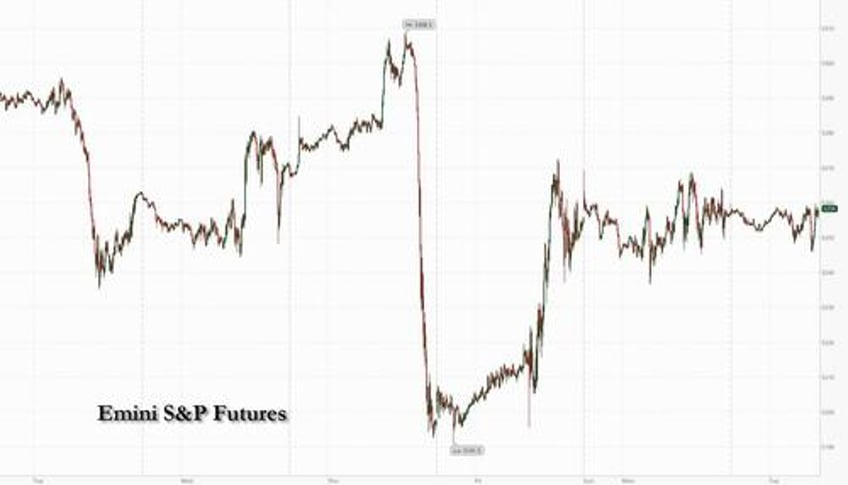

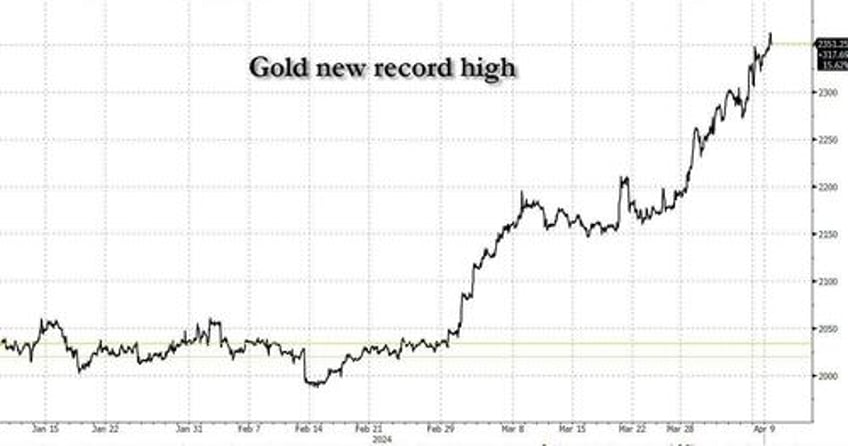

US equity futures are trading in a narrow range, swinging between gains and losses as bonds climbed, clawing back some of Monday’s slump which sent yields to the highest since last November in the buildup to US CPI print tomorrow that is crucial to the Fed's decision when it will start to cut interest rates; Government debt in the UK and Germany followed suit, with yields falling across the curve after a 20-year UK bond sale drew record demand from investors. As of 8:00am, S&P futures were up 0.1% but traded tightly around the unchanged line as they extended Monday’s flat close on Wall Street, when trading was the thinnest since Christmas. Nasdaq futures gained 0.2% while Europe's Estoxx 50 was down about 0.5%, with technology and industrials leading to the downside. Commodity markets are higher lead by Energy and Metals, with Gold hitting a new record high, rising as much as $25 to $2,365 before paring gains. The macro picture is light today but keep an eye on the 3Y auction, which may give some cues to investor positioning ahead of the CPI.

In premarket trading, Mag7 names are mixed with Semis up. Blackberry rose 6.9% after the Canadian software company announced a robotics collaboration with AMD. Here are some other notable premarket movers:

- ChargePoint shares fell 4.3% as Goldman Sachs downgraded the provider of electric vehicle charging solutions to sell from neutral, on expectations of a slower EV market in the US. Goldman also lowered its rating on sector peer Sensata to neutral from sell.

- Maxeon Solar shares dropped 16% after the solar-panel maker’s first-quarter revenue forecast missed estimates.

Caution dominates sentiment before Wednesday’s inflation report, which is forecast to show some further easing of price pressures but may surprise to the upside after the recent surge in oil prices. Traders are also preparing for the ECB's rates announcement on Thursday, which could support bets on earlier easing by the ECB than the Fed, and for the start of the first-quarter earnings season. While markets now favor just two US rate cuts this year, former Fed St. Louis President James Bullard said three reductions remain “the base case."

