US futures are lower as we enter the "last hike" day, with European stocks slumping after ugly results from LVMH (which tumbled 4.5%) and Asian markets also closing in the red as investors brace for more tightening from the Federal Reserve, even as results from some of the biggest European and American companies hinted at slowing economy and declining earnings. As of 7:30am ET, S&P eminis dropped 0.1% at 4,589 while Nasdaq futures were down 0.3%, pressured by disappointing results from some top constituents.

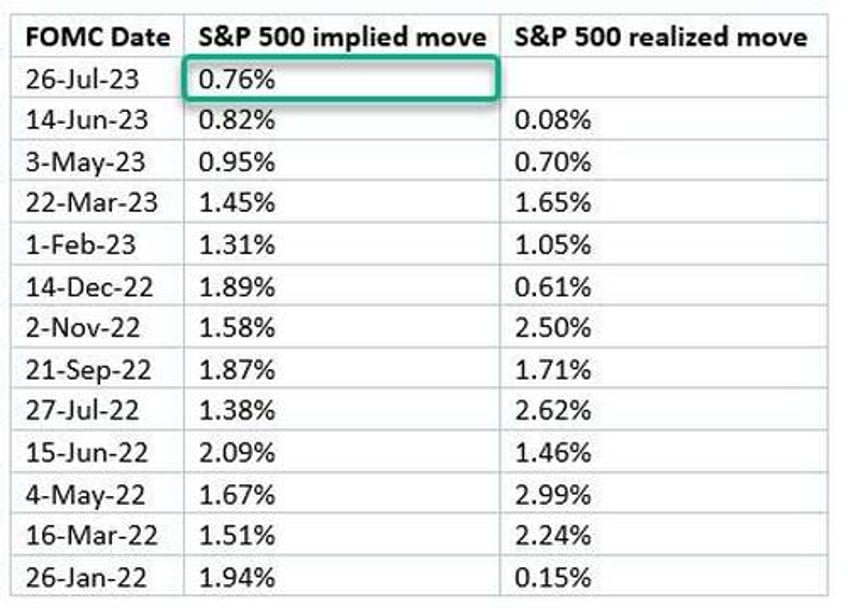

The market is pricing in just a 0.76% move after today's FOMC, the lowest implied move on a Fed day since at least 2021.

Meanwhile, solid earnings from Boeing have propelled the Dow higher: the Dow Jones Industrial Average has risen 12 days straight — the longest winning run in over six years — and a 13th day of gains will extend the record to the longest since 1987.

Treasury yields were 1-2bps lower; the USD was weaker and commodities are mixed with base metals leading and Ags lagging. Today, focus will be Fed’s decision at 2pm ET and Powell’s Press Conference at 2.30pm ET. A 25bp hike is fully priced in, with consensus expecting (i) little meaningful changes to the post-meeting statement and (ii) Powell pointing to the June dots as the best guide as to the forward direction of policy (our full preview is here).

In premarket trading, Microsoft fell 4%, having posted tepid sales growth and amid missed Azure growth guidance while Snap sank 19%. Analysts, however, note that the unit’s deceleration is starting to moderate and they were positive about demand for the company’s new artificial intelligence-powered products and services. Chipmakers also mostly lost ground, after a subpar outlook from Texas Instruments, the biggest maker of analog semiconductors, indicated a demand slump for key types of electronics. On the other end, GOOGL jumped 7% after posting forecast-beating revenue. Meta rose ahead of its own report later Wednesday. Overall, tech earnings so far are still largely in line with expectation. Here are the most notable premarket movers:

- Boeing rose 3% after reporting $2.58 billion in free cash flow in the second quarter, surprising investors as a flurry of jet deliveries and customer deposits helped overcome the financial strain from supplier glitches.

- Dish Network jumps as much as 15% in premarket trading on Wednesday after Bloomberg News reported that the company said it will start selling its premium wireless service on Amazon.com later this week.

- PacWest jumped as much as 39% following news that it’s being bought by smaller rival Banc of California in a rescue deal aimed at boosting confidence in the lenders. Banc of California rose as much as 16%.

- Snap shares are sinking 19% after the social media company reported its second-quarter results and gave a revenue outlook that was weaker than expected. Analysts note that the company is still contending with weakness in its ads business as it looks to invest in new AI tools.

