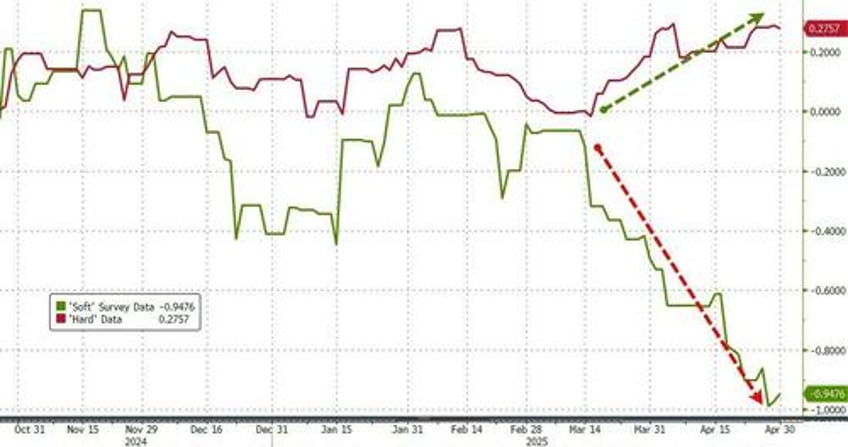

Following a slew of regional Fed surveys (and various other sentiment readings) sending 'soft' data dramatically lower (as 'hard' data continues to strengthen), this morning's Manufacturing PMIs are expected to signal further weakness.

Source: Bloomberg

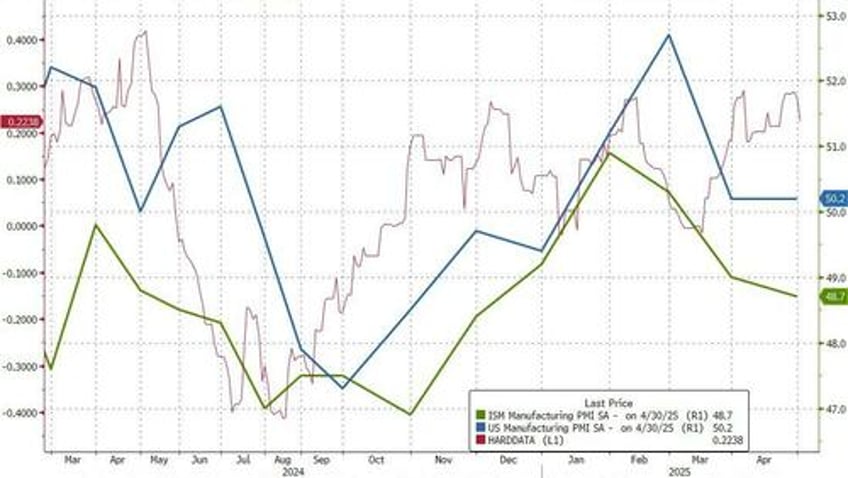

The final S&P Global Manufacturing PMI did indeed disappoint, sliding from 50.7 flash print to 50.2 - exactly in line with March's final print (but below the 50.5 expected).

ISM's Manufacturing PMI beat expectations, printing 48.7 (down from the 49.0 in March but better than the 47.9 expectations) - lowest since Nov 2024.

So Hard data up, PMI flat, ISM down... take your pick

But none of the three factors point to a recession:

“The past relationship between the Manufacturing PMI® and the overall economy indicates that the April reading (48.7 percent) corresponds to a change of +1.8 percent in real gross domestic product (GDP) on an annualized basis,” says ISM's Timothy Fiore.

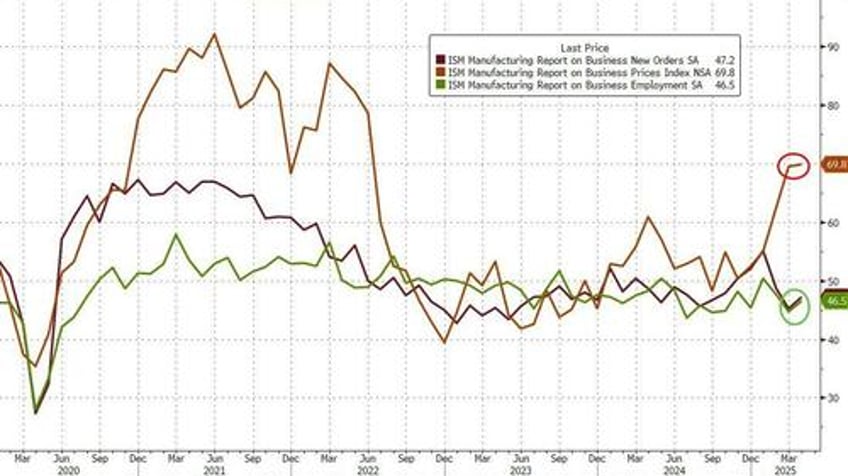

Under the hood, all the main components beat expectations with New Orders and Employment improving and Prices Paid rising (but less than expected)...

