTs than Gilts in terms of the magnitude of gains thus far. Holding just off the 131.87 peak around Wednesday's 131.67 best.

- Gilts are outperforming but largely a function of catch-up play to the strong 20yr US sale, yesterday's Bailey remarks and the general bullish grind for benchmarks late doors on Tuesday. As it stands, Gilts at a 97.20 peak having picked up markedly from Wednesday's 96.01 contract low.

- Spain sells EUR 6.143bln vs exp. EUR 5.5-6.5bln 2.50% 2027, 1.95% 2030, 3.25% 2034 & 3.45% 2066.

- France sells EUR 12.417bln vs exp. EUR 11.0-12.5bln 0.00% 2027, 2.50% 2027, 2.75% 2030 & 0.00% 2032 OATs.

Commodities

- The crude complex extended on yesterday's slide, with prices subdued by the lack of Israeli response against Iran coupled with this week's inventory builds in weekly data. More recent reports meanwhile suggested a potential Israeli strike on Iran after Passover; Brent June looking to test USD 85.50/bbl to the downside.

- Precious metals are firmer across the board amid the softer Dollar, with mild outperformance in palladium vs gold and silver; XAU currently sits at the top of USD 2,361.10-2.381.10/oz range.

- Base metals are higher trade across the board for base metals with copper reaching a level last seen in June 2022, and iron ore continuing to surge higher. The complex is supported by optimism surrounding China coupled with the intraday fall in the Dollar.

- Qatar set June-loading Al-Shaheen crude term premium at USD 2.54/bbl which is the highest in six months.

- Chile President Boric said 'totally clear' that copper prices are on the upswing, while he added that Codelco copper production levels are going to slowly grow as of this year and reach 1.7mln tons by 2030. Furthermore, the government is dedicated to speeding up the mining permitting process and they hope to double lithium output.

- Kazakhstan's Energy Ministry says oil production losses due to floods have amounted to 16k tons; Azerbaijan is in talks to ship up to 5mln tons of Kazakh crude via Baku-Supsa pipeline.

Geopolitics: Middle East

- "Multiple reports claiming Netanyahu is postponing counter strike on Iran till after Passover next week", according to Sky News' Waghorn "Al Araby al Jadeed claiming he’s promised a more limited retaliation in return for freedom to strike Rafah hard."

- US has reportedly agreed to back an Israeli operation in Rafah in return for Israel not conducting a major strike on Iran, via JNS citing Egyptian officials.

- "Israel Broadcasting Corporation: The army is waiting for the green light to start its operations in Rafah, south of Gaza", according to Al Arabiya.

- "Al-Arabiya correspondent: Large movements of Israeli armoured vehicles near the outskirts of the city of Rafah", according to Al Arabiya.

- US Pentagon spokesman said won't hesitate to defend Israel and will work to protect its forces in the region, while the spokesman added that Defense Secretary Austin made a series of contacts to de-escalate so as not to go to a wider war, according to Al Jazeera.

- UK Ministry of Defence insider speaking to Politico says they now expect “strikes back and forth” between Israel and Iran, via Politico

Geopolitics: Other

- G7 statement noted significant geo-political risks from Russia's war against Ukraine and the Middle East situation could affect trade, supply chains and commodity prices, while they welcomed the EU proposal to direct extraordinary revenues from Russia's frozen assets to aid Ukraine and will continue working on all possible avenues by which frozen Russian assets could be used to support Ukraine. It was also reported that Japan's top currency diplomat Kanda said the G7 discussion on Iran-related language was a bit complicated and they haven't yet reached a conclusion on what sanction should be applied.

US Event Calendar

- 08:30: April Continuing Claims, est. 1.82m, prior 1.82m

- 08:30: April Initial Jobless Claims, est. 215,000, prior 211,000

- 08:30: April Philadelphia Fed Business Outl, est. 2.0, prior 3.2

- 10:00: March Existing Home Sales MoM, est. -4.1%, prior 9.5%

- 10:00: March Home Resales with Condos, est. 4.2m, prior 4.38m

- 10:00: March Leading Index, est. -0.1%, prior 0.1%

Central Bank Speakers

- 09:05: Fed’s Bowman Gives Opening Remarks

- 09:15: Fed’s Williams Participates in Moderated Discussion

- 09:15: Fed’s Bowman Speaks at SIFMA Basel III Endgame Roundtable

- 11:00: Fed’s Bostic Speaks in Fireside Chat on Economy

- 12:00: Fed’s Collins Travels to Connecticut

- 17:45: Fed’s Bostic Chats About Economy, Monetary Policy

DB's Jim Reid concludes the overnight wrap

I’m struggling at the moment. For the last 2-3 weeks all that I can hear in my head is Beyonce’s latest single (a number one around the world over the last few weeks) which if you haven’t heard is an irritatingly catchy country-style song. In quiet (and busy moments) all I have going on in my mind is a jaunty “It’s a real-life boogie and a real-life hoedown....” with the next line containing parental advisory lyrics so I can’t print! I need something to dislodge it before it drives me crazy and/or infiltrates my research.