- Teladoc rises 6.1% after the virtual healthcare provider raised the bottom end of its revenue forecast range for the full year, with analysts saying that the firm’s control over costs is bearing fruit even as it faces a tough backdrop.

- Texas Instruments shares drop 3.5% after the chipmaker provided a forecast for the third quarter that left analysts disappointed, with some saying it overshadowed the second-quarter beat.

- Wells Fargo shares gain 2.6% in premarket trading after the lender announced plans to repurchase as much as $30 billion of its shares and boosted its dividend. Piper Sandler saw the authorization of the buyback as an “important show of strength” relating to the capital position of Wells Fargo, though Citi didn’t see any incremental information in the news.

Here is a summary of the most notable earnings reports:

- Alphabet Inc (GOOGL) Q2 2023 (USD): EPS 1.44 (exp. 1.34), Revenue 74.60bln (exp. 72.82bln). +6.9% in pre-market trade

- Microsoft Corp (MSFT) Q4 2023 (USD): EPS 2.69 (exp. 2.55), Revenue 56.2bln (exp. 55.47bln); soft Q1 guidance. -4.1% in pre-market trade

- Snap Inc (SNAP) Q2 2023 (USD): Adj. EPS -0.02 (exp. -0.04), Revenue 1.07bln (exp. 1.05bln) -18% in pre-market trade

- Texas Instruments Inc (TXN) Q2 2023 (USD): EPS 1.87 (exp. 1.76), Revenue 4.53bln (exp. 4.36bln) -3.8% in pre-market trade

- Visa Inc (V) Q3 2023 (USD): EPS 2.16 (exp. 2.12), Revenue 8.1bln (exp. 8.06bln) -0.3% in pre-market trade

- X Corp (formerly Twitter) is offering incentives on certain ad formats within the US and UK, via WSJ citing emails; additionally, has warned brands that verified status could be lost if certain spending thresholds are not met.

Fahad Kamal, chief investment officer at SG Kleinwort Hambros Bank, noted that Wednesday’s market pullback comes after a broad stretch of gains, with the S&P 500 less than 5% off record highs. “The bigger picture is that this quarter is probably the low point for earnings, this year will end up positive both in Europe and US,” he said, while cautioning of risks from “the effect of central bank policy tightening.”

“We are going to see some deceleration in corporate earnings, deceleration in economic growth, softening of demand, all of this will have a higher impact on equities,” Aarthi Chandrasekaran, director of investments at Shuaa Asset Management said on Bloomberg TV. Still, “the US economy is weakening but it’s not weakening enough to price in a full rate cut next year,” she said. Still, despite some disappointments, roughly 80% of US companies have thus far beaten profit estimates, as have half of European names. This is largely due to a steady trimming of expectations before the season kicked off.

Later on Wednesday, the Fed is expected to raise rates by 25 basis points, and swap contracts are factoring some additional rate increases by year-end as well. The expected Fed rate increase would be 11th since March 2022, cycle in which rates were raised at each scheduled meeting until last month’s, when policy makers said a pause was warranted to assess the impact of their cumulative actions on the economy and banking system. The European Central Bank should also deliver a quarter-point increase on Thursday. With those hikes baked in, investors will focus on signals on how much more policy tightening might be warranted (full preview here).

European stocks are lower and set to snap a six-session win streak after a flurry of corporate earnings dented investor sentiment. The Stoxx 600 is down 0.5%, led lower by the luxury-goods sector as LVMH tumbled as much as 4.5% after Europe’s biggest company provided further evidence of a slowdown in spending by US wealthy consumers. Miners are also under pressure after Rio Tinto cut its dividend following a fall in first-half profit. Here are the most notable European movers:

- Rolls-Royce shares rose as much as 25% to their highest level since March 2020 after the engine maker boosted its adjusted operating profit guidance for the year as its turnaround begins to bear fruit

- BAT shares gained as much as 3.4% after the tobacco company reaffirmed its forecast for the year, which was in line with last month’s update and reassured investors given the tough backdrop

- Stellantis shares rise as much as 2.9% after the carmaker reported first-half results that analysts say were strong and above consensus across the board

