Several Chinese stock indices have been in rally mode since the start of February, fueling market bottom calls by some Wall Street analysts. This comes as Beijing ramps up its commitment to end the market rout.

On Tuesday, the Hang Seng Tech Index became the latest Chinese index to enter a technical bull market, joining tech-heavy ChiNext, materials index, and renewables.

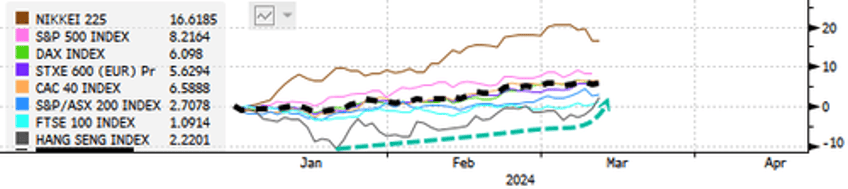

Market sentiment was improving from a month ago when Chinese shares were among the world's worst performers.

We pointed out the extreme bearishness in a Jan. 19 note titled "China Stocks Hit Rock Bottom: After $6.3 Trillion Market Loss, Brokers Suspend Short-Selling." By Feb. 18, we cited a UBS note that outlined buying returned to Chinese stocks as flows improved.

M&G Investment Management now believes a bottom in Chinese equities has formed, mainly influenced by Beijing's market interventions, signs of improving economy and earnings, and a return of foreign flows into the equity market.

"It's rare to see China's markets sustain a rally for weeks since the second half of last year," said Fanwei Zeng, investment analyst at GAM Investment Management.

Zeng continued: "Most Chinese tech and renewables companies have been focusing on cost-cutting and improving efficiency; we've seen improvements in margins and decent topline growth."

Despite the ongoing deflation and property crisis concerns, investors are coming to terms with Beijing's attempts to restructure its economy. Some are betting on President Xi Jinping's attempt to drive high-tech growth and end the real estate crisis.

Even with the lack of massive stimulus, some investors see a reduction in the mortgage reference rate and more liquidity, and a crackdown on quants is sufficient to make bottom calls (for now).

"We expect high single-digit or low-teen earnings growth overall this year," said Nicholas Yeo, head of China equities at abrdn plc, adding, "We expect deflationary pressure to reduce this year which would provide companies with more pricing power. We are around the range of the bottoming."

Earlier this month, Goldman's Si Fu and Kinger Lau asked clients: "When will flows come back to China?"

Responding to their own question, the analysts stated:

"Recent "National Team" buying has put a near-term floor on the market and boosted investor confidence."

Early Tuesday, US-listed Chinese stocks traded higher, with KraneShares CSI China Internet ETF up nearly 3%. If premarket gains hold, this would be the highest level since Dec. 29.

Fu outlined his strategy for buying Chinese stocks:

"We believe 1) companies with low PB(<1x), solid fundamentals and strong cash returns; and 2) technology-oriented SOEs with high R&D investment and aligned management incentives may benefit the most from the reform."

The question remains whether this is the start of a crazy new V-shaped bull market recovery or if it is similar to Japan's L-shaped three-decade bottom.