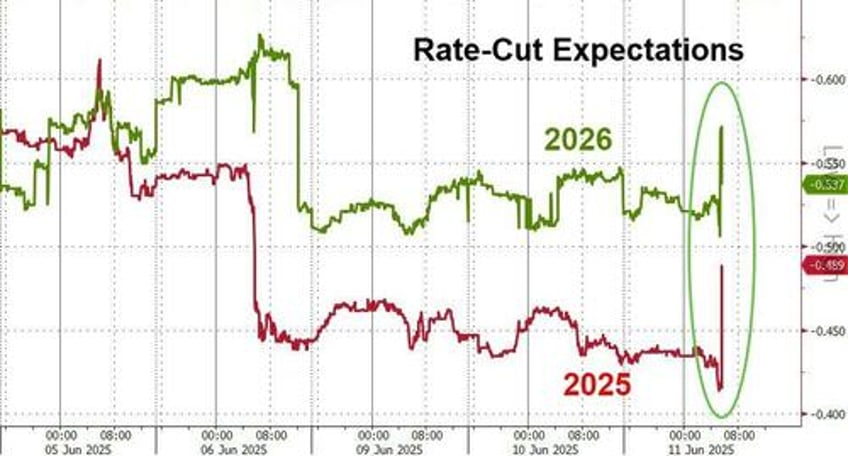

A 'disappointing' CPI print (cooler than expected) has promoted a surge higher in the market's expectation for rate-cut...

Source: Bloomberg

Prompting a surge higher in EVERYTHING.

Stocks spiked...

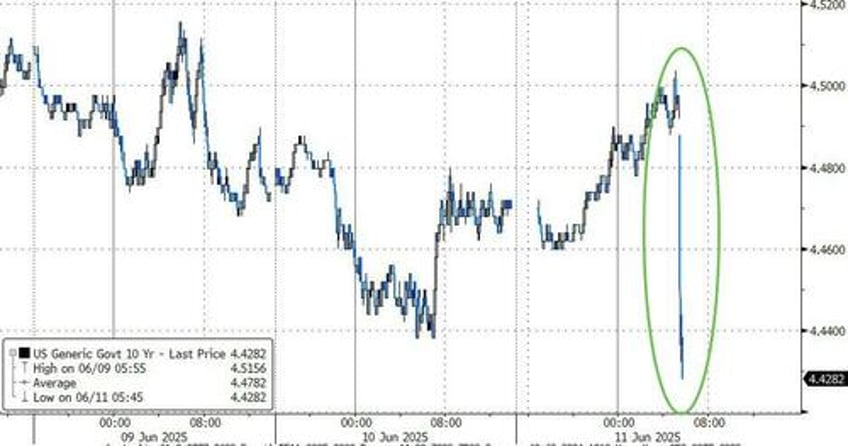

Treasuries were aggressively bid with 10Y yields sdown 5bps...

Source: Bloomberg

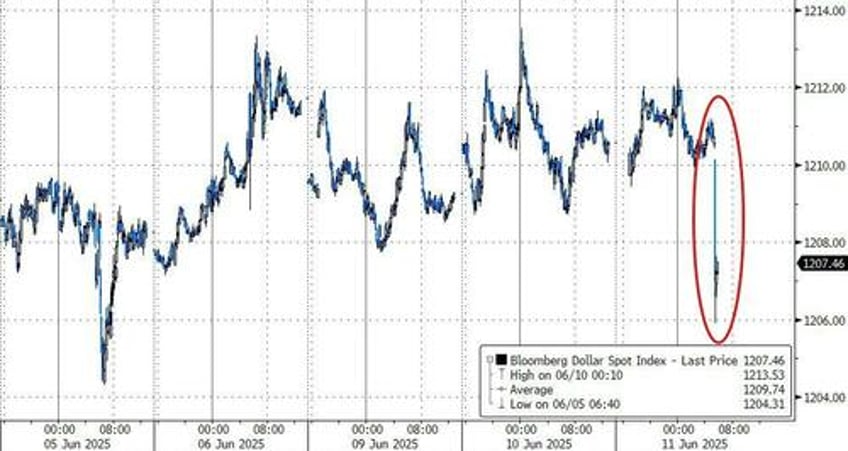

The dollar fell...

Source: Bloomberg

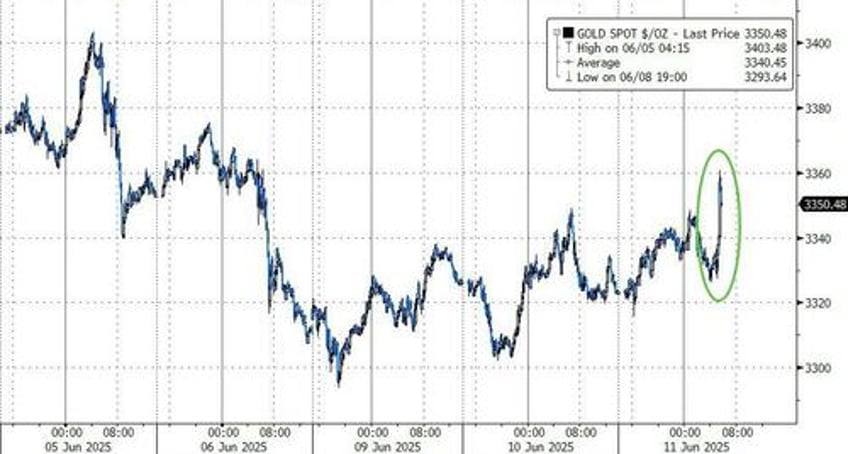

Helping gold to accelerate...

Source: Bloomberg

Goldman said that this would be a materially dovish print (<0.25% MoM for Core CPI) would prompt the bond market to add back at least 2x 25bp rate cuts (it already has) and for Equities to react positively (up 2-2.5%) to the bull steepening that likely ensues.

What excuse will Powell come up with next to NOT cut?