- RWE shares climbed as much as 3%, the most since April, after it boosted its adjusted Ebitda guidance for the full year. Morgan Stanley says the increase will likely trigger significant EPS upgrades

- Just EatTakeaway shares rally as much as 10% after the online food delivery company’s adjusted Ebitda for the first half beat estimates. Analysts praised the strong performance in its European markets

- Verallia gains as much as 11%, most in more than a year, after the French maker of glass bottles raised its earnings guidance. Citi says consensus earnings estimates should increase by double-digits

- Worldline shares rise as much as 6% after the payments company reported a second-quarter revenue and margins beat, with analysts noting the strength in the key Merchant Services business

- LVMH shares fell over 4.5% at the start of trading in Paris after the French luxury behemoth reported second-quarter revenue that provided further evidence of a slowdown in spending by wealthy US consumers

- Hexagon shares fall as much as 8.4% after the Swedish industrial software group’s free cash flow and Ebit came in below analyst expectations

- Lloyds falls as much as 5.2% after the UK lender booked additional loan-loss impairments. The bank’s upgraded loan margins were likely already in consensus estimates, analysts say

- Danone falls as much as 3.4%, most since May 9, after reporting like-for-like sales for the second quarter that beat the average estimate, with analysts saying more progress may be needed in 2H

- Porsche shares fell as much as 2.5% after the German luxury sports-car maker reported first-half sales that missed estimates. The results raise concerns about automotive pricing, according to Morgan Stanley

Earlier in the session, Asia’s key stock gauge snapped a two-day wining run as investors trimmed their positions ahead of the Federal Reserve’s monetary policy outcome, while Chinese stocks declined after Tuesday’s rally. The MSCI Asia Pacific Index declined as much as 0.3% with markets in Japan, South Korea and Hong Kong leading the losses. Stocks in Australia extended gains after consumer prices rose at a slower than expected pace for the three months ended June, fueling bets for a continued pause by the Reserve Bank next week.

The Fed is poised to hike interest rates by another 25 basis points, with investors keeping an eye on commentary by Chairman Jerome Powell. Asian stocks have, on average, reacted positively after a rate hike in 10 of the previous instances, data compiled by Bloomberg showed. Stocks in Asia have generally held their gains this month, buoyed by the receding odds of a recession in the US as well as China’s pivot toward a more friendly approach to the private sector and pledge of support for the economy.

Chinese stocks in Hong Kong fell after Tuesday’s surge as investors await more concrete policy decisions by Beijing following the politburo meeting. Policymakers have signaled that they intend to ease monetary policies and boost property markets. “It is really important that in the coming days and weeks, we see continued strong messages coming from different parts of the government,” Winnie Wu, China equity strategist at BofA Securities told Bloomberg Television in an interview.

Japan's Nikkei 225 swung between gains and losses with the mood indecisive as softer Services PPI data from Japan added to the second-guessing surrounding this week’s BoJ meeting. ASX 200 outperformed with gains led by the mining industry and the top-weighted financials sector, while participants also reflected on the mostly softer-than-expected inflation data which showed headline CPI Q/Q was at its slowest pace of increase since 2021. Key stock gauges in India snapped a two-day losing run to outpace most regional peers Wednesday, boosted by gains in index heavyweights Reliance Industries, ITC, and Larsen & Toubro. The S&P BSE Sensex rose 0.5% to 66,707.20 in Mumbai, while the NSE Nifty 50 Index advanced by the same magnitude. Larsen & Toubro closed at record high after better-than-expected first quarter earnings and announcing a $1.2 billion buyback plan. The infrastructure company’s results gave boost to stocks of its peers as well with BSE Capital Goods index rising 1.6%. Reliance Industries, which contributed the most to the Sensex’s gain, rose 1.6% after Financial Times reported that QIA is mulling investment in company’s retail unit. Out of 31 shares in the Sensex index, 19 rose and 11 fell, while 1 was unchanged

In FX, the Bloomberg Dollar Spot Index was little changed. The euro rose as much as 0.2% against the US dollar to 1.1078, halting a six-day streak of declines. It also rose as much as 0.2% against the pound to 0.8586. The pound was little changed against the US dollar at around $1.29, while it weakened slightly against the euro. The Australian dollar declined as much as 0.9% to 0.6731 before trimming that drop after slower-than-expected inflation in the last quarter strengthened bets for the Reserve Bank to pause again next week. USD/JPY fell 0.5% to 140.24, heading for a third day of declines. One-week risk-reversals for dollar-yen, a gauge of the expected direction, fell to the lowest level since early March. The Aussie is the worst performer among the G-10s, falling 0.4% versus the greenback after Australian CPI slowed more than expected. The yen is the strongest.