Markets have been doing the “Do-si-do” this week as initial recoveries have given way to sell-offs as rates and concerns over events in the Middle East dominate, while weaker tech sentiment was a major driver yesterday as the day progressed. This morning we've seen more flipping as Asia is higher again. Before that, yesterday saw the S&P 500 peak at +0.5% near the open but closed -0.58% lower and with it lost ground for a 4th consecutive session, which last happened in early January. Moreover, the index has now shed over 3% over these last four sessions, which is the first time that’s happened since October 23, the same day that the 10yr Treasury yield moved above 5% intraday. To be fair, there was a recovery for bonds, but that was partly a risk-off move into safe havens, which pushed the 10yr Treasury yield (-8.0bps) down from its 5-month high the previous day to 4.59%. Lower oil which we'll discuss below also helped. Yields are another couple of basis points lower across the curve in Asia.

At the close, the S&P 500 had fallen by -4.42% from its all-time high at the end of March, which is more than double the largest pullback it had seen during its remarkable +27% rally that started in late October. The latest decline yesterday was led by tech stocks, with the NASDAQ down -1.15%, and the Magnificent 7 down -1.23%. Chipmakers in particular underperformed as the producer of chipmaking equipment ASML (-6.68%) reported a sizeable decline in orders in Q1. This saw the Philadelphia semiconductor index (-3.25%) fall to its lowest level in nearly two months, with Nvidia down -3.87% in sympathy. Small-cap stocks were still affected as well though, with the Russell 2000 (-0.99%) falling to a two-month low. T he main exception to this pattern came from Europe, where the STOXX 600 (+0.06%) stabilised after its worst daily performance in nine months. The index did close when the US equity market had only dipped to flat, but Euro STOXX futures have edged back into positive territory this morning after a strong Asia session with S&P (+0.30%) and Nasdaq (+0.43%) futures also rebounding again.

Overnight in Japan, we heard from the BoJ’s currency chief Kanda, who confirmed the central bank’s commitment on the yen. Kanda pushed back against a stronger dollar, stating that excessive currency moves harm the economy. Moreover, US Treasury Secretary Yellen acknowledged Japan’s worries over a sharp yen depreciation in a joint statement with her counterparts in Japan and South Korea after a trilateral meeting that suggested the US would give a green light to intervention in both currencies. The yen stabilised off the back of these comments and is now up +0.07% against the dollar as I type. The offshore Chinese yuan also held steady after the People’s Bank of China emphasised its commitment to preventing exchange rate overshoot in a strong dollar environment. Against this backdrop, Asian equities are mostly in the green. As I type, the Nikkei 225 is up +0.49%, the Hang Seng +1.16%, the Korean Kospi +1.71%, and in China, the CSI 300 and Shanghai Comp are up +0.61% and +0.55% respectively. Elsewhere, Australian unemployment came in at 3.8% (vs 3.9% expected), but the downside surprise was largely offset by an otherwise mixed jobs report.

The bond rally we discussed above has been helped by the latest decline in oil prices, with Brent Crude (-3.03%) closing at a 3-week low of $87.29/bbl, which came as the latest EIA report showed US crude inventories at their highest level in 9 months. And in Europe, natural gas futures also fell back after their recent advance, with a decline of -6.43% on the day. So a wild ride in commodities this week.

The decline in oil prices played out even as uncertainty remains over the direction of the conflict in the Middle East. Yesterday, Israeli PM Netanyahu met with UK Foreign Secretary Cameron and German Foreign Minister Baerbock yesterday, but he also said that “I want to make it clear - we will make our own decisions, and the State of Israel will do everything necessary to defend itself." The comments raised the prospect that some sort of response would still happen, and Cameron said that “It’s right to have made our views clear about what should happen next, but it’s clear the Israelis are making a decision to act”.

Back in Europe, the decline in yields was more modest with yields on 10yr bunds (-2.1bps), gilts (-3.7bps) and OATs (-2.8bps) all seeing moderate dips. The moves were more muted at the front-end, at +0.6bps for 2yr bunds and -1.0bps for 2yr gilts. In part, that reflected continued concerns about sticky inflation following the UK’s latest inflation data, which showed that headline CPI only fell back to +3.2% in March (vs. +3.1% expected), whilst core CPI was also a tenth above expectations at +4.2%.

That led investors to dial back the likelihood of a June rate cut by the Bank of England to less than 25% intra-day from 38% the previous day, though this rose back to 35% in part thanks to fairly dovish comments from Governor Bailey. He noted that with the latest inflation data “we are actually pretty much on track” with what the BoE projected back in February. Our UK Economist Sanjay Raja has pushed back his expectation of the first cut from May to June but still sees an additional 50bps this year split between September and December. The terminal rate of 3% will be hit in H1 2026. See his report here for the full explanation. Meanwhile, there was little change in ECB pricing with ECB commentary continuing to point to a rate cut at the next meeting in June. Bundesbank President Nagel, one of the more hawkish ECB voices, said that “a rate cut in June has become more likely” although “there are still some caveats”.

Finally, the IMF published their latest Fiscal Monitor yesterday, which projected that government debt would continue to rise globally over the years ahead. Their forecasts for general government gross debt saw an increase globally from 93.2% of GDP in 2023 to 98.8% by 2029. For the United States, it saw debt rising from 122.1% in 2023 to 133.9% in 2029.

To the day ahead now, and US data releases include the weekly initial jobless claims, the Philadelphia Fed’s business outlook for April, the Conference Board’s leading index for March, and existing home sales for March. From central banks, we’ll hear from ECB Vice President de Guindos, the ECB’s Nagel, Centeno, Simkus and Vujcic, the Fed’s Bowman, Williams, and Bostic, along with the BoE’s Greene.