For Mohit Kumar, strategist and chief economist for Europe at Jefferies, the more important discussion should be over how the Fed would respond to any signs that resilience in the American economy is faltering. "The right question is whether the Fed is willing to cut rates if there is any sign of weakness,” Kumar wrote in a note to clients. “And on that we are reasonably confident that if the economy weakens, we will see easing from the Fed which would support risk sentiment.”

While economists surveyed by Bloomberg expect the consumer price index will show some cooling in inflation, the core gauge, which excludes food and energy costs, is forecast to be up 3.7% from a year earlier — above the Fed’s 2% target. Concerns, however, are for hotter prints in the future, which reflect the ongoing surge in gold, which rose as much as $25 to $2,365 this morning, a new record high, and up more 17% since mid-February. Copper traded near a 15-month high as supply tightens and global manufacturing picks up.

Marija Veitmane, head of equity markets research at State Street Global, said her firm’s measure of online inflation pointed to a potentially above-consensus read. “We have seen prices in every sector we track to grow at higher than average pace in March,” she said. As for corporate results, “we continue to worry about narrowness of earnings, where majority of growth comes from the tech/large-cap stocks, which majority of companies are showing signs of stress,” Veitmane said. “Falling margins are particular concerns as they tend to precede layoffs.”

European stocks fall with consumer products, construction and real estate underperforming. FTSE 100 outperforms peers, adding 0.2%, DAX lags, dropping 0.6%. In individual stock moves Tuesday, BP Plc rose to a five-month high after an update that analysts said showed a strong performance in oil and gas trading. Renault SA advanced after an upgrade from analysts at Barclays Plc. Mining stocks were a bright spot in Europe as iron ore headed for its biggest two-day rally in more than two years.

Earlier in the session, Asian stocks climbed for a second day, as TSMC helped drive gains in tech shares on investor excitement over its US production plans. The MSCI Asia Pacific Index climbed 0.7%, with TSMC the biggest boost after the US announced an agreement for $11.6 billion in grants and loans to help the chipmaker build factories. Taiwan led gains across the region, with its benchmark index gaining as much as 1.9% to a record high. Stocks also advanced in Hong Kong, Japan and Australia.

- Hang Seng and Shanghai Comp. were varied with the Hong Kong benchmark lifted although the psychologically key 17,000 level continued to elude. Conversely, the mainland lagged after another tepid PBoC liquidity operation, while Premier Li recently noted uncertainty and complexity in the external environment are rising.

- Nikkei 225 continued to benefit from recent currency weakness with USD/JPY lying in wait for a retest of 152.00.

- ASX 200 was led by miners but with gains capped after weak consumer sentiment and a mixed business survey.

In FX, the Bloomberg dollar spot index is flat, while NOK and SEK outperform, and JPY and DKK lag G-10 FX. The yen hovered near a 34-year low and around the closely watched 152 level that many say will trigger Japanese authorities to act.

In rates, treasuries rise, paring some of Monday’s losses that saw 10-year yields climb to the highest since November. Bunds, gilts follow suit as yields across the curve drop; treasuries are richer across the curve by at least 2bp, tracking bigger gains in core European rates. Treasury 10-year yields around 4.39% are down by more than 3bp on the day, but trail bunds and gilts in the sector by ~1.5bp as curve spreads remain within about 1bp of Monday’s closing levels. Gilt and bund futures remain near best levels of the day after UK 20-year bond sale drew record demand from investors. Asia session flows included two 2s10s block flatteners for a combined $650k/DV01 in cash risk. US session highlights include $58 billion 3-year note auction, first of three coupon sales this week. Coupon auction cycle begins at 1pm New York time with $58b 3-year note; $39b 10-year note and $22b 30-year bond reopenings follow Wednesday and Thursday. WI 3-year yield at roughly 4.565% is ~31bp cheaper than last month’s, which stopped 1.3bp through on strong demand.

In commodities, oil traded near a five-month high as investors weighed simmering tensions in the Middle East and persistent supply concerns. Israel said progress has been made in negotiations for a cease-fire in Gaza, signaling a potential easing of hostilities, but Hamas denied the claim. WTI traded within Monday’s range, adding 0.5% to trade around $86; meanwhile base metals are mixed; LME aluminum falls 0.5% while LME tin gains 2%. Spot gold held a record high, rising roughly $20 to trade near $2,359/oz, and up more 17% since mid-February. Copper traded near a 15-month high as supply tightens and global manufacturing picks up.