Treasuries edged higher and yields are mixed as short- dated Treasury yields edged lower and 10-year yields were little changed to begin the US session focused on a Fed rate decision at 2pm New York time. Yields are within 1bp of closing levels from Tuesday, when most tenors traded at their highest levels in more than a week as expectations for another rate increase this year after July edged higher. Euro-area yields rose across the curve. The Treasury supply cycle pauses for Fed decision, is set to conclude Thursday with $35b 7-year auction. A 25bp increase in the fed funds band to 5.25%-5.5% is fully priced into swap contracts, along with about half of an additional 25bp hike by year-end.

In commodities, crude futures decline with WTI falling 0.7% to trade near $79.10. Spot gold rises 0.3%.

Bitcoin is relatively contained and resides well within, but at the lower-end, of Monday's $28842 to $30342 range. Thus far, specific drivers have been a touch limited with markets generally focused on the upcoming FOMC meeting and Powell's presser.

Looking to the day ahead now, the main highlight will be the Fed’s policy decision and Chair Powell’s press conference. Otherwise, data releases include US new home sales for June and the Euro Area M3 money supply for June. Finally, today’s earnings releases include Meta, Coca-Cola, Union Pacific, Boeing and AT&T.

Market Snapshot

- S&P 500 futures little changed at 4,595.00

- MXAP up 0.1% to 168.69

- MXAPJ little changed at 533.11

- Nikkei little changed at 32,668.34

- Topix down 0.1% to 2,283.09

- Hang Seng Index down 0.4% to 19,365.14

- Shanghai Composite down 0.3% to 3,223.03

- Sensex up 0.7% to 66,797.58

- Australia S&P/ASX 200 up 0.8% to 7,402.01

- Kospi down 1.7% to 2,592.36

- STOXX Europe 600 down 0.5% to 465.75

- German 10Y yield little changed at 2.44%

- Euro up 0.1% to $1.1068

- Brent Futures down 0.6% to $83.17/bbl

- Gold spot up 0.3% to $1,971.80

- U.S. Dollar Index down 0.19% to 101.16

Top Overnight News

- Australian inflation slowed more than expected in the second quarter thanks to falls in the cost of domestic holidays and petrol, suggesting less pressure for another hike in interest rates and sending the local dollar sharply lower. RTRS

- Japan’s services PPI in June cools by more than anticipated, coming in at +1.2% (down from +1.7% in May and below the Street’s +1.5% forecast). BBG

- Ant plans to break off some non-core operations as it prepares to revive a Hong Kong IPO, people familiar said. It may strip out blockchain, database management services and overseas units when it applies for a financial holding license in China. An IPO attempt may come after 2024, Bloomberg Intelligence said. BBG

- Deutsche Bank's fixed-income traders outperformed their Wall Street peers in the second quarter, with CFO James von Moltke noting there was no concentrated or unusual gain. The lender gave slightly more positive 2023 revenue guidance, but higher-than-expected expenses overshadowed results. BBG

- Labour leader Sir Keir Starmer has said NatWest was “wrong” in its treatment of Nigel Farage and that its chief executive “had to resign” after its private bank Coutts refused the former Brexit party leader a bank account. Alison Rose stepped down on Wednesday after admitting to the inaccurate briefing of a BBC journalist about the closure of Farage’s account, a decision that Sir Keir described as “fairly straightforward” in an interview on BBC Radio 5 Live. FT

- Joe Lewis, the billionaire real estate investor and owner of Tottenham Hotspur football club, has been charged over multiple alleged instances of insider trading, US prosecutors said on Tuesday. The 86-year-old, who is one of Britain’s richest men, is accused of tipping off employees, associates, friends and romantic interests with non-public information about companies in which he had invested, and lending some of them hundreds of thousands of dollars to trade on the knowledge. FT

