Over the weekend we reported that, in a surprise move, the US and UK imposed new restrictions on trading Russian aluminum, copper and nickel in the latest bid to curb President Vladimir Putin’s ability to fund his war machine (as discussed previously, Russian oil is now trading above the western embargo "cap" price virtually everywhere). According to Bloomberg, the rules would prohibit delivery of new supplies from Russia to the London Metal Exchange, where the global benchmark prices are set, as well as to the Chicago Mercantile Exchange. The restrictions apply to copper, nickel and aluminum produced on or after April 13, and the US is also banning Russian imports of all three metals.

In analyzing the potential market impact of this development, we quoted Goldman's commodity traders who said that the announcement "did not reduce the supply of spot metal to the ex-China market; end-users are not restricted from consuming Russian metal, US consumption of Russian metal is already essentially zero, and Rusal (aluminium) and Norilsk (nickel) will not immediately divert supply to China due to arbitrage economics and capacity constraints" which is why Goldman did not anticipate a big price impact on metals such as aluminum and copper, although it hedged that with history teaching us that "the market will price in some “full-sanction” risk premium which when combined with the current macro bid (reflation narrative etc) means we expect a complex wide rally on the Monday’s Shanghai open." Still - Goldman cautioned - at some point the rally (in vol and price) should be faded (especially in nickel), "but given where CTA momentum indicators are currently, this is a debate for another day."

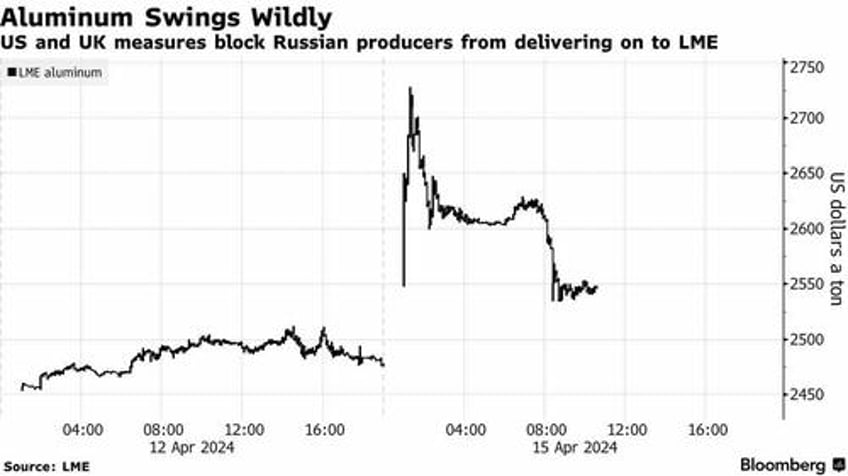

In retrospect, it's a very good thing Goldman hedged because overnight, aluminum and nickel first soared on the London Metal Exchange... before slumping and erasing almost all gains as traders responded to the new US and UK sanctions that banned deliveries of any Russian supplies produced after midnight on Friday.

Initially aluminum jumped as much as 9.4%, the most since the current form of the contract was launched in 1987, while nickel rose as much as 8.8%. However, both metals were only up by around 2% as trading got under way in Europe, and copper was little changed. On the Shanghai Futures Exchange, where some brands of Russian metal can still be delivered, aluminum closed marginally lower, while nickel was up 0.7%, all in keeping with Goldman's warning to fade the initial spike.

The rally is being fueled by “worries that the sanctions will reduce Russian flows to Western markets,” said Jia Zheng, head of trading and research at Shanghai Dongwu Jiuying Investment Management. “Any stimulation will be amplified amid an existing bullish backdrop.” And while there are also lingering concerns over the prospect of a flood of old Russian metal — which is still permitted — getting dumped onto the LME, clearly those did not prevail this morning.

As Bloomberg reports, many of the LME’s dealers and brokers have spent the weekend at work gaming out the market implications of the sanctions. The timing of the news, just ahead of the global copper industry’s annual CESCO Week gathering in Chile, has also made for lively conversations in business class cabins and passport queues as the industry descends on Santiago.

In London, the home of the LME, many traders were glued to their screens late on Sunday night: the scenes were familiar - metals traders have become hardened to wild swings and long weekends after a period marked by a nickel short squeeze that almost destroyed the LME in March 2022, and sanctions on United Co Rusal International PJSC that caused havoc in 2018.

But traders and executives said that the new restrictions were ultimately unlikely to have as dramatic an impact as those two events. That's because Russia’s two metal giants, Rusal and MMC Norilsk Nickel PJSC, are much less entangled in the western financial system than they were before the war, and the industry has spent the past two years preparing for the prospect of sanctions.

