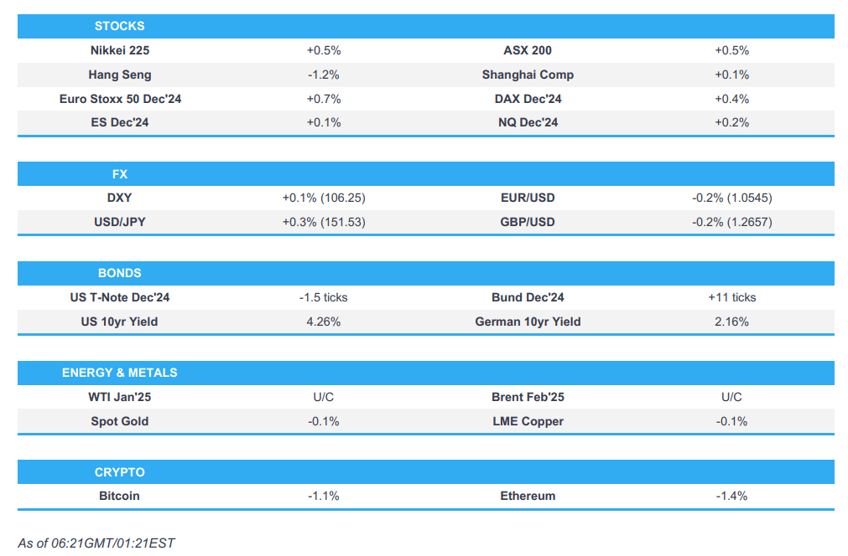

- APAC stocks traded mixed after the subdued lead from Wall St where stocks retreated heading into Thanksgiving and month-end.

- European equity futures are indicative of a positive cash open with the Euro Stoxx 50 future +0.6% after the cash market closed lower by 0.6% on Wednesday.

- USD is broadly firmer vs. peers following yesterday's broad-based selling.

- Bunds are a touch higher heading into the European open, crude futures are lacklustre.

- Looking ahead, highlights include Spanish & German Flash/Prelim. CPI, EZ Consumer Confidence Final, Japanese Tokyo CPI & Retail Sales, Speakers including RBA Governor Bullock, ECB’s Lane & Elderson, Supply from Italy.

- Holiday: US Thanksgiving; normal service on Thursday 28th November until 18:00GMT/13:00EST, upon which the desk will close and then re-open later at 22:00GMT/17:00EST for the beginning of the Asia-Pacific session.

SNAPSHOT

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks were primarily sold heading into the Thanksgiving holiday and on the last full trading day of the month with notable underperformance in the Nasdaq after some tech and software names stumbled post-earnings, while small caps initially outperformed but then wiped out nearly all of the gains by the US close, likely on month-end related flows. T-notes rallied throughout the session in the wake of a plethora of US data and a strong 7yr auction in which the data showed US Q3 GDP was left unchanged, but the quarterly Core PCE was revised lower and the monthly PCE was in line with expectations for both the headline and core. Furthermore, Jobless Claims were relatively in line with estimates and Durable Goods missed on the headline.

- SPX -0.38% at 5,999, NDX -0.85% at 20,744, DJIA -0.31% at 42,722, RUT +0.08% at 2,426.

- Click here for a detailed summary.

NOTABLE HEADLINES

- US President-elect Trump said he had a wonderful conversation with Mexico's President Sheinbaum who has agreed to stop migration through Mexico into the US, effectively closing the southern border, while they talked about what can be done to stop the flow of drugs into the US. Furthermore, Trump added that their conversation was very productive and he reiterated that Mexico will stop people from going to the US's southern border, effective immediately.

- US President-elect Trump picked Keith Kellogg to serve as assistant to the President and special envoy for Ukraine and Russia, while Trump reportedly eyes former SEC commissioner Atkins to succeed Gensler as SEC Chair, according to Bloomberg. It was also reported that Gail Slater is the leading contender to head the anti-trust unit in President-elect Trump's DoJ, according to FT.