- We expect a hike today to 5.25-5.5% to be the last of the cycle. But on a probability-weighted basis, our Fed views remain more hawkish than market pricing. This reflects both our lower probability of recession and our expectations that the threshold for rate cuts will be fairly high and that cuts will be gradual. We expect cuts to start in 2024Q2, to proceed at 25bp per quarter, and to end with the funds rate at 3-3.25%, above the FOMC’s 2.5% longer run dot. GIR

- Gov. Ron DeSantis of Florida is sharply cutting the size of his presidential campaign staff, reducing by more than one-third a payroll that had swelled to more than 90 people in his first two months as a candidate, according to four people with knowledge of the decision. NYT

- BANC (Banc of California) after the close said it will purchase PACW (PacWest), a deal that was first reported on by the WSJ during trading on Tuesday (PacWest stockholders will receive 0.6569 of a share of Banc of California). WSJ

A More detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed with most bourses lacking firm direction heading into the looming major central bank policy decisions beginning with the FOMC later today. ASX 200 outperformed with gains led by the mining industry and the top-weighted financials sector, while participants also reflected on the mostly softer-than-expected inflation data which showed headline CPI Q/Q was at its slowest pace of increase since 2021.Nikkei 225 swung between gains and losses with the mood indecisive as softer Services PPI data from Japan added to the second-guessing surrounding this week’s BoJ meeting. Hang Seng and Shanghai Comp were weaker after the prior day’s stimulus boost lost steam but with downside limited owing to wide expectations for further support measures and after the PBoC upped its liquidity efforts, while China also replaced the head of its central bank amid the increasing challenges facing its economy.

Top Asian news

- US Secretary of State Blinken said he expects to work well with new Chinese Foreign Minister Wang Yi, while it was separately reported that Japanese Chief Cabinet Secretary Matsuno said he wants to closely communicate on various levels with China including with Foreign Minister Wang Yi.

- Japan maintains its overall view on the economy and says it is "recovering moderately"; Japan raises its view on business sentiment in July for the first time in 7 months.

- Japanese Gov't official, citing BoJ's Ueda, says market sentiment continues to improve. Adds, long-term yield rate remains stable under YCC. USD/JPY is slightly volatile partly due to rate differentials. To maintain an accommodative monetary environment for firms.

- China is said to be mulling easing proposed rules that require foreign office equipment makers operating in the country to transfer key product technology to China, according to Nikkei sources.

European bourses are primarily in the red but with some more mixed performance, Euro Stoxx 50 -1.0%; action which comes after numerous key earnings incl. LVMH, -4.4% which is weighing on the Euro Stoxx 50 & CAC 40 -1.4%. Sectors are largely reflective of the corporate updates, Consumer Products & Services lags given LVMH while Basic Resources slip after earnings/production updates from Rio Tinto and Fresnillo. While the Banking sector is torn between two-way corporate updates and an ongoing NatWest story. Stateside, futures are slightly mixed but yet to differ markedly from near-unchanged levels, ES -0.1%, ahead of the FOMC and further corporate heavyweights after digesting the likes of MSFT and GOOGL after-hours on Tuesday.

Top European news

- London Mayor Khan urged the UK government to provide more funding to finance a more generous scrapping scheme for older cars affected by his plan to widen the Ultra Low Emission Zone to the entire capital, according to FT.

FX

- DXY slips ahead of the Fed, but also amidst Yen strength pre-BoJ and a Euro bounce on the eve of ECB.

- Index fades within 101.430-080 range, as USD/JPY retreats towards 140.00 from 141.00+ peak and EUR/USD eyes the top of an expiry range spanning 1.1100-1.1000.

- Aussie undermined by sub-forecast CPI data and higher probability of RBA pause next week, AUD/USD softer between 0.6793-29 parameters, but supported by 21 and 200 DMAs.

- Loonie lags awaiting BoC minutes as crude recoils, USD/CAD closer to the top of 1.3202-1.3169 bounds.

- PBoC set USD/CNY mid-point at 7.1295 vs exp. 7.1341 (prev. 7.1406)

Fixed Income

- Bonds meander either side of par pre-FOMC and with eyes on the ECB and BoJ thereafter.