Looking at today's calendar, there is no US economic data or Fed speakers scheduled for the session

Market Snapshot

- S&P 500 futures little changed at 5,251.25

- STOXX Europe 600 down 0.2% to 507.93

- MXAP up 0.7% to 177.20

- MXAPJ up 0.6% to 541.29

- Nikkei up 1.1% to 39,773.13

- Topix up 1.0% to 2,754.69

- Hang Seng Index up 0.6% to 16,828.07

- Shanghai Composite little changed at 3,048.54

- Sensex little changed at 74,726.49

- Australia S&P/ASX 200 up 0.5% to 7,824.24

- Kospi down 0.5% to 2,705.16

- German 10Y yield little changed at 2.41%

- Euro little changed at $1.0854

- Brent Futures up 0.5% to $90.84/bbl

- Gold spot up 0.8% to $2,357.69

- US Dollar Index little changed at 104.17

Top Overnight News

- The Bank of Japan will maintain accommodative monetary conditions for now, Gov. Kazuo Ueda reiterated Tuesday, while not ruling out the possibility of further policy changes. “We will consider reducing a degree of monetary easing” if underlying inflation rises further, Ueda said in a parliamentary committee meeting. WSJ

- Joe Biden and Japan’s Fumio Kishida plan to form a council on defense industries and allow workers in Japan to perform more maintenance work on US Navy ships, according to a senior administration official. Defense will top the agenda at their meeting tomorrow. BBG

- Berkshire Hathaway plans to sell yen bonds, fueling speculation that Warren Buffett is weighing more investments in Japan. It mandated banks for a potential benchmark SEC-registered bond offering, a person familiar said. BBG

- UBS is in talks to attain full ownership of its China platform by swapping its holding in Credit Suisse’s onshore securities venture with a Beijing government investment fund, people familiar said. BBG

- European banks saw a “further substantial decline” in demand for business loans in Q1 according to a new ECB survey (“higher interest rates, as well as lower fixed investment for firms and lower consumer confidence for households, exerted dampening pressure on loan demand”). ECB

- Blackstone is close to a deal with L’Occitane owner Reinold Geiger to take the Hong-Kong listed company private, people familiar said. Blackstone may provide debt financing for the buyout. BBG

- AI models such as OpenAI’s ChatGPT “are just insatiable in terms of their thirst” for electricity, Arm's CEO Reene Haas said. “The more information they gather, the smarter they are, but the more information they gather to get smarter, the more power it takes.” Without greater efficiency, “by the end of the decade, AI data centers could consume as much as 20% to 25% of U.S. power requirements. Today that’s probably 4% or less,” he said. “That’s hardly very sustainable, to be honest with you.” WSJ

- Former Federal Reserve Bank of St. Louis President James Bullard said he’s expecting three interest-rate cuts this year as inflation moves toward the central bank’s target while the economy remains resilient. “At this point, you should probably take the committee and chair at face value — their best guess right now is still three cuts this year,” Bullard said Tuesday in a Bloomberg TV interview with Haslinda Amin. “That’s the base case.” BBG

- The largest US banks are set to earn higher profits from their lending businesses than expected this year as it becomes more likely that the Federal Reserve will make only modest cuts to benchmark interest rates. FT

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mostly higher but with price action relatively rangebound with global markets lacking any major catalysts ahead of upcoming risk events. ASX 200 was led by miners but with gains capped after weak consumer sentiment and a mixed business survey. Nikkei 225 continued to benefit from recent currency weakness with USD/JPY lying in wait for a retest of 152.00. Hang Seng and Shanghai Comp. were varied with the Hong Kong benchmark lifted although the psychologically key 17,000 level continued to elude. Conversely, the mainland lagged after another tepid PBoC liquidity operation, while Premier Li recently noted uncertainty and complexity in the external environment are rising.

Top Asian News

- HKMA said Hong Kong is considering deepening some of the Connect schemes between Hong Kong and Mainland China.