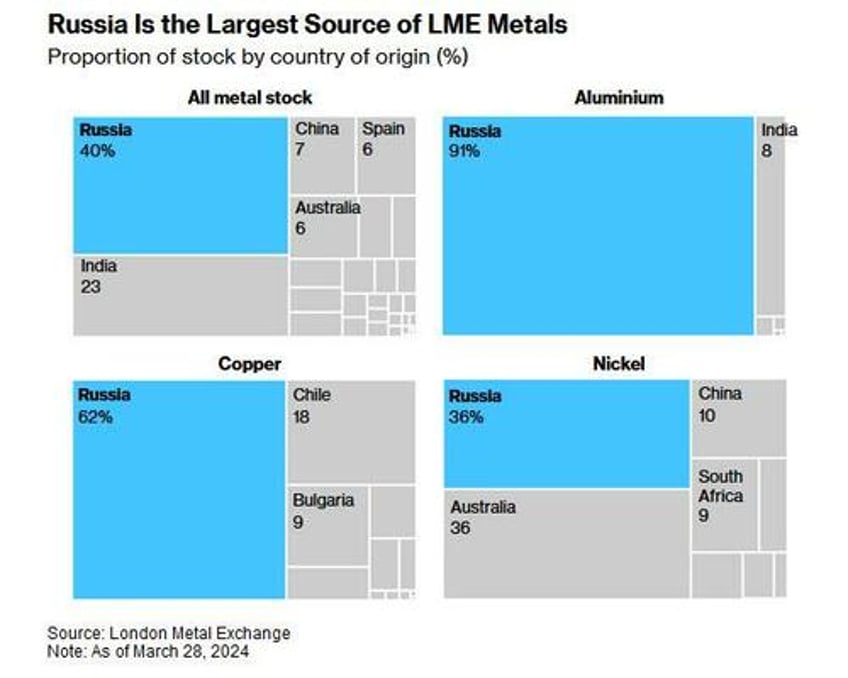

Still, Russia remains an important producer, accounting for 6% of global nickel supply, 5% of aluminum and 4% of copper. And its role on the LME is even more significant — in nickel for example, Nornickel has long been the largest supplier of refined metal, which is the only form deliverable to the LME. And just in case things get out of hand, the LME has put daily limits in place since the historic squeeze that prevent copper and aluminum prices from rising more than 12% in a day, while nickel has a 15% limit.

For those who missed our explainer on Saturday, here's is a quick primer from Bloomberg:

- Russia is an important metals producer, accounting for 6% of global nickel supply, 5% of aluminum and 4% of copper.

- The sanctions are aimed at curbing President Vladimir Putin’s ability to fund his war machine by choking off Russian producers’ access to western exchanges, while still allowing metal to flow to manufacturers in allied nations that depend on them.

- By targeting supplies of Russian metal produced from April 13 onwards, the sanctions divide the market into three categories: new Russian metal, which is now blocked from delivery to the LME; old Russian metal, produced before April 13; and non-Russian metal.

In many ways, this will lead to a similar bifurcation in the base metals market similar to that observed in oil since 2022, when Russian oil sold to Asia trades (or used to trade) at a lower price than unsanctioned oil sold to the West.

Indeed, as Bloomberg says, "the measures look set to cement China’s status as Moscow’s buyer of last resort, potentially leaving Russian supplies trading at deepening discounts to benchmark LME prices."

Both companies have already been selling increasing volumes to China as many western buyers backed away, and aluminum giant United Co. Rusal International PJSC said on Monday that the measures will have no impact on its ability to supply customers.

Since Russian metal accounted for 91% of LME aluminum stocks at the end of March, 62% of copper and 36% of nickel, traders are now expecting a wave of deliveries of Russian material that was being held outside the LME system which could now be dumped onto the exchange as its owners worry about the prospect of future restrictions. In the aluminum market, estimates of the amount of Russian metal being held outside of the LME system range from a couple of hundred thousand tons to as much as one million tons.

The reason why the price may move much higher after the kneejerk response is digested, is that the decision is likely to reignite a debate over whether Russian metal should be banned altogether to protect the exchange’s role as the home of global benchmark prices. By continuing to allow Russian supplies, the LME left open the possibility of a short-term surge in deliveries of that “old” Russian metal into its warehouses, which in turn could create further pricing dislocations. In its notice on Saturday, the LME acknowledged the possibility that the uncertainty caused by the sanctions means “a relatively large supply” of Russian metal could flood onto the exchange.

Estimates of the amount of Russian aluminum being held outside of the LME system range from a couple of hundred thousand tons to as much as one million tons.