- Bunds marginally underperform within a 133.67-26 range and absorbing 7 year German supply.

- Gilts also mostly adrift between 96.62-29 parameters and T-note afloat having peaked peaked at 111-29 and troughed just above Tuesday's 111-19+ low.

Commodities

- WTI and Brent futures are subdued intraday after rising to fresh multi-month highs on Tuesday amid further stimulative pledges by China alongside potential supply concerns, ahead of the FOMC.

- Spot gold is modestly firmer amid the softer Dollar with the yellow metal back above its 100 DMA (USD 1,964.25/oz today) as all eyes turn to the Federal Reserve’s decision and Chair Powell’s press conference.

- Base metals are mostly softer and take a breather from the recent China-induced gains, with 3M LME copper just dipping under USD 8,600/t from a recent peak near USD 8,700/t.

- US Energy Inventory Data (bbls): Crude +1.3mln (exp. -2.0mln), Gasoline -1.0mln (exp. -2.0mln), Distillate +1.6mln (exp. -0.1mln), Cushing -2.3mln.

- China's state planner NDRC is to increase prices of retail gasoline and retail diesel by CNY 275/t and CNY 260t respectively from July 27th.

Geopolitics

- Chinese Defense Ministry said China and Russia will soon hold their third joint naval patrol in the western and northern parts of the Pacific Ocean which is not aimed at any third party or related to global or regional situations, according to Global Times.

- India "open" to Chinese investment despite border clashes, official says, according to FT.

US Event Calendar

- 07:00: July MBA Mortgage Applications -1.8%, prior 1.1%

- 10:00: June New Home Sales MoM, est. -5.0%, prior 12.2%

- 10:00: June New Home Sales, est. 725,000, prior 763,000

- 14:00: July FOMC Rate Decision

DB's Jim Reid concludes the overnight wrap

Markets put in another resilient performance over the last 24 hours, as all eyes turn to the Fed’s latest decision today. The positive mood was supported by another strong round of US data, which included the Conference Board’s consumer confidence index hitting a 2-year high. That offered a fresh boost to risk assets, with the S&P 500 (+0.28%) rising to its highest level in 15 months yesterday, Brent Crude oil prices closing above $83/bbl for the first time since April, and US HY credit spreads reaching their tightest level in 15 months too. In addition, there was a significant milestone for the Dow Jones (+0.08%), which recorded a 12th consecutive gain for the first time since 2017. If we get a 13th today that would be the longest run since 1987, so one to watch out for.

When it comes to the Fed today, they’re widely expected to hike rates by 25bps. That’s in line with market pricing, which sees a 97% chance of a hike, as well as the overwhelming consensus of economists. In turn, that would take the target range for the federal funds rate up to 5.25%-5.50%, marking its highest level since 2001. But since a hike today is almost fully priced in, the bigger question for markets will be if the statement and the press conference signal anything about the likelihood of further rate hikes ahead.

In their preview of today’s meeting (link here), our US economists think that there’s limited downside from Chair Powell delivering a hawkish-leaning message. Even after the very positive CPI print, he’s likely to emphasise that further evidence is needed to be confident that inflation will be tamed. Furthermore, the FOMC themselves signalled in their June dot plot that two further hikes were their baseline by year-end, implying one more after today. Remember as well that there are still two jobs reports and CPI reports ahead of the next meeting – as well as the Jackson Hole gathering – so our economists think Powell is unlikely to provide strong guidance about the outcomes of upcoming meetings.

When it comes to market pricing, fed funds futures are currently pricing just a 44% chance of a second hike after today’s. In other words, the central expectation is that this will be the last hike of the current cycle. But it’s worth remembering that we’ve been here before. In fact, after the two most recent hikes in March and May, market pricing by the close that day was that the Fed were most likely done hiking. So they’ve shown themselves willing to adjust in recent months, particularly as the ramifications from the regional bank crisis weren’t as bad as many feared at the time.