Admittedly, respondents are fearful of the impact of tariffs to come:

“Uncertainty over tariffs is providing a big challenge from both Tier-1 suppliers we will have to pay tariffs on directly and Tier-2 suppliers that will try to pass tariffs through to us in the form of price increases and tariff surcharges.” [Chemical Products]

“Tariffs impacting operations — specifically, delayed border crossings and duties calculations that are complex and not completely understood. As a result, we are potentially overpaying duties. Unsure of potential drawbacks. Implementation of tariffs and their application is sudden and abrupt. The business is taking countermeasures.” [Transportation Equipment]

“Business climate is apprehensive, and with tariff costs implemented, all inbound Chinese shipments are on hold. It is not feasible for our business or customers to sustain the pricing required to provide an acceptable margin.” [Computer & Electronic Products]

“The most important topic is tariffs. Risks include margin erosion due to rising operational costs and freight delays disrupting delivery timelines. Supplier relationships are strained by pain-share negotiations, and competitors are gaining share by importing from lower-tariff regions.” [Food, Beverage & Tobacco Products]

“Tariff whiplash is causing us major issues with customers. The two issues we are seeing: (1) customers are holding back orders to understand what is happening with tariffs on their products or (2) they are forcing us to accept the tariffs, which causes us to ‘no quote’ the job as we cannot take on that type of risk for an order.” [Machinery]

“There is a lot of concern about the inflationary impacts from tariffs in our industry. Domestic producers are charging more for everything because they can.” [Fabricated Metal Products]

“Tariff trade wars are incredibly volatile, quickly changing, and disrupting a ton of our current work. We are 90 percent sourced out of China, and the cost models keep changing every week. We are flying to visit suppliers in a few weeks to negotiate current terms and pricing, as well as develop more long-term, strategic plans to reduce risk in the region.” [Apparel, Leather & Allied Products]

“Demand is slightly lower than plan, but it has been steady amid tariff concerns. Significant time has been spent quantifying the impact of changing tariff rates. Our costs will increase, and we are discussing how to share that impact across suppliers and customers.” [Electrical Equipment, Appliances & Components]

“The recently imposed 145-percent tariff rate on Chinese imports is significantly affecting our 2025 profitability. Due to the complexity of our parts and the lack of alternate sources, we are unable to find any alternate suppliers — especially at a reasonable cost — to our current Chinese sources. Incoming orders have slowed due to market volatility and uncertainty.” [Miscellaneous Manufacturing]

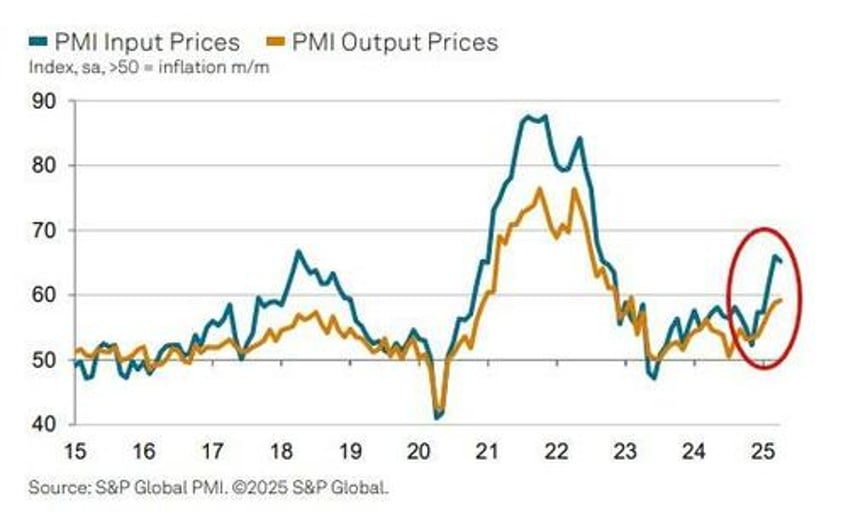

"Manufacturing continued to flat-line in April amid worrying downside risks to the outlook and sharply rising costs," said Chris Williamson, Chief Business Economist at S&P Global Market Intelligence.

"Factory output fell for a second successive month as tariffs were widely blamed on a slump in export orders and curbed spending among customers more broadly amid rising uncertainty.

But, even they were forced to admit a small silver lining in the report...

"Although the survey saw some producers report evidence of beneficial tariff-related switching of customer demand away from imports, any such sales increase was countered by worries over tariff-related disruptions to supply chains and lost export sales.

This served to drive business confidence about prospects in the year ahead down sharply to the gloomiest for 10 months.

And just like all the other surveys, PMI respondents sees Prices rising...

"Concerns have also spiked in terms of input costs, especially for imported materials and components, due to the triple whammy of tariff-related price hikes, supply shortages, and the weaker dollar.

"Manufacturers are responding to these changing demand, supply and cost conditions by raising their selling prices and trimming headcounts to help protect their margins."

So, take what you will from this - are these data points a reflection of reality or the incessant FUD being peddled by the mainstream media?

If you need a reminder, as we noted earlier, there is a massive gap between what CEOs are saying and what CEOs are doing...

Corporate CEOs are just like Long Onlies on Wall Street: everyone is "apocalyptic", nobody is selling....

— zerohedge (@zerohedge) May 1, 2025

only here everyone is "apocalyptic", and nobody is firing pic.twitter.com/Wtu0uNeRqt

Will CEOs suddenly announce massive waves of layoffs, or, with stocks now having erased all of the post-Liberation Day losses, will CEOs suddenly find a renewed optimism?