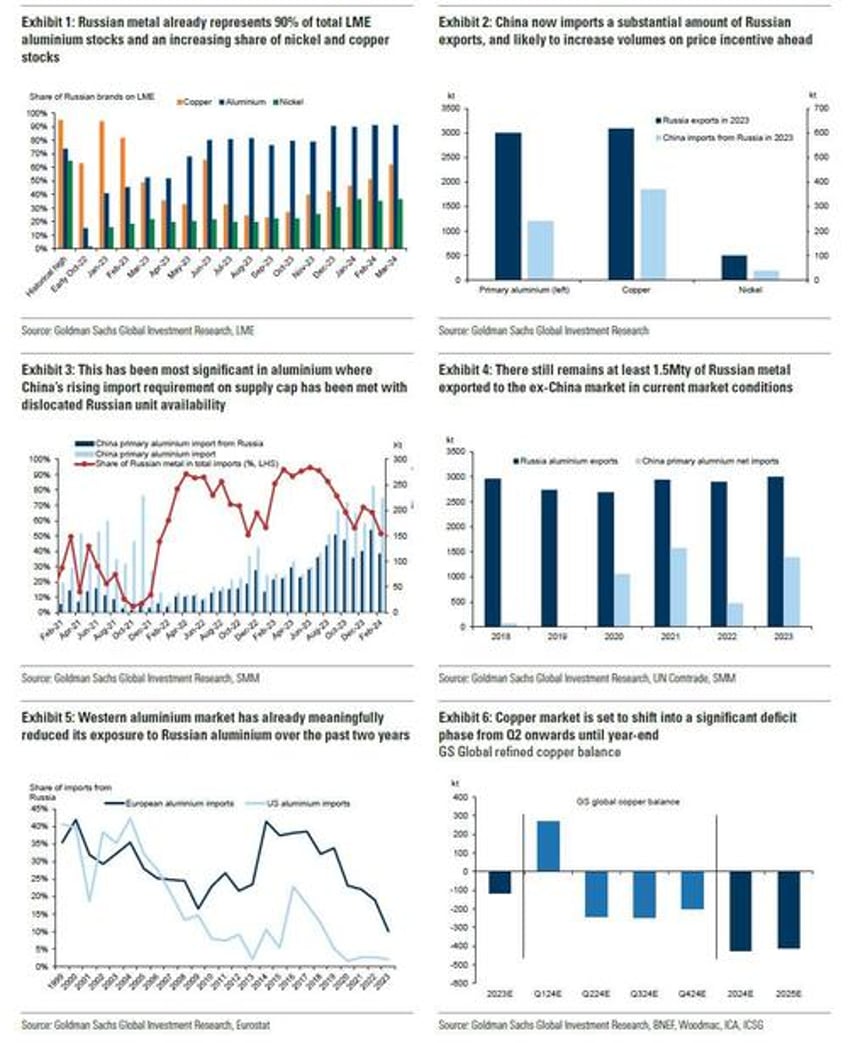

Finally, here is a more detailed analysis from Goldman analyst Nicholas Snowdown on the impact of the Russian ban:

The LME bans new Russian metal. The U.S. Treasury and U.K. government announced jointly on Friday fresh restrictions on Russian aluminum, copper and nickel focused on Western exchange activity, rather than on specific companies as was the case with the Rusal sanctions in 2018. Crucially they announced that any Russian metal produced on or after 13th April cannot be delivered (warranted) into Western metals exchanges (LME, CME). This was followed by the LME’s announcement on Saturday where (1) they confirmed metal produced on or after April 13th could no longer be warranted into the LME warehouse system, (2) Russian metal produced and warranted before the end of 12th April in the LME system can be cancelled (and rewarranted) by UK persons and (3) Russian metal produced before 13th April and not currently warranted in the LME system can be warranted though will be distinguished as a separate warrant category, whilst U.K. members cannot cancel these warrants unless on behalf of a non-UK person. Development (1) ends the risk of future Russian metal production being delivered into the LME, as the least preferred market units. Crucially, policy (2) actually makes current LME held Russian units more accessible and more approved to Western traders versus rules in place previously. This lessens the stickiness of those units currently held on exchange and increases the risk of draws, particularly in copper and aluminium. Dependent on market conditions, there remains the risk that for metals with relatively high off-warrant Russian stocks, aluminium most in focus, ruling (3) enables some LME deliveries if demand for those units does not materialise.

No immediate supply-demand shock. From a fundamental perspective, it is important to recognise that these exchange focused rule adjustments will not generate a necessary supply-demand shock. Russian producers can continue to sell metal to non U.K./US markets - in this respect there is no immediate tightening implication or trade flow dislocation to Western markets from current structure, in the way there was with Rusal’s sanctions in 2018. Nonetheless, there remains the uncertainty of whether other key ex-China markets and consumers will also continue to consume the same volumes of Russian metal ahead, whether due to incremental sanctions - for example if Europe follows suit with a Russian import ban - or consumer self sanctioning, just as we have seen in Europe since mid-2022. Given clearer deficit conditions are emerging in at least the copper and aluminium markets now, increased risk premia on Russian metal should at least provide some marginal demand for non-Russian units (supporting physical premia) whilst as a tightening risk, an upside factor for LME flat pricing albeit without initial spot market impact. We would note that we would also expect markets with no Russian unit sensitivity, most prominently China, India and Turkey, to absorb any incremental Russian metal given probable price incentive and tightening aggregate market conditions.

