With US futures and European markets closed for Good Friday, the only markets trading overnight were in Asia where stocks gained following another record close on Wall Street, with focus turning to key PCE data due later Friday as well as a speech by Fed chair Powell.

Benchmarks in Japan, South Korea and mainland China showed modest increases, after US stocks wrapped up the first quarter on a positive note, including the 5th monthly gain in a row and closing up 18 of the past 22 weeks - something markets haven't done since 1989.

And while they won't be able to trade it - except perhaps through crypto which never closes - investors are bracing for a print of the Federal Reserve’s preferred consumer price reading for fresh clues about its policy outlook.

Several Asian markets, including Australia, Hong Kong and Singapore, are also closed Friday for a public holiday. The gains in the region came after traders sent the S&P 500 to its 22nd record this year on the back of data showing the US economy remained healthy. A $4 trillion surge in US equity values in just three months has startled doomsayers, while leaving a host of strategists scrambling to update their 2024 targets.

“Domestic events are driving the gains in China, Japan and South Korea with investor sentiment underpinned by the overnight gains in the US market,” said Seo Sang-Young, a market strategist at Mirae Asset Securities. End-of-quarter portfolio rebalancing also seems to be at play, Seo added.

Eslewhere, traders remain on alert for intervention in Japan’s currency after officials stepped up warnings this week to stem its slide. The yen’s weakness is not in line with economic fundamentals, Masato Kanda, vice finance minister for international affairs, said in an interview Friday. He also reaffirmed the commitment to act if needed to prevent excessive swings in the exchange rate.

There is a growing sense of wariness of intervention, said Taishi Fujita, associate in the global markets division for the Americas at MUFG Bank. “Even if you build a position selling the yen during a strong phase, you are likely to drop the position as it approaches 152.” He pointed out that the market may continue to hover in the low 151-yen per dollar range.

Latest data showed that consumer price growth in Tokyo moderated while staying well above the central bank’s inflation target. It may keep authorities on track to consider more rate increases after they hiked earlier this month for the first time since 2007.

On China’s corporate front, one of the nation’s biggest property firms delayed its earnings report while another posted a historic profit decline. Country Garden Holdings Co. announced late Thursday it will miss a deadline for reporting annual results, saying it needs more information. Developer China Vanke Co. said net profit tumbled 46% last year.

According to Bloomberg, swaps traders on Thursday slightly trimmed wagers that the Fed would cut rates as soon as June following Fed Governor Christopher Waller’s comments on Wednesday that there was no rush to lower interest rates. Two-year Treasury yields climbed five basis points to 4.62% in a shortened session ahead of the holiday, while the dollar extended its quarterly advance. Trading of cash Treasuries in Asia is closed due to the holiday.

With both GDP and consumer spending posting strong advances at the end of last year, consumer sentiment rose markedly toward the end of March, supported partly by the strong stock-market gains. In addition to the release of the PCE price index, the Fed’s preferred inflation gauge, traders will also closely monitor a speech by Fed Chairman Jerome Powell later Friday.

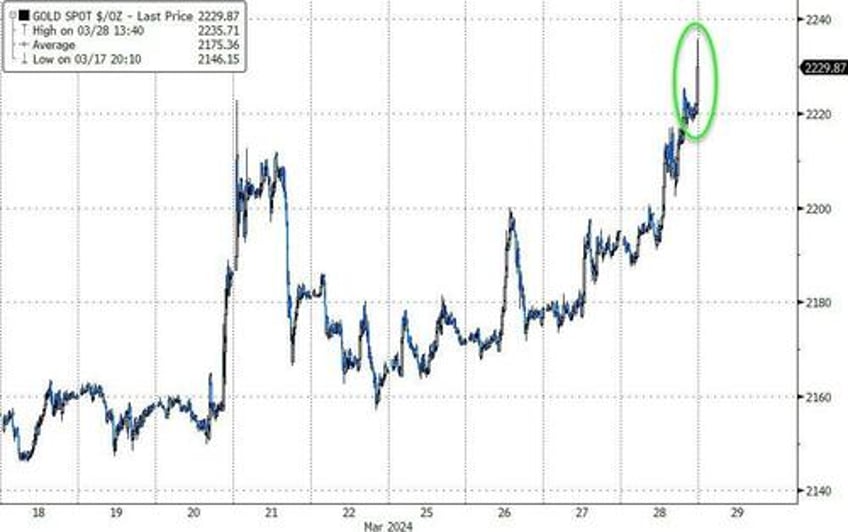

Elsewhere, gold hit a fresh all-time high, extending a weeks-long rally fueled by bets on Fed rate cuts and deepening geopolitical tensions. Oil scored a 16% quarterly gain in the latest sign that export curbs by OPEC and its allies are reining in global supplies.

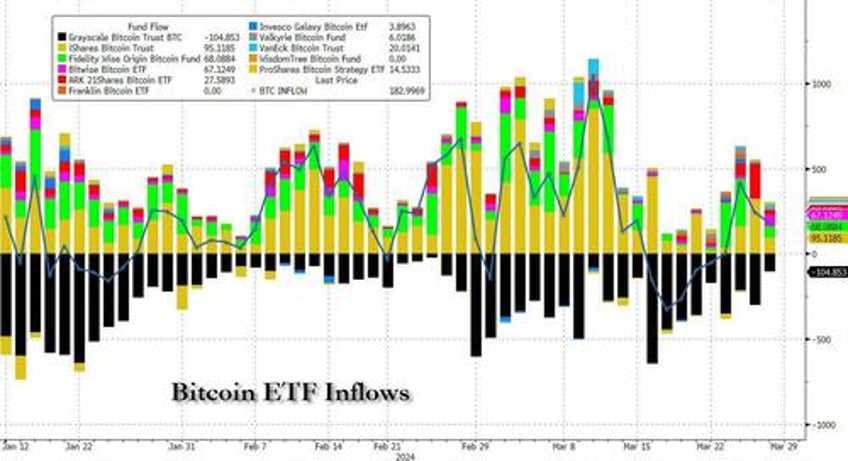

Bitcoin eased Friday after climbing to $71,555 in the previous session, despite another session of strong inflows into ETFs, as bitcoin futures get slammed constantly, affording new spot buyers cheaper prices.

Fed Chair Jerome Powell is speaking at the San Francisco Federal Reserve Bank’s Macroeconomics and Monetary Policy Conference today. The conversation, moderated by Marketplace’s Kai Ryssdal, will start at 11:30 a.m. ET. It should cover several topics including inflation and interest rates.