- BoJ Governor Ueda said Japan's economy is showing some weakness but is recovering moderately and the chance of solid wage growth this year is heightening, while he added the BoJ expects accommodative monetary conditions to continue for the time being and it is important to maintain accommodative monetary conditions as trend inflation is yet to hit 2%. Ueda said if the economy and price developments proceed as projected now, they need to think about reducing the degree of monetary support but added whether this will happen will depend on upcoming data and there is no pre-set idea now on how and when they will adjust interest rate levels. Ueda added that even after March policy shift, expect interest rates to stay low and real interest rates to remain at deeply negative territory. Ueda reiterated that if FX moves have impact on economy and prices in a way that is hard to ignore, we will of course respond with monetary policy.

European bourses in the red, Stoxx 600 -0.2%, action is subdued across the board but with some mild divergence in catalysts thin trade. DAX 40 -0.6% the relatively underperformer pressured by heavyweights SAP & Daimler Trucks and despite support in Infineon from TSMC; defence names, including Germany's Rheinmetall, pressured after commentary from GS on defence valuations and earlier geopolitical reports around necessary export licenses. Sectors more broadly do not have any overarching bias/theme, with relative outperformance in Basic Resources and Energy names echoing underlying benchmarks and helping the FTSE 100 +0.1% tread water. Stateside, futures near the unchanged mark (ES +0.1%, NQ +0.1%) with catalysts light thus far and the docket ahead sparse before Wednesday's CPI & Minutes; Tesla -0.3% in focus after a fatal crash lawsuit settled and given the latest CPCA numbers.

Top European News

- Barclays said UK March consumer spending rose 1.9% vs prev. 1.9% increase in February and was the joint-smallest increase since September 2022, according to Reuters.

- EU Competition Chief Vestager is set to pitch a tougher, joint approach to tackling challenges posed by China as part of a speech in the US, via Politico. To say that the EU has accepted a mistake was made a decade ago by the failure to impose restrictions on China's heavily state-subsidises solar panels. Decision from the EU investigation into Chinese subsidies is said to be picking up pace, decisions expected as soon as the summer; Vestager to say if the investigation finds China EV exports have been subsidised than the EU will impose restrictions.

- ECB Bank Lending Survey - Credit standards were broadly unchanged in the first quarter of 2024. Loan demand from firms declined substantially, contrary to bank expectations of a recovery; Corporate credit standards tightened in Q1 but eased for household mortgages; Banks are expecting a moderate net decrease in demand for loans to firms and a net increase in demand for loans to households in the second quarter of 2024 - click here for more.

- Russian Kremlin says there is no specific time frame for a visit by President Putin to China, but the visit of Foreign Minister Lavrov can be considered as preparation for high-level contacts of which there is a need for.

FX

- DXY steady for much of the morning and holding above 104.00; modest pressure came as BoJ sources via Bloomberg pulled USD/JPY away from the 151.93 base and by extension the YTD peak at 151.97 above with USD/JPY down to and holding around a 151.74 base.

- EUR slightly softer initially but has derived some modest support alongside GBP in the wake of the JPY-induced USD-pressure. Though, to be clear, action is contained overall with the magnitude of upside marginal.

- Cable saw a slight acceleration in gains after it surpassed the 50- & 100-DMAs of 1.2663 and 1.2668, to a 1.2685 peak.

- Antipodeans steady but have also benefited from the relative USD pressure in the second half of the European morning with participants looking ahead to the RBNZ which is expected to leave rates unchanged; AUD and NZD near highs of 0.6625 and 0.6055.

- BoJ is said to consider raising its inflation forecast following the "surprisingly strong" results from annual wage negotiations, according to Bloomberg sources; Core CPI is seen revised up from the current forecast of 2.4%. BoJ is likely to forecast price growth of around 2%. Officials also highlight that they need be aware of possible downside risks to inflation when making projections for fiscal 2026.

- PBoC set USD/CNY mid-point at 7.0956 vs exp. 7.2248 (prev. 7.0947).

Fixed Income

- Comparably contained start for USTs with the docket sparse, upside potentially via haven flows as geopols remains in focus. Overnight JGB auction was robust though a touch softer than the prior.

- USTs currently post gains of circa. 5 ticks with yields slightly lower but without a clear flattening/steepening bias thus far.

- EGBs & Gilts outperform, no real reaction to supply which was well received despite the lack of fresh concession into the auction while the latest ECB BLS spurred some modest upside in Bunds which are currently around the 132.29 peak; overall, while bid EGBs remain much closer to last week's 131.87 base than the 133.43 peak.

