The payrolls headline for April is expected at 138k, a sharp drop from Marchʼs 228k, with Bloomberg analyst estimates ranging between 50k and 171k (a very narrow range, so expect another 4-6 sigma outlier). The unemployment rate is seen unchanged at 4.2% (range 4.1-4.3%), and below the 2025 median Fed forecast of 4.4%. The labor market report will be gauged to see whether the implementation of tariffs has started to take effect with reciprocal tariffs being implemented from April 2nd, with the reduced rates announced from April 9th. In Powellʼs recent remarks, he has continued to toe the line that the Fed is well-positioned to wait for greater clarity before considering altering its policy stance, sticking to his ‘wait-and-see approachʼ. Other influential officials, such as Governor Waller, have leaned dovish while there is also significant pressure from President Trump for the Fed to lower rates, as he continues to stress the Fed is moving too slowly (in fact, the easiest way to get Powell to cut rates is for Trump to "instruct" the BLS to show a -100K print with a surge in government layoffs and unemployment as discussed here).

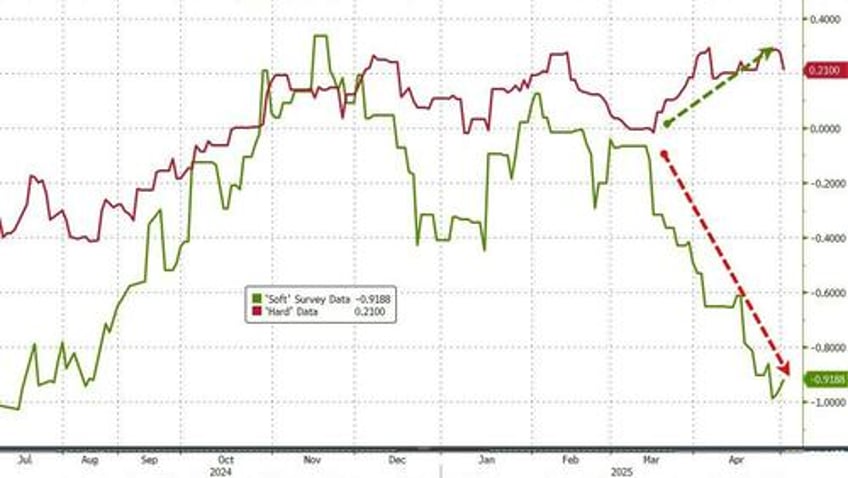

Heading into the jobs report, there have been some contrasting forces in play for April, as the soft and hard data continue to paint a different picture. While business and household economic expectations have plunged recently, the actual labor market indicators are not showing any break in the labor market, although the latest ADP report was weak.