Ahead of the Fed, there was a fresh selloff for sovereign bonds thanks to another round of resilient data. Firstly, we had the Conference Board’s latest consumer confidence reading, which hit a 2-year high of 117.0 (vs. 112.0 expected). Second, housing inflation was more resilient than expected in May, with the S&P CoreLogic Case-Shiller index up by +0.99% over the month (vs. +0.70% expected). In fact, that’s the fastest monthly house price growth in a year, which is adding to the signs that housing inflation has now bottomed out and if anything is accelerating again.

That backdrop meant that yields on 10yr Treasuries rose by a modest +1.2bps to 3.88%, a two-week high. The sell-off was driven by rising real rates, while the 10yr breakeven (-1.2bps) retreated slightly after hitting hit a post-SVB high on Monday. And over in Europe it was much the same story, with yields on 10yr bunds (+0.5bps), OATs (+0.7bps) and BTPs (+3.5bps) all seeing a moderate increase.

For equities, yesterday brought another resilient performance, with the S&P 500 (+0.28%) hitting another 15-month high. We also had a 12th consecutive daily increase for the Dow Jones (+0.08%) for the first time since February 2017, and if we get a 13th gain today, that would be the longest run of gains since January 1987. Tech stocks were the main outperformer, with the NASDAQ (+0.61%) and the FANG+ index (+0.93%) seeing larger gains. Meanwhile in Europe, the STOXX 600 (+0.48%) advanced for a 6th day running for the first time since January.

After the US close, we received earnings releases from Microsoft and Alphabet, which both beat earnings estimates but received contrasting reactions. Microsoft was trading lower in after-hours trading (-3.7%) after reporting slowing growth in cloud computing. Conversely, Alphabet saw a positive reaction (+6.1%) amid revenue outperformance boosted by its search business. Elsewhere overnight, US equity futures are flat ahead of the Fed’s rate decision, with those on the S&P 500 up +0.01%.

There were some interesting other developments back in Europe yesterday, since we got the ECB’s latest Bank Lending Survey for Q2. That had evidence for both sides of the hard vs soft landing debate. On the downside, it showed the sharpest decline in demand for loans by enterprises in the survey’s history since 2003. The share of rejected corporate loans also rose. But on the upside, the pace of tightening in credit standards moderated, and banks expected credit conditions to improve closer to neutral settings in Q3.

The release comes ahead of tomorrow’s ECB policy decision, where another 25bp hike is widely expected. However, markets have continued to downgrade the chances of a second hike after tomorrow’s decision, with the probability now at 75% this morning, having been 88% at the end of last week. That also followed the release of the Ifo’s business climate indicator from Germany, which showed a larger-than-expected decline in July. The main reading came in at an 8-month low of 87.3 (vs. 88.0 expected), and the current assessment component fell to 91.3 (vs. 93.0 expected), which is the lowest since February 2021.

Asian equity markets are mostly losing ground this morning after yesterday’s rally. Across the region, the Hang Seng (-0.79%) is the biggest underperformer, with the KOSPI (-0.70%), the Shanghai Composite (-0.35%) and the CSI 300 (-0.34%) also edging lower. Otherwise, the Nikkei (-0.03%) is struggling to gain traction, but the S&P/ASX 200 (+0.88%) has seen a strong outperformance after Australia’s inflation eased for the second straight quarter.

In terms of that release from Australia, CPI only rose by a quarterly +0.8% in Q2, which was beneath the +1.0% reading expected by the consensus. The trimmed mean also came in beneath expectations, with just a +0.9% increase rather than the +1.1% gain expected. In turn, markets are pricing in a growing chance that the RBA will keep rates on hold at its next meeting, with the chance of an August hike down from 44% to 16%. Australian government bonds are also outperforming this morning, with their 10yr yield down -3.4bps to 3.99%.

There wasn’t much in the way of other data yesterday. However, we did get the IMF’s latest economic forecasts, which upgraded their 2023 global growth projection for this year to 3.0%, up two-tenths from April. The upgrades were fairly broad-based across countries, with Germany being the only G7 member to see a downgrade to this year’s projections, with the IMF now expecting a -0.3% contraction in 2023.

To the day ahead now, and the main highlight will be the Fed’s policy decision and Chair Powell’s press conference. Otherwise, data releases include US new home sales for June and the Euro Area M3 money supply for June. Finally, today’s earnings releases include Meta, Coca-Cola, Union Pacific, Boeing and AT&T.