- Gilts outperform, again no reaction to supply with the DMO back in the market on Wednesday. Possible upside from the latest Barclays data though the BRC numbers showed strong March figures, but these often slump ahead in the post-Easter period. Upside brings 99.00 back into play before Friday's 99.15 peak and Thursday's at 99.37 thereafter.

Commodities

- Crude benchmarks incrementally firmer but with action largely sideways in the European morning; WTI May resides in an USD 86.38-86.94/bbl range, while Brent June is within USD 90.38-90.90/bbl parameters.

- Complex remains focused on geopols after Israel pencilled in a date for the Rafah operation while BP expects Q1 upstream production higher Q/Q; EIA STEO due later.

- European and US gas benchmarks diverge with TTF lower while Henry Hub lifts but price action overall is uneventful and absent specific catalysts.

- UK, Germany, Belgium, Netherlands, Denmark and Norway signed a declaration to protect infrastructure in the North Sea.

- Azerbaijan oil production 481k BPD in March (prev. 476k BPD in February), according to the Energy Ministry.

- Morgan Stanley raises its Q3 Brent oil price forecast to USD 94/bbl to reflect geopolitical risks.

- Precious metals bid despite the relatively stable/modestly firmer USD for much of the morning with support coming from the lower yield environment and with haven flows potentially factoring; spot gold at a fresh USD 2365/oz ATH; base peers see a pullback in LME Copper after Monday's marked strength while Dalian iron ore soared in APAC trade.

Geopolitics: Middle East

- Hamas said Israeli position during last round of negotiations in Cairo remains stubborn and did not meet any demands of Palestinians, while it is still studying Israel's proposal and will inform mediators of its response, according to a statement.

- US Pentagon said Defense Secretary Austin expressed commitment to support an unconditional return of hostages and hopes for a cessation of hostilities through negotiations. Austin also expressed hope that the ongoing negotiations between Israel and Hamas will lead to a truce and he affirmed unwavering US support for defending Israel in light of threats from Iran and its network of proxies, according to Al Jazeera and Al Arabiya.

- US intelligence assesses that Iran has urged several of its proxy militia groups to simultaneously launch a large-scale attack against Israel, using drones and missiles, while they could attack as soon as this week, according to sources cited by CNN. Furthermore, sources familiar with US intelligence said an Iranian attack would likely be carried out by proxy forces in the region, rather than by Iran directly, and one of the sources noted the threat is very clear and credible with the pieces in place to conduct the attack and Iran are just waiting for the right time.

- Iraqi armed faction said they bombed a vital target in Ashkelon in southern Israel and another target in the past 72 hours, according to Al Arabiya.

- US military said it destroyed air defence and drone systems of Houthi forces in an area of the Red Sea, while there were no injuries or damage to US, coalition or commercial ships.

- "Israeli military says it has carried out raids on Syrian army military infrastructure in southern Syria", according to Al Arabiya.

Geopolitics: Other

- EU Foreign Minister Borrell in a speech within Brussels says that "war is certainly looming all around us" and that a "high-intensity, conventional war in Europe is no longer a fantasy", via FT.

- Australia's PM Albanese said Japan is a natural candidate to cooperate on stage two of the AUKUS security pact but added there are no plans to expand AUKUS membership beyond Britain, Australia and the US. There were prior reports that China was 'gravely concerned' as Australia, US, UK confirmed that Japan was being considered for AUKUS.

- Chinese military newspaper said Japan is showing 'obvious offensive characteristics' with its new Okinawa missile unit, according to SCMP.

- The extraordinary session of the IAEA Board of Governors on the escalation of the situation at the Zaporizhzhia nuclear power plant may be convened Thursday, according to Russia's Permanent Representative to International Organizations.

US Event Calendar

- 06:00: March Small Business Optimism 88.5, est. 89.9, prior 89.4

DB's Henry Allen concludes the overnight wrap

Markets got the week off to a subdued start yesterday, with little in the way of fresh developments to drive any new moves. That should change later in the week, as we’ll get the US CPI report, the ECB’s policy decision, and the start of the Q1 earnings season. But for now at least, the main theme has been the continuation of last week’s trends, including more and more doubts about rate cuts this year, and growing fears about inflation. Indeed, the US 5yr inflation swap (+1.0bps) hit 2.57% by yesterday’s close, marking its highest level since October.