APAC TRADE

EQUITIES

- APAC stocks traded mixed after the subdued lead from Wall St where stocks retreated heading into Thanksgiving and month-end.

- ASX 200 was led by strength in healthcare, tech, financials and utilities, while the latest quarterly capex data also topped forecasts.

- Nikkei 225 clawed back opening losses and rose back above the 38,000 level as the recent currency strength moderated.

- Hang Seng and Shanghai Comp retreated amid tariff and trade concerns, with the US said to ready China chip curbs and will impose restrictions around AI memory chips, while the US will also add 100 firms to the entity list including Huawei partners.

- US equity futures (ES +0.1%) nursed some of the prior day's losses in quiet trade amid Thanksgiving celebrations.

- European equity futures are indicative of a positive cash open with the Euro Stoxx 50 future +0.6% after the cash market closed lower by 0.6% on Wednesday.

FX

- DXY found slight reprieve following yesterday's broad-based selling heading into the Thanksgiving holiday in which further upside in the yen had added to the pressure for the greenback, while there was a recent slew of data including the monthly PCE prices which matched estimates, as did the 2nd estimate for Q3 GDP, although Q3 Core PCE was revised lower and ING also suggested rebalancing could influence downside moves.

- EUR/USD pared some of its gains but retained a firm footing above 1.0500 after recent dollar pressure and a hawkish Schnabel.

- GBP/USD marginally eased back from a weekly high after upward momentum stalled just shy of the 1.2700 territory.

- USD/JPY mildly rebounded from a fresh monthly low around the 150.50 level but with the recovery limited by a lack of key data releases and amid bets for the BoJ to resume hiking rates next month.

- Antipodeans traded rangebound alongside the mixed risk appetite and with AUD/USD failing to benefit from the better-than-expected Australian Private Capital Expenditure data, while there was also a muted reaction to the mixed New Zealand Business Surveys.

- USD/MXN declined after comments from US President-elect Trump that he had a wonderful conversation with Mexico's President Sheinbaum who agreed to stop migration through Mexico into the US, effectively closing the US southern border.

- PBoC set USD/CNY mid-point at 7.1894 vs exp. 7.2227 (prev. 7.1982).

- Brazilian Finance Minister Haddad said in a TV address that the minimum wage will continue to grow in a sustainable way under the fiscal framework and the government proposed changing the range of the annual "wage bonus" to workers earning up to BRL 2,640, while he confirmed spending cut measures will imply savings of BRL 70bln in the next two years and the government will propose raising income tax exemption to those earning up to BRL 5,000. Haddad also confirmed they will introduce a minimum retirement age for military pensions and limit the transfer of benefits, as well as stated that those earning over BRL 50,000 a month will pay "a little more".

FIXED INCOME

- 10yr UST futures took a breather after gaining yesterday in the wake of a plethora of US data and a strong 7yr auction, while overnight price action was restricted amid the US cash market closure for Thanksgiving Day.

- Bund futures remained afloat and held on to the 134.00 level after its recent choppy performance and ahead of German inflation.

- 10yr JGB futures retained opening gains after recently tracking US counterparts higher although further upside was limited by a lack of fresh drivers and with prices stuck around the 143.00 level.

COMMODITIES

- Crude futures remained lacklustre after the weekly EIA report posted a smaller crude draw than the recent private sector inventory data and as the Israel-Hezbollah ceasefire entered its second day.

- Baker Hughes Rig Count: Oil -2 at 477, Nat Gas +1 at 100, Total -1 at 582.

- Spot gold initially extended on the pullback from yesterday's peak with selling pressure seen as Shanghai commodities trade got underway, but then gradually clawed back its losses.

- Copper futures failed to sustain early gains amid the mixed risk sentiment in Asia and as its largest buyer, China, lagged.

CRYPTO

- Bitcoin traded indecisively on both sides of the USD 96,000 level and returned to relatively flat territory.

NOTABLE ASIA-PAC HEADLINES

- US is said to ready China chip curbs that stop short of early proposals and will impose restrictions around AI memory chips, while it will add 100 firms to the entity list including Huawei partners, according to Bloomberg. It was also earlier reported that the US is expected to announce more AI sanctions against China on Monday.