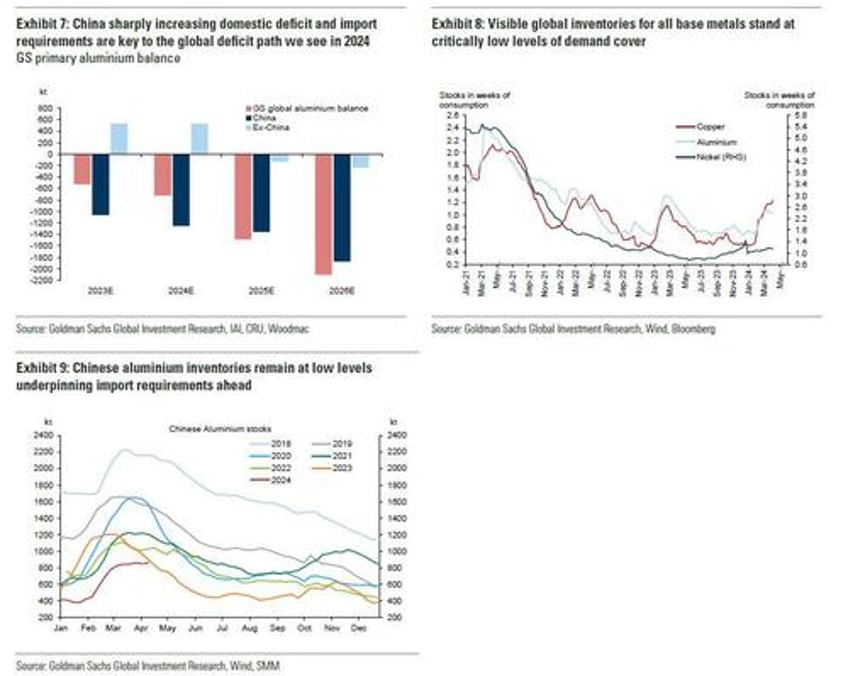

LME Russian dislocation is set to moderate. Crucially these announcements are significant in terms of the impact of actual LME physical function. For much of the last two years, in mostly benign market conditions, dislocated Russian units due to Western consumer self-sanctioning have been remapped either to Eastern consumers (China, Turkey, India) and into the LME system where they were still accepted. This has contributed to a build of unwanted Russian units on the LME which has generated a negative distortion of front-end spreads, as the LME curve has priced carry on Russian units. After this latest announcement, there are three conclusions on path ahead. First, the improved access and acceptability of currently held LME Russian stocks means that liquidity on cancellations increases. This should particularly be the case in copper, where the prospective extreme tightness ahead and already low market stocks, mean Russian units are vital to solving market shortfalls. In turn, this suggests a catalyst for tightening in front end spreads from the current sizeable contango. Second, longer term tightening in LME supply from the end of newly produced Russian metals – the LME is no longer the bid of last resort for this metal stream - means that longer dated spreads should also see a tightening bias though there has been less distortion on forward spreads from Russian dislocations. Third, there remains the risk that for metals with relatively high off-warrant Russian stock holding, namely aluminium, that the new LME warrant classification will enable future deliveries. Whilst we see a large global aluminium deficit this year (and next) limiting that channel, it remains a risk and could abate front end spread tightening.

Stay long copper and aluminium. It is important to recognise that these exchange focused rule adjustments are taking place in an environment where fundamentals for copper and aluminium are inflecting into a sustained tightening direction, after two benign years for fundamentals in 2022 and 2023. Indeed, the strong performance of the industrial metals complex over the year so far is a trend we expect to gather momentum ahead. This view particularly resonates with copper and aluminium, given the unprecedented fundamental shortfalls facing both metals over the next three years. We see three key factors underpinning this reflationary phase in industrial metals: (1) a continuation of China’s green metals demand strength, (2) greater restraint on China onshore metals supply supporting stronger metals import pull into China, set against (3) a cyclical recovery in Western manufacturing, increasing competition for metal units. While the apparent troughing in the global industrial cycle presents a broadly supportive demand factor, it is only for copper ($12,000/t 12M target) and aluminium ($2,700/t 12M target) that fundamentals present a structural extension in bull market, tied to a combination of high green transition demand leverage, underinvested predominantly long-cycle supply dynamics, and already extremely low inventory cover. Whilst nickel is also likely to rally on the LME announcement, reinforced by greater short covering risk, the continued surplus in that market will limit the sustainability of such upside in our opinion.

15 April

More in the full Goldman note available to pro subs in the usual place.