Those questions about rate cuts have been clear from market pricing. For instance, the probability of a cut by the Fed’s June meeting was down to just 52% by the close yesterday, where it remains this morning. That’s the lowest since October, back when the 10yr Treasury yield was trading near 5% and there was growing belief in the “higher for longer” narrative when it came to rates. In addition, the total number of cuts priced for 2024 also fell, with just 61.5bps of cuts priced by the Fed’s December meeting, down -3.3bps on the previous day. And it’s clear that trend is happening globally as well, with overnight index swaps taking the chance of an ECB cut by June down from 97% to 91%, and this morning that’s fallen further to 88%. Moreover, the ECB cuts priced by December came down -4.8bps to 84bps, with a further decline overnight to just 80.5bps, which is the fewest so far this year.

With investors pricing in in fewer rate cuts, that’s helped to drive a bond selloff on both sides of the Atlantic. I n the US, it saw the 2yr Treasury yield rise +3.9bps to 4.79%, while the 10yr yield was up +1.8bps to 4.42%, the highest closing levels of 2024 so far for both. At one point intraday, the 10yr yield even moved as high as 4.46%, before coming back down again into the close. Both the 10yr real yield and 10yr breakeven reached year-to-date highs. And over in Europe, there was a similar bond selloff, with yields on 10yr bunds (+3.7bps), OATs (+1.7bps) and BTPs (+1.1bps) all moving higher.

Looking forward, the focus is now on tomorrow’s US CPI report for March, but yesterday’s Fedspeak offered little guidance on the timing of any rate cuts. Chicago Fed President Goolsbee, who’s a more dovish member, noted that if rates stayed high, then “the unemployment rate is going to start going up”. Separately, Minneapolis Fed President Kashkari said that the labour was still tight, although his base case was that inflation would continue to fall.

Earlier in the day, we also had the New York Fed’s latest Survey of Consumer Expectations, but it showed a mixed picture on inflation expectations. The good news was that 5yr expectations fell by three-tenths to +2.6%, but 1yr expectations were constant at +3.0%, and the 3yr measure ticked up again to a four-month high of +2.9%. So no obvious headline on the inflation side. But there were some more negative trends on the labour market, which showed consumers were becoming distinctly less confident. For example, the mean probability of losing one’s job rose to 15.7%, which is the highest it’s been in three-and-a-half years. And the mean probability of finding another job in the next three months if their current job was lost fell to 51.2%, the lowest in almost three years.

When it came to equities, there were signs that the volatility at the end of last week was beginning to subside, with the S&P 500 (-0.04%) seeing little change and the VIX coming down by -0.8pts. Small-cap stocks were an outperformer, with the Russell 2000 up +0.50%. Energy stocks underperformed within the S&P 500 (-0.63%), as oil prices saw a moderate retreat from five-month highs at the end of last week (Brent crude -0.87% to $90.38/bbl). The Magnificent 7 saw a slight outperformance (+0.27%) thanks to a +4.90% gain for Tesla following news late last week that it plans to unveil a robotaxi in August.

Over in Europe, the STOXX 600 (+0.47%) posted its strongest start to a week since February, whilst there were solid gains for the DAX (+0.79%) and the CAC 40 (+0.72%) as well. That strength was evident among other risk assets too, and yesterday saw US HY spreads (-5bps) and EUR HY spreads (-4bps) both tighten. Meanwhile, with the Q1 earnings season coming up, our colleagues in Credit Strategy have sketched their expectations for EUR IG. Although spreads have already tightened a lot since the autumn, they believe earnings should still prove supportive for spreads. See their full report here.

Overnight in Asia, the subdued tone has continued, and there’s been a mixed performance for equities across the region. That includes gains for the Nikkei (+0.86%) and the Hang Seng (+0.55%), alongside modest declines for the KOSPI (-0.12%), the Shanghai Comp (-0.15%) and the CSI 300 (-0.25%). In the meantime, there’ve been fresh losses for Japanese sovereign bonds, and the 2yr yield (+1.2bps) is up to 0.23% this morning, marking its highest level since 2011. That comes amidst comments from BoJ Governor Ueda overnight, who said that he expects Japan’s price trend to increase toward the end of the BoJ’s projection period. Looking forward, US equity futures remain broadly flat, with those on the S&P 500 up just +0.06%. And for US Treasuries there’s been a slight recovery this morning, with the 10yr yield down -1.0bps to 4.41%.

Finally, it’s a quiet day ahead on the calendar, but we will get the ECB’s Bank Lending Survey, and in the US there’s the NFIB’s small business optimism index for March.