- BoK unexpectedly cut its Base Rate by 25bps to 3.00% (exp. unchanged at 3.25%), while the rate decision was not unanimous as board members Chang Yong-Sung and Ryoo Sang-Dai dissented. BoK said it will thoroughly assess the impact of the base rate cut on inflation, growth, and financial stability, as well as assess trade-offs among policy variables in determining the pace of further cuts. BoK Governor Rhee said three board members were open to rate cuts in the three months ahead said that gradual easing looks appropriate while Rhee said they had an extensive discussion about the impact of the rate cut on FX and will take steps to stabilize the FX market if needed. Rhee said they will monitor the impact of the rate cut on FX and the economy, as well as coordinate with the government to ease FX volatility if needed, while he noted that rapid moves in FX rates need to be curbed and they have tools to stabilise the pace of FX moves.

- RBNZ Assistant Governor Silk said RBNZ forecasts show a slower pace of easing after February, while she added that the rapid easing pace indicates RBNZ didn't over-tighten and noted that policy is to remain mildly restrictive in 2025. Silk also stated that a rate cut of either 25bps or 50bps will be on the table for February and that everything was on the table this week, but the Committee reached a consensus on a 50bps cut very quickly and she did not feel the need to do more than 50bps because there is still work to do on domestic inflation.

DATA RECAP

- Australian Private Capital Expenditure for 2024-25 (AUD)(Estimate 4) 178.2B (Prev. 170.7B)

- Australian Capital Expenditure (Q3) 1.1% vs. Exp. 0.9% (Prev. -2.2%)

- New Zealand ANZ Business Confidence (Nov) 64.9 (Prev. 65.7)

- New Zealand ANZ Activity Outlook (Nov) 48.0 (Prev. 45.9)

GEOPOLITICS

MIDDLE EAST

- Israel's Home Front Command decided not to change restrictions in the north despite the ceasefire agreement in Lebanon, according to Sky News Arabia.

- Israel's Channel 12 reported that Washington is committed to working with Israel to prevent Iran from destabilizing the region and preventing it from strengthening its presence in Lebanon, according to Sky News Arabia

- Lebanon's Hezbollah said it is ready to deal with Israel's assaults and will continue to follow up with the withdrawal of Israeli forces beyond borders.

- Egyptian security delegation is to travel to Israel on Thursday in an effort to reach a Gaza ceasefire deal, according to two Egyptian security sources cited by Reuters.

RUSSIA-UKRAINE

- Explosions were reported in Ukraine's Odesa, according to Ukrainian news outlet Zerkalo Tyzhnya.

- Ukraine said its energy sector was 'under massive enemy attack', according to a minister cited by AFP News Agency.

- US President Biden's administration is preparing USD 725mln in weapons for Ukraine including land mines, according to sources cited by Reuters. It was also reported that the Biden administration doesn’t have enough time to use the billions that lawmakers had authorised to arm Ukraine, leaving it in President-elect Trump’s hands what to do with the remaining money, according to WSJ citing officials.US intelligence source said nuclear escalation risk remains unlikely after Ukraine fired US weapons at targets inside of Russia.

- German foreign intelligence service head said the Kremlin sees Germany as an adversary and that they are in direct confrontation with Moscow, while he added that Russia has started to use kinetic measures against the West including acts of sabotage against infrastructure. Furthermore, he expects further escalation of the situation and said there is a rising risk this will raise the question of invoking NATO Article 5.

- Russian Deputy Foreign Minister said a Ukraine peace deal can only be negotiated if the West admits Russian President Putin's offer is the only option, according to RIA.

EU/UK

NOTABLE HEADLINES

- UK PM Starmer is to be invited to meet EU leaders in February as Brussels seeks closer ties with the UK, according to FT.

- ECB's Lagarde said a trade war may cause a slight increase in inflation and Europe could talk about buying more LNG from the US, while she added that free trade with China is more attractive if it's reciprocal and beneficial for both